-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

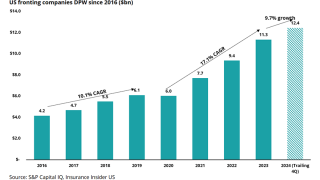

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

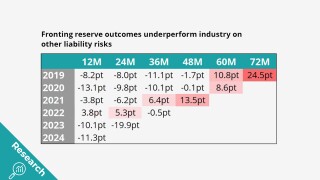

Fronting doesn’t look any better when it’s broken down by segment.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

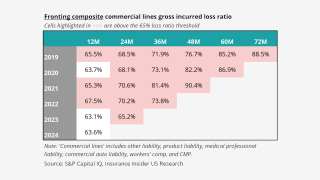

Reinsurers will not back business indefinitely where loss ratios continue to exceed the industry by a wide margin.

-

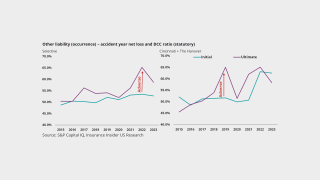

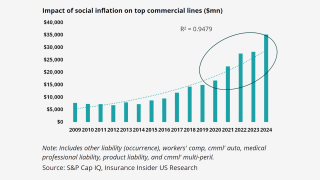

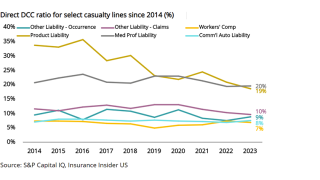

Persistent social inflation challenges evident across key long-tail lines at half-year mark.

-

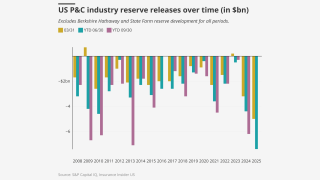

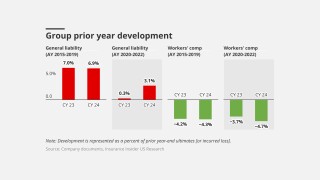

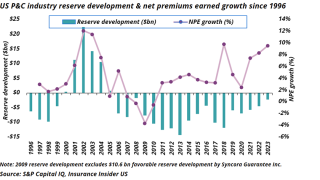

High H1 reserve releases of $7.4bn were driven by the largest of carriers.

-

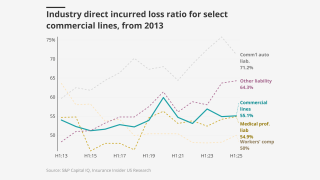

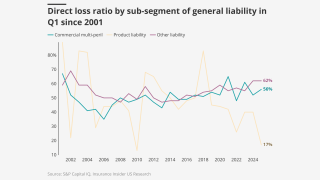

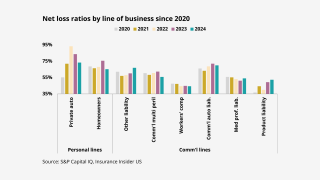

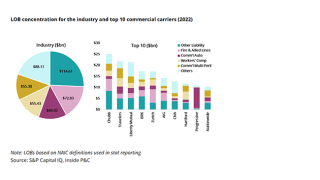

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

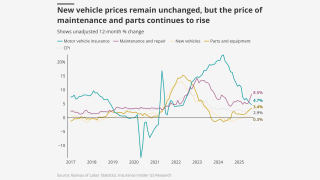

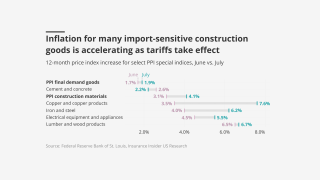

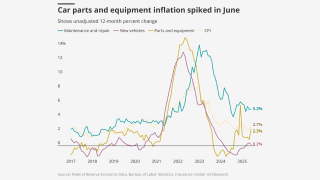

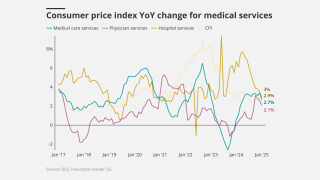

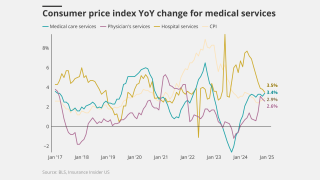

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

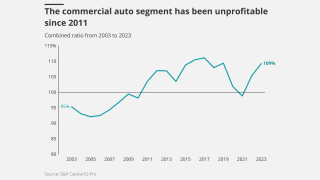

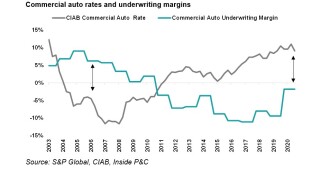

Commercial auto saw the largest rate change, which was down about a half point by the end of July to 7.96%.

-

Appointments include leadership in transportation, energy, marine and others.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

The company also purchased $15mn of SCS parametric coverage.

-

The pace of increases ticked down in the second quarter compared to Q1.

-

The regional insurer has increased its weighting to OLO and commercial auto, versus comp.

-

Morgan Stanley first invested in Cover Whale in May 2024 with structured debt.

-

The executive said the claims industry is going to “be transformed”.

-

Rising inflation could raise claims severity but also increase investment income.

-

All lines except workers’ comp are up year over year, however.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

Premium rose across the top 15 P&C risks in 2024.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

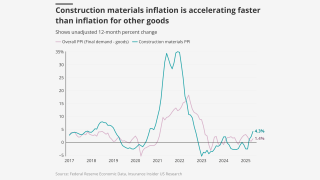

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

A deep-dive analysis shows LitFin is not the boogeyman this industry paints it out to be.

-

Rates need to be fair but also should not be “destructive of competition”.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The former Hub executive has over 30 years of experience in transportation.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.

-

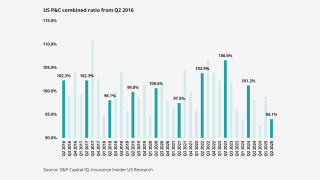

High general liability losses are cause for concern despite modest improvements in other lines.

-

Inflation indices fell in April, but some items related to P&C are still elevated.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The two deals bring the combined company’s Ebitda to about $25mn-$30mn.

-

The MGA market now makes up 10% of the overall P&C market.

-

The company has reduced its exposure on large commercial auto and property.

-

The executive has been with the firm’s underwriting team for over 12 years.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

Rates for umbrella accelerated to 9.26%, from 8.76% in Q4 2024.

-

Despite positive inflation headlines, there are issues for insurers under the surface.

-

The executive will also oversee premium audit and customer service.

-

Data, technology and telematics could turn the struggling sector profitable.

-

Korte had been serving as interim president of the unit since December.

-

The costs of accident/casualty-related claims continue to rise.

-

The InsurTech was also removed from under review, negative.

-

Surplus lines are still strong, but not the standout they used to be.

-

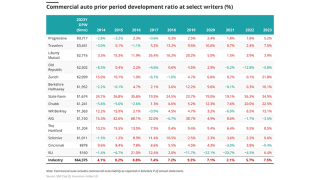

Newly released annual stat filings on reserve data show some troubling trends.

-

Last month’s inflation figures were lower than expected, but tariffs continue to loom.

-

Auto and homeowners’ insurance will see effects from the tariffs.

-

The industry continues to take reserve addition medicine in smaller doses than recommended.

-

The funding round valued the company at around $850mn.

-

Excess/umbrella liability and commercial auto broke the trend with high price increases, however.

-

Workers' comp continued to offset GL adverse development, but the bucket is running dry.

-

Approximately 12% to 13% of Skyward’s premium was in commercial auto in Q4.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

January CPI/PPI heats up but won’t translate to higher loss costs.

-

Carriers that started earlier in correcting their books and catching up with loss trend may be reaping rewards.

-

The company’s combined ratio rose 6.5 points from 2023.

-

The executive joins after 20 years with Lexington.

-

Loss-cost indicators are high for liability, low for property.

-

The suit seeks compensatory and punitive damages from 180 defendants.

-

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

A quick roundup of our best journalism for the week.

-

The MGA secured backing from buyout heavyweight KKR in March 2021.

-

Newcomers enter on the belief that they have a “better mousetrap”, said Donato Monaco.

-

Sources said that the underwriter has been working with Houlihan Lokey to find a potential backer.

-

Initial expectations for the later storm prove overblown, while inland auto losses mount for the earlier event.

-

Excess casualty rates were up 10% and have been double-digit all year, the executive said.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

Worrisome trends in the line may be warning signs of worse to come.

-

It’s time regulators take decisive action regarding the company and regulation, sources say.

-

The storm is projected to make landfall in the next 24 hours in the highly populated Tampa Bay region.

-

Milton stole the limelight from slightly stuck PE-backed brokers, acquisitive globals and the casualty conundrum.

-

Sources expect loss amplification in claims from Georgia, the Carolinas and Tennessee.

-

In Q2, median property price increases decelerated to 2.3%.

-

Idaho and Minnesota far outpaced other reporting states in premium growth, stamping office data shows.

-

No-fault state regulation and alleged fraud continue to plague the fraught market.

-

Hereford and Maya have written $141mn and $15mn in DWP for H1 2024, respectively.

-

ATIC insures about 60% of the NY livery market.

-

The losses added 12.3 points to the firm's 100.4% CoR.

-

The company writes roughly $300mn with Ebitda of roughly $30mn.

-

The mean nuclear verdict for 2013-2022 was $89mn, versus $76mn in 2010-2019.

-

The InsurTech had been pursuing strategic investment options, including a minority stake sale.

-

The all-items CPI has increased 3.4% over the last 12 months.

-

Former NTUM president Justin Joyce will lead the ANTU binding unit.

-

It is understood that the company needs to secure cash within less than 30 days.

-

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

A litany of underwriting and quoting constraints has made it much harder to write business.

-

However, capacity build has slowed over the past year, sources say.

-

Workers’ comp releases continue to mask deteriorating reserves in 2023.

-

The agency cited the InsurTech’s material underwriting losses in 2023.

-

This continues a consecutive quarterly gain of over 6%.

-

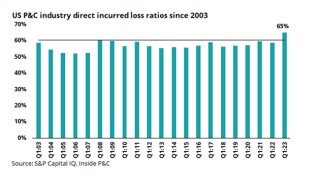

Sizeable investment returns masked 10-year high underwriting losses.

-

Bill Fahrner most recently served as CUO at Joyn Insurance.

-

The company’s book is being run off by Boost Insurance.

-

The company would ideally like to target a minority investment.

-

He joins Fairmatic’s executive team to lead new product production.

-

Koffie began work on a sale earlier this month following major layoffs.

-

December’s increase was an acceleration from 19.2% in November and October, with the CPI all-items index up 3.4% vs a 3.1% YoY rise for November.

-

The ratings agency cited persistently strong underwriting results throughout the pandemic and amid substantial economic and capital markets volatility as being among the reasons for maintaining the outlook at stable.

-

The company also plans to ramp up its media spend in 2024 after having significantly slashed advertising budgets earlier this year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Loss costs trends continue to increase in both physical damage and bodily injury coverages for nearly all of Progressive’s commercial auto products, CEO Tricia Griffith wrote in a quarterly update.

-

From 2020 to 2023, P&C replacement costs increased by 45% on average, whereas inflation for the overall US economy increased 15% within that same period, though the forecast expects that to change.

-

The carrier booked net pre-tax unfavorable development of $154mn in Q3, primarily driven by $263mn of unfavorable development from its business insurance unit.

-

An RPS report cites a drop in demand from Covid highs, along with increasing competition among carriers and near-record capacity as among the challenges currently facing transportation insurers.

-

On a year-on-year basis, the all-items index for September increased 3.7% before seasonal adjustment.

-

US commercial and personal auto insurer claim payouts combined were up between $96bn and $105bn for the period from 2013 to 2022.

-

Competing forces of loss cost inflation and mixed rate action yield uneven trajectories for the largest commercial lines.

-

Adoption of telematics is the first step, but the next step is analyzing the data and using it to make better drivers via retraining, rewards and incentives.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Nationwide’s recent exit from its E&S commercial auto business has spurred a flurry of speculation as to what's next for the space.

-

The ratings downgrade follows the departure of former CEO Marty Young and a round of layoffs in April.

-

The intermediary’s latest study shows double-digit rate increases in commercial property and auto lines.

-

The carrier had estimated a write-off in the range of $25mn-$35mn.

-

Recently released statutory data shows the US P&C industry loss ratio touching the 65% mark, the highest level in two decades.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AM Best’s last rating was to downgrade the financial strength rating (FSR) of the members of the Hallmark Financial Group to C++ (marginal) from B++ (good).

-

The update comes days after the agency downgraded the carrier’s ratings late last week.

-

The carrier has exhausted the limit of the loss portfolio transfer with Darag on its troubled commercial auto book and is subject to further reserve deterioration.

-

One question in the community is whether nuclear verdicts this year will spark a re-acceleration of rates, especially in the lead excess layers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The results were based on an analysis of paid loss data for commercial auto liability between 2012 and 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

2022 statutory data is now available, and results show winners and losers

-

Sentiment scores across US P&C segments dropped sequentially in Q4, though InsurTechs bucked the trend.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This compares to a 14.2% annual increase in auto insurance prices in December, while the overall index slightly moderated to a 6.4% gain from 6.5% in December.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Month to month, the motor vehicle insurance index in December recorded a 0.6-point increase.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

While Canopius has been in the US for 10 years, the insurer has been building “a multi-platform approach” in which underwriters can write business on several different types of paper.

-

It is expected to begin rolling out in the first half of 2023.

-

Third-quarter statutory data reveals premium growth, worsening loss ratio because of increased loss cost trends and Hurricane Ian.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Amid record high economic inflation, continuing supply chain issues and proliferating nuclear verdicts, carrier CEOs have emphasized the need to keep rate above loss costs during Q3 conference calls.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

On a call with analysts, Lindner said AFG is assuming commercial auto liability loss cost trends at 7%.

-

Former Embroker COO Julie Zimmer has joined the leadership team as CEO as part of the fundraise.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The commercial trucking insurer is now available in 27 states for its auto liability coverage.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Casualty underwriters were taking a “conservative and selective approach” with high-risk categories and accounts with poorer loss histories.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Sources expect rates to increase in the mid-high single-digit range through at least 2023, closer to 15% to 25% for higher risks.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

August’s overall consumer price index edged up 0.1 points, after no change in the prior month.

-

Used car prices in August fell further, down 4% from July, according to auction house Manheim’s monthly market report.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

With the recapitalization, the Chattanooga, Tennessee-based brokerage expects to grow to $1bn in GWP from ~$500mn in three years.

-

The Manheim Used Vehicle Value Index declined to 211.6, up 8.8% from a year ago but showing a gradual decline after reaching a January peak of 236.3, except for an increase in May.

-

The motor vehicle insurance index rose 7.4% year on year that month, from 6.0% in June, while the annual gain in all-items CPI dropped to 8.5% from 9.1%.

-

This is the second monthly decline after May and a sign of continued moderation after the index reached a peak in January.

-

The broker sees rising costs pushing more careful underwriting and rate rises across multiple business lines for the rest of 2022.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The cost of a new car gained 6% last month.

-

Used car prices are on a general decline this year but the impact on personal auto insurers is yet to be seen.

-

Aon said supply chain disruptions are easing, shipping costs are receding and building materials and vehicle pricing are decelerating.

-

Commercial auto, hospitality, public entity and higher ed are among the sectors seeing continued rate hikes and limited capacity, according to CRC Group.

-

Although P&C insurers had 9% premium growth, the underwriting loss in 2021 follows a $4.4bn underwriting gain in 2020.

-

In his new role, he will oversee insurance operations across business development, underwriting, claims, carrier and reinsurance relationships.

-

The medical care index increased 0.4% month over month (in line with April's increase) and 4% versus May 2021.

-

Month over month, rates were up across business owners’ policy, general liability, commercial property and workers’ comp.

-

The Truist-owned broker aims to make purchasing and managing home and auto coverage easier for retail clients.

-

For the month, motor vehicle insurance costs rose 0.8%, compared to 0.7% in March.

-

Premium renewal rate change for major commercial lines of business moved up year-on-year, except workers’ compensation, which remained negative.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The program focuses on underserved mid-fleet trucking accounts.

-

Unlike other P&C lines who managed to deliver combined ratios averaging in the low-to-mid-90s, commercial auto averaged 106% for around the last decade.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Nirvana aims to use telematics data to help trucking fleets mitigate risk, improve driver performance, and simply the trucking insurance process.

-

An examination of the costs of claims found a 21.3% increase in total costs in 2019 over 2015 when an attorney is involved.

-

While the report categorized auto as “challenging” overall, cyber remains the most problematic, with Aon predicting that rate pressure will continue for at least the first half of 2022.

-

Investors were reacting to the $257mn underwriting loss the company reported for Q4, and concerns the carrier’s rate increases are lagging the rise in claims severity trends.

-

The chief executive said a surge in costs for labor, auto body repairs and rental cars, along with the lagged effect of earned rate increases, all weighed on Kemper’s results.

-

In contrast to the second and third quarters, when Kemper took $81mn and $25mn reserve charges, the fourth quarter loss came from a spike in severity on current AY claims.

-

The company’s 79% jump in underwriting income to $109mn benefitted from $61mn in reserve releases.

-

The new entity will expand its operations into the specialty commercial auto space, with a workforce of around 600 employees and over $1.1bn in equity capital.

-

The reinsurer and the tech firm will collaborate on driverless vehicle products.

-

Personal lines giant Allstate is increasing rates for its auto insurance business in response to rising loss severity that has hit the segment, the firm’s CEO Tom Wilson said.

-

The firm’s margin expansion – despite rates tapering in some lines, including excess casualty – offset Ida losses during Q3.

-

Trucking companies, having already increased self-insured retentions by millions, will need to contend with further rate increases into 2024.

-

The commercial auto specialist MGA secured the new capital from Ambac Financial Group and TigerRisk Partners' subsidiary Applied Financial Technologies.

-

James River ceded approximately $345mn of commercial auto liabilities relating to business written for Uber’s ridesharing business.

-

The rebooting of efforts to find a buyer was considered, but CEO David Disiere has decided to retain the business.

-

Texas-based InsurTech Overhaul has entered a strategic partnership with commercial P&C insurer CNA to mitigate cargo-theft risk within the trucking industry by way of Overhaul’s TruckShield technology.

-

The carrier seeks to reduce commercial auto category below 20% of its overall book.

-

THG’s underlying loss ratio rose by 6 points in the second quarter, to 57.8%, which the company said was the result of rising economic activity.

-

The Austin-based insurance firm recently provided capacity to CRC-owned 5Star Specialty, and it plans to write business in all 50 states by the end of next year.

-

Gallagher sees opportunity for new entrants to commercial auto marketplace with rates high and frequency down.

-

The Chicago-based specialty carrier also generated its best growth print in recent memory, expanding the top line by 13%.

-

While the pandemic offered some relief to commercial auto insurers, maintaining margins will be tricky to achieve given rate moderation.

-

The deal combines the two major mobile telematics companies, which will now cover 21 of the 25 top US auto insurers.

-

Progressive has hailed its rigorous approach to reserving and depth of experience in commercial auto as the secret to its success with insuring TNCs.

-

The transaction adds around $547mn of gross written premiums to Progressive’s $5.6bn commercial auto book.

-

The ratings agency finds that auto carriers accounted for five out of seven cases in which companies were liquidated.

-

The carrier now provides policies for drivers using the app in 16 states and the District of Columbia.

-

The line of business was Donegal’s worst by far for underwriting profitability.

-

The former Hallmark trio arrive to lead a transportation push.

-

A deal would end the saga of the Indiana-based insurer which has been in question for two years.

-

Better underlying results and lower cats were partially offset by a $10mn reserve charge in preferred personal auto.

-

Earlier this month, NHTSA said that traffic deaths had spiked by 13% in the third quarter.