Progressive

-

The commissioner said more work needs to be done, but big companies are interested in coming back.

-

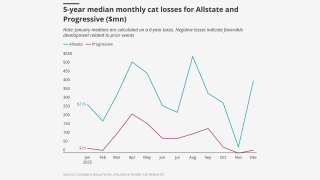

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Early Q3 earnings reports point to worsening market conditions.

-

The selloff may hint at headwinds for equity investors.

-

The insurer booked a $950mn policyholder credit expense in September.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

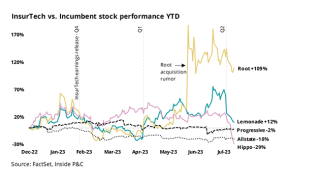

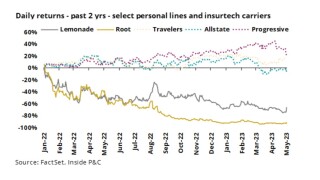

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The company also purchased $15mn of SCS parametric coverage.

-

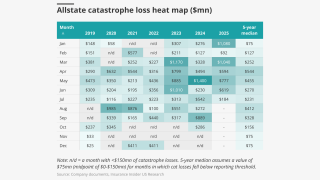

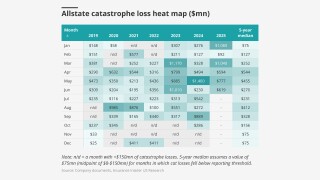

The research team presents the June cat heatmap.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

Net property losses from Hurricane Milton in October reached $153.6mn.

-

The company incurred $563mn of total cat losses related to the storm.

-

It had planned to non-renew 47,000 DP-3 and 53,000 high-risk homeowners’ policies this year.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

-

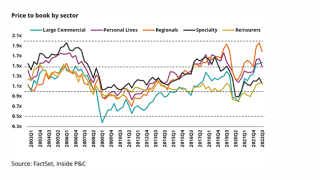

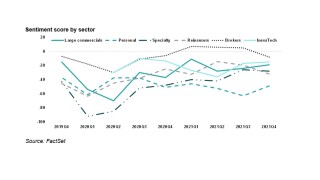

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

The losses added 12.3 points to the firm's 100.4% CoR.

-

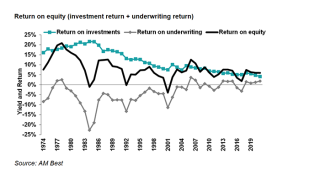

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The CoR for homeowners’ insurance rose to 95.4% from 75.8% in February.

-

The homeowners' CoR fell over 32 points sequentially to 75.8%.

-

The carrier also plans to ramp up media spend.

-

Personal auto rates increased 19% during the year.

-

The homeowners’ CoR worsened 39 points sequentially to 107.9%.

-

The commercial auto CoR decreased to 93.7% in December, while the homeowners’ CoR improved 13.2 points to 68.9%.

-

The commercial auto CoR worsened 7.8 points to 108.6% for the month, while the homeowners’ CoR deteriorated 15.1 points to 82.1%.

-

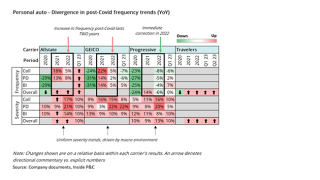

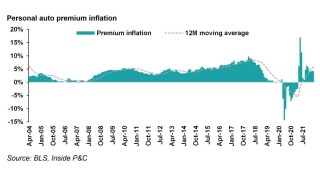

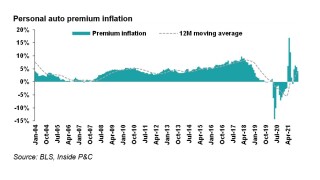

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

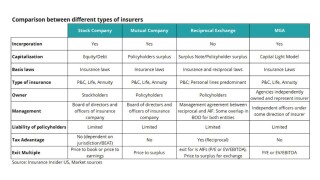

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

The net cat loss ratio dropped to 0.4% from 1.8% in September, but the consolidated loss ratio deteriorated 2.4 points to 75.5% during the same period.

-

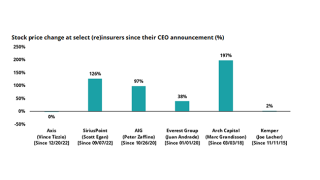

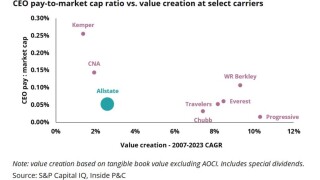

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

The company also plans to ramp up its media spend in 2024 after having significantly slashed advertising budgets earlier this year.

-

Loss costs trends continue to increase in both physical damage and bodily injury coverages for nearly all of Progressive’s commercial auto products, CEO Tricia Griffith wrote in a quarterly update.

-

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

These figures mark an improvement from August, which was impacted by losses from Hurricane Idalia.

-

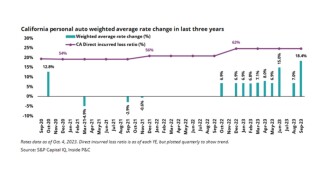

Insurance regulators in California and other states signed off much-needed personal lines rate hikes in September.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The first non-renewals are scheduled for May 2024 in what is expected to be an 18-month process.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Nearly half of the cat losses incurred during the month of August were attributable to Idalia.

-

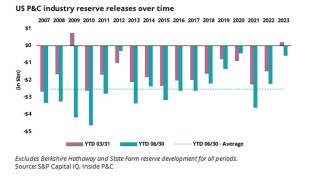

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

For July, Progressive’s underlying combined ratio improved 4.7 from last month to 87.9%, driven by significant rate hikes and more selective underwriting and risk selection policies.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The carrier had renewed its catastrophe XoL private market reinsurance for its property business, effective June 1.

-

Personal auto loss severity rose about 12% year-over-year. The carrier also experienced a “modest” year-over-year increase in frequency of about 1%.

-

Progressive has now reported three consecutive months of adverse development. The Inside P&C Research team takes a closer look.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

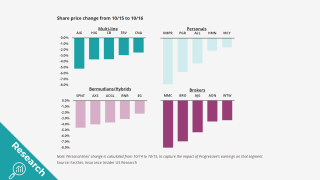

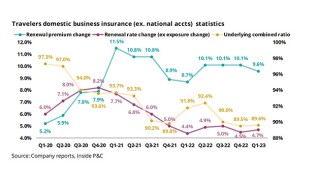

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company added that prior and current accident year increases were related to a higher ultimate severity on previously closed claims in its property damage coverages.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

An uneven loss environment in personal lines calls for a cautious reading of reserves.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company booked another 4.6 points of adverse reserve development during the quarter, with 85% attributed to personal auto and 20% to commercial auto.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company experienced unfavorable reserve development of 2.6 points during the quarter, with 85% attributed to auto and 20% to commercial auto.

-

InsurTech carriers pivot to profitability vs growth.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

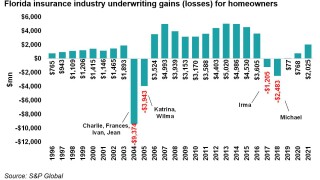

In March, there were 280,000 civil lawsuits filed in Florida industry-wide, up nearly 130% since the all-time high of May 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Progressive booked a $621.2mn adverse development, compared with a $190.8mn reserve charge in Q1 2022.

-

Travelers posts strong results boosted by better pricing, personal lines performance, and favorable development.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Although year-over-year headline CPI has decreased a bit, CPI levels pertaining to insurance are on the rise.

-

The carrier booked unfavorable prior accident year reserve development of 3.4 points, driven primarily by its personal auto products related to recently passed legislation in Florida.

-

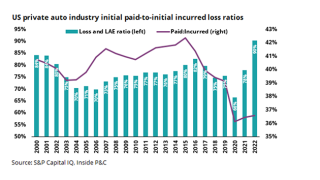

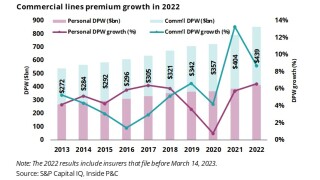

The new 2022 stat data shows personal lines premium has grown year-over-year, but the loss ratios have been hit hard by catastrophes and loss cost inflation.

-

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

The carrier also booked unfavorable prior accident year reserve development of 3.5 points.

-

2022 statutory data is now available, and results show winners and losers

-

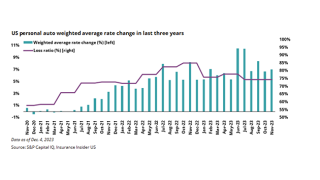

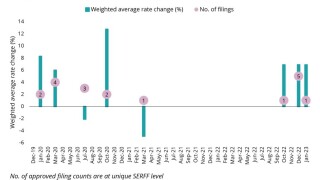

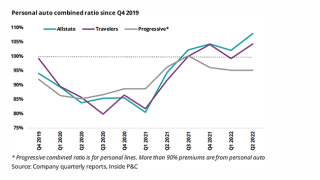

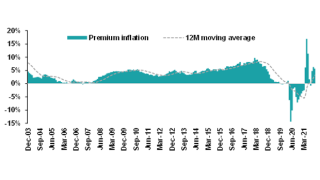

Rate action for personal auto insurers has been increasing in 2023 to balance rising loss cost trends

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Management spoke with analysts after the carrier released its 10-K and the CEO’s shareholder letter.

-

The carrier raised rates on average of 19% across the segment in 2022, with larger increases in Florida and hail-prone states such as Colorado and Oklahoma.

-

The carrier also booked unfavorable prior accident year reserve development of 6.5 points, driven primarily by its personal auto products.

-

The firm’s playbook struggles provide valuable insights for its InsurTech competitors as they all navigate a challenging loss cost environment.

-

Five auto insurers receive approval to raise rates after 32-month halt by the California Department of Insurance.

-

The company's net cat loss ratio increased to 18% from 8.3% in November, attributed primarily to winter storms, wind and thunderstorms.

-

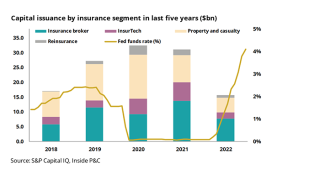

Increased interest rates and unfavorable market conditions led to reduction in capital issuance activity in the P&C insurance industry in 2022.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

Personal lines insurers see a vastly different outlook in 2022 than 2021 and their reserve development reflects this.

-

The updated loss and allocated loss adjustment expenses in the property segment from the hurricane is now $1bn.

-

The insurer’s underlying loss ratio fell almost two points sequentially to 75.5% in November.

-

While Allstate may be beyond the worst of the reserve charges, execution of initiatives needs to go smoothly for it to get back on track.

-

The Canadian investment fund now owns almost 3.8 million shares of the personal lines insurer, compared to 281,773 in Q2.

-

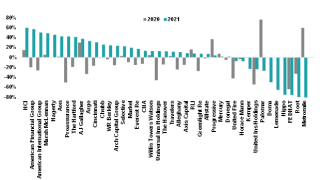

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Progressive’s superior digital distribution and widening auto margins put it far ahead of the competition.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive added that Progressive is not open for new business in home, dwelling fire and condo coverages.

-

Meanwhile, Tricia Griffith said the commercial lines business experienced minimal impact from Ian, as physical damage and comprehensive cover are smaller parts of its premium.

-

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

The carrier reported that $585mn was recorded from auto losses incurred, including boats and recreational vehicles.

-

Auto insurers look set to generate a larger share of losses than with most US wind events.

-

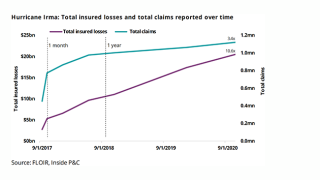

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

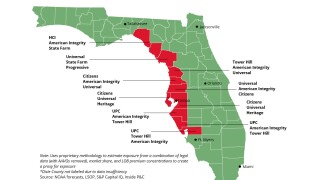

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

The personal lines insurer’s results were also impacted by the states’ regulatory climates and inflationary trends.

-

On an investor call with analysts, Pratt added that the challenges of the Florida property market have greatly impacted Progressive.

-

Chubb pushed its loss trend assumptions higher as it seeks to stay ahead of inflationary pressures.

-

CEO Griffith noted that the company is feeling "the impact of weather and inflation" and that Progressive saw inflation impact the average cost to settle a claim.

-

For the quarter, Progressive posted a combined ratio of 95.6%, a slight improvement from 96.5% in Q2 2021.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Embedded insurance can help sidestep some of the challenges faced by InsurTech 1.0.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Results for May show that the carrier’s combined ratio rose above its 96% target after dipping in April.

-

Forecasters have again predicted an active season for storm activity, with the Florida market particularly vulnerable to high cat activity.

-

The personal auto writer’s partnership with the digital dealership should serve as a warning for other InsurTechs.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

Inside P&C’s news team runs you through the key developments from the week.

-

The executive noted in her shareholder letter yesterday that loss costs on average were up almost 18% from the same quarter last year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Progressive’s response has been to take underwriting and non-underwriting actions and work with regulators to take more rate.

-

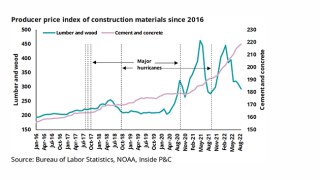

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

Insurance carriers tailor their comments to leave investors walking away with an optimistic view.

-

While vehicle miles traveled dipped in January, likely due to the Omicron variant, the auto insurer said February’s preliminary results indicate a rebound and frequency is expected to rise.

-

The insurer’s net premiums written in personal lines also increased by nearly $3bn to $36.2bn for 2021.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.

-

Data from Apple and Google show that Omicron has slowed the return to driving in some of the largest states by premiums.

-

Johnson’s departure follows the deal in which auto firm Progressive Corporation acquired the Indiana-based insurer for $338mn.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

The monthly CPI report shows that inflation continues to push severity higher as carriers take rate in response.

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.