Hamilton Insurance Group

-

The executive’s 30-year career includes stints at Neon, Chubb and Arch.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

The company bolstered casualty reserves by $18mn, mostly from discontinued lines.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has also promoted Alex Baker and Tim Duffin.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Hamilton also expects rising demand and stable supply for June 1 renewals.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sills’ background, a strong backing, and laser-sharp E&S focus make Bowhead stand out.

-

The estimate is based on industry losses in the range of $35bn-$45bn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The new offerings will be part of the specialty reinsurance portfolio.

-

The executive will build out Hamilton Americas property team and a book targeting commercial E&S risks.

-

D&O and D&F are also facing increased competition, but property remains price adequate.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Albo cited rate increases, improved terms and conditions and line size management among cedants.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

-

These cedants could offer the firm access to support their casualty and specialty lines as well.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The ratings agency flagged the “increasingly favourable” underwriting results.

-

The executive is replacing Chad Cundliffe, who is retiring from the company.

-

The Bermudian posted 18.5% top line growth in its first year as a public company.

-

Patterson will also serve as chair of the audit committee.

-

Jamie Secor has over 20 years of underwriting and senior management experience and joined Hamilton in 2021 to oversee its US E&O business.

-

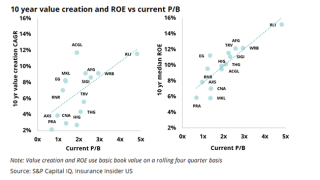

The Aspen IPO provides an opportunity to benefit from the specialty market without commensurate prior-year reserve risks due to an LPT cover.

-

Peter Riihiluoma will succeed Richard Sammons, who is set to leave the business.

-

Hamilton is seeing additional opportunities on the casualty reinsurance front as other players pull back, given the loss activity stemming from 2019 and prior years.

-

The executive said that property cat market terms and conditions continue to be favorable, while demand is anticipated to increase in January 1 and throughout 2024.

-

Its combined ratio for the quarter improved nearly 30 points, particularly driven by better performance in its Bermuda segment.

-

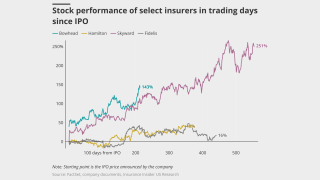

As this publication previously reported, the IPO pricing came in under book value but has still narrowed the gap on predecessor Fidelis, listing at 0.9x book value vs Fidelis’ 0.8x.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Hamilton’s IPO share price came in at the lower end of historical trends observed amongst insurers that have missed their target range upon listing.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier’s $15 per share listing came in below its $16.90 book value per share at the mid-year reporting point, or a 0.9x multiple.