WTW

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

-

Former head of construction Bill Creedon will assume the role of chairman.

-

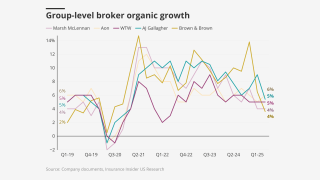

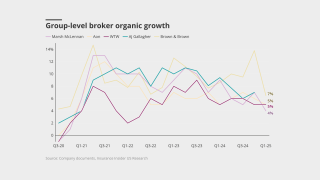

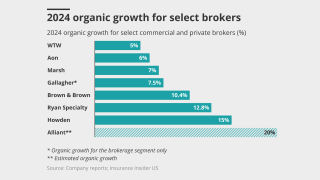

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

She joins the brokerage after 18 years at Canada’s Intact.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The Bermuda-based team is led by John Fletcher.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It will be tough to pull off prior goals despite management assurances.

-

The pair add to the roster of aviation-focused hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

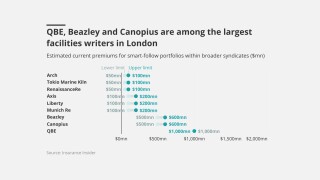

The big brokers are lining up London capacity to write follow lines on US risks.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Starr-leads the WTW-placed all-risks cover for American Airlines.

-

Bradley was construction team leader for US casualty at WTW.

-

The Willis name, which dates back to 1828, will be used with clients and markets.

-

He succeeds Hugo Wegbrans, who becomes head of CRB for Europe.

-

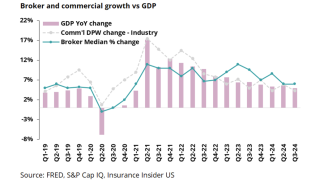

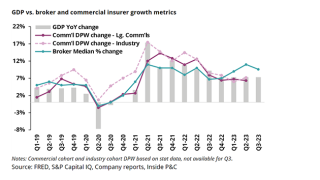

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

CMP and BOP reached their highest levels in over a decade.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

A quick roundup of our best journalism for the week.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

Adam Garrard will cover his responsibilities on an interim basis.

-

WTW will hold a significant minority stake in the start-up with an option to acquire complete ownership over time.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The global market is stabilising and softening, and casualty and specialty lines are generally stable, the CEO said.

-

The broker posted a net loss of $1.67bn including pre-tax non-cash losses.

-

He brings over 25 years of experience in PE and transactions solutions.

-

The broker will take a charge of $1.6bn-$2.1bn relating to the sale.

-

Baudouin is transitioning to a chairman position in Mexico.

-

Commercial auto and excess umbrella continue to face upward pressure.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

The two parties are targeting a launch by the end of the year, with scope for WTW to buy the start-up at maturity.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

The company yesterday promoted Jenna Ziomek to P&C leader for PE and M&A.

-

Ziomek joined WTW in 2021 and has 17 years of industry experience.

-

The new broking president added that hundreds of Marsh staff would not show up tomorrow at WTW.

-

The broker said achieving profitability “remains challenging” for insurers.

-

CRB NA growth was driven by specialty lines, including natural resources, construction and real estate.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

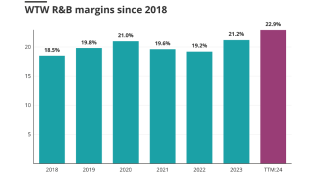

The broker raised the low end of its 2024 target ranges for adjusted operating margin and adjusted EPS.

-

A quick roundup of today’s need-to-know news, including the CrowdStrike outage and a hire at SiriusPoint.

-

Alongside the appointment, Adam Garrard will take on the new role of chairman of risk and broking.

-

-

Jorgen Andersson and Peter Galla will serve as deputy heads of the division.

-

The executive previously led the excess casualty practice at Aon.

-

He brings more than 20 years of industry experience to the role.

-

Quarterly price increases of around 6% have remained steady since the pandemic.

-

deLaricheliere will report to WTW head of FIPS Brad Messinger.

-

The executive said expansion was driven by retention and new business.

-

CEO Carl Hess hailed a “solid” first quarter of results.

-

Prior to her stint at Lockton, the executive worked at Marsh.

-

The firm reportedly parted ways with 120-130 employees as part of the cuts.

-

The executive joins from regional insurer ASSA, where he spent almost 16 years.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

The US regulator faces litigation from both sides of the climate issue.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

Graham Knight will become chairman of natural resources.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

WTW said adverse development “is evident” in auto liability lines from 2015 to present.

-

WTW hired Kolos for transactional solutions, Chin for tax insurance and Kesack for contingent solutions.

-

The facility offers a range of $25mn to $50mn in excess capacity.

-

Insurance Insider US runs you through the earnings results for the day.

-

At market close, WTW shares were up almost $18.

-

The CEO said winning back clients had “validated” the broker’s approach.

-

Risk and broking was driven by new business, client retention and rates.

-

The role marks Miranda Rodriguez’s return to WTW from Brookfield Asset Management, where she was vice president of risk and insurance.

-

In October 2023, it was announced that Powell was leaving Marsh to join WTW as the broker’s global chief claims officer.

-

The broker said there was a “record level of dry powder” waiting to be deployed.

-

Joining WTW in 2010, Despina Buganski has served as COO for the Ppersonal lines business since 2015.

-

Tyson Stevenson will be responsible for producing new business and driving growth in WTW’s real estate portfolio for 2024.

-

Commercial Property experienced the greatest rate increase, with a double-digit surge that came in slightly lower than the previous quarter.

-

The appointment comes two weeks after this publication revealed that the executive had resigned from Lockton to join the rival broker.

-

The broker said reinsurance capacity has contracted over the past 18 months, and the once-diamond-hard aviation war market has started to soften.

-

WTW also said private equity will continue to dominate the M&A landscape in 2024, with firms sitting on “over $2tn in dry powder” which is ready to deploy.

-

The broker said it anticipated new entrants in the downstream class following a profitable 2023.

-

A quick roundup of this week’s biggest stories.

-

The executive joined family-owned Lockton in 2020, as director of energy within the South Florida-based Latin America and Caribbean team.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

SEC filings show that, in Q3, the activist shareholder liquidated its remaining 508,880 shares in WTW — worth around $120mn at the end of Q2.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

The broker has not been acquisitive since the deal to create the group in 2015, and has divested a number of its units in that time.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Work is at an exploratory stage, with efforts focused on London specialty and US P&C mid-market expertise.

-

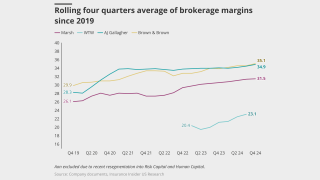

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

As of 14:00 ET, the broker’s stock stood at $232.24 per share, 11.9% higher than the previous close of $207.74.

-

The broker’s Q3 organic growth was driven by specialty lines, including fac financial solutions, natural resources, surety, construction and aviation.

-

WTW said that new staff were ramping up revenue production, following a period of investment in talent.

-

The exercise is understood to involve mainly junior and non-broking staff.

-

Kenneth Gould and Frank Scardino resigned “effective immediately” in early October to join WTW, allegedly forgoing a required 30-day notice period.

-

Despite an upswing in deal activity, large deals have continued to see a steady decline in volume that began in 2021.

-

The two executives, based in Dallas, Texas, have close to 60 years of combined insurance experience.

-

The start-up MGU will initially focus on real estate, hospitality and leisure, financial institutions and professional services industries.

-

The executive was most recently global engagement partner at Marsh.

-

Survey participants said "much work remains post-implementation".