Allstate

-

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

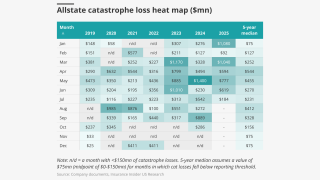

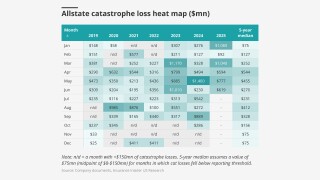

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The research team presents the June cat heatmap.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Two wind and hail events were responsible for 60% of the total.

-

Insurers haven’t announced concrete steps – yet.

-

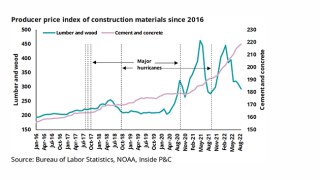

But automotive repair costs are likely to increase faster than home repair.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

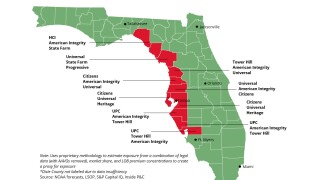

The carrier has not added new business in the state since 2007.

-

The carrier has been reducing its presence in the state since 2007.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

Insurers are fighting to recoup claims they have paid out.

-

Fifteen events caused estimated losses of $306mn.

-

The news team runs you through this week’s key M&A deals.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

Total catastrophe losses stemmed from 20 events and were estimated at $587mn.

-

NatGen allegedly collected $500mn associated with the fraud.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty, Marsh, Allstate.

-

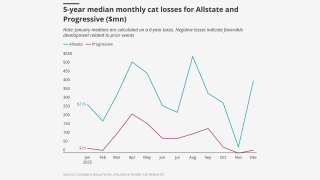

Allstate’s total pre-tax cat losses for H1 2024 were $2.85bn versus an estimated $4.39bn in H1 2023.

-

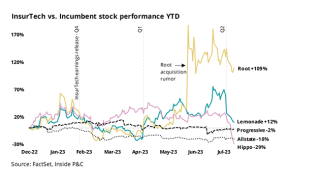

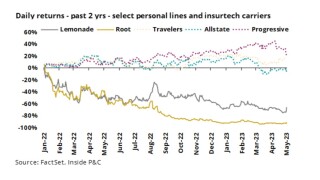

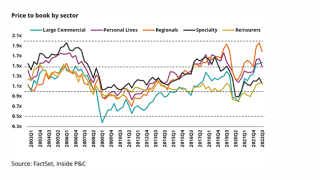

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

This takes pre-tax year-to-date cat losses to $2.62bn.

-

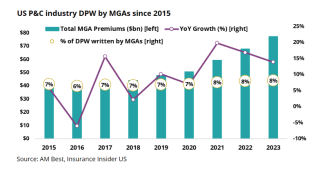

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

Changes in investment strategy and strong results show carriers can weather financial storms.

-

This takes pre-tax cat losses for the calendar year to $1.23bn

-

This follows February’s cat losses coming in below the $150mn reporting threshold.

-

This follows January pre-tax cat losses of $276mn.

-

Two events comprised approximately 80% of the losses.

-

The carrier expects to "get smaller in New Jersey" due to lack of rate adequacy.

-

Insurance Insider US runs you through the earnings results for the day.

-

Unfavorable prior year reserve re-estimates, excluding catastrophes, totaled $199mn in Q4, with approximately $148mn related to personal auto, including costs for litigation claims.

-

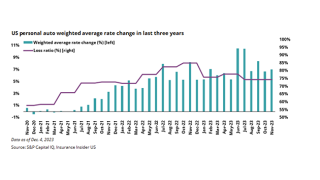

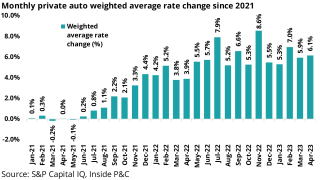

For the month of November, Allstate brand’s auto rate increases totaled $262mn, after implementing $517mn and $1.49bn of rate increases in Q3 and Q2, respectively.

-

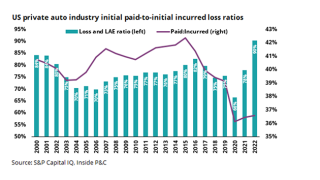

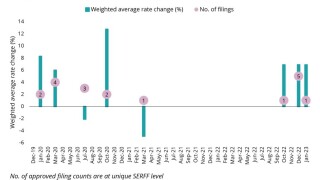

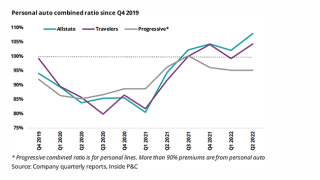

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

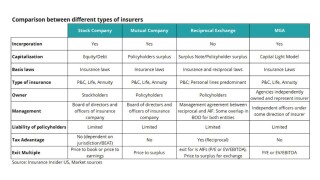

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

Meanwhile, the company’s October cat losses came in below the reporting threshold of $150mn, compared eith $317mn of cat losses in September and nearly $1.2bn for Q3.

-

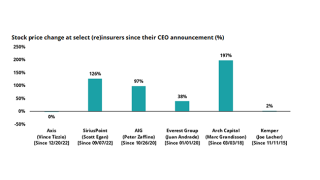

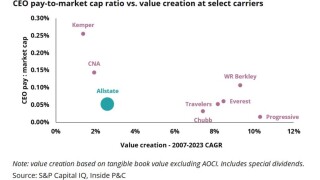

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

Three states — California, New Jersey, New York — were responsible for adding five points to YTD combined ratio for 2023.

-

The Inside P&C news team runs you through the earnings results for the day.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

Most of the losses, around 80%, were the result of two wind and hail events.

-

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

The carrier has suffered five quarters of losses, largely spurred on by hefty natural catastrophe losses.

-

-

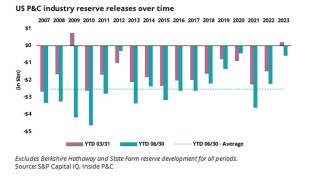

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

The settlement would resolve claims that Allstate defrauded shareholders by underreporting “skyrocketing” auto claims to artificially boost the stock price, which later crashed.

-

Allstate reported cat losses of $1bn and $885mn for June and May.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

The downgrades reflect the negative impact of challenging macro-economic trends on underwriting results and risk-adjusted capitalization.

-

In California, the carrier filed for a 35% increase this quarter after implementing a 6.9% rate hike in April.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Q2 cat losses reported by most carriers were significantly higher than a year ago owing to the number of US convective storms and likely higher carrier retentions at reinsurance renewals.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Nearly $148mn of the unfavorable reserve development was related to National General, primarily driven by personal auto injury coverages.

-

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

An uneven loss environment in personal lines calls for a cautious reading of reserves.

-

California Insurance Commissioner Ricardo Lara was speaking about climate change's impact on insurance pricing at the Bermuda Climate Summit.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier said 70% of the claims stemmed from two wind and hail events.

-

CPI figures show loss costs are cooling, and if rate levels cannot reach adequacy we are likely to see more pausing from the industry beyond State Farm, Allstate and Nationwide.

-

The company reportedly recently applied for a rate increase of about 40% on California homeowners’ business.

-

The loss for the month was 60% comprising losses from two wind and hail events.

-

InsurTech carriers pivot to profitability vs growth.

-

The carrier will continue to push for more auto rates through 2023 as drivers of severity continue to persist.

-

The carrier shifted retentions up and made use of multi-year contracts.

-

Personal lines rates ticked up in April compared to the prior month as insurers try to stay ahead of rising loss costs.

-

The carrier contended with 10 events over the month, with 75% of its losses stemming from three wind events.

-

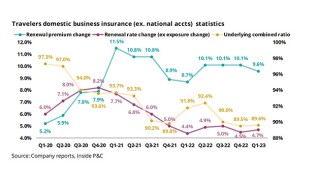

Travelers posts strong results boosted by better pricing, personal lines performance, and favorable development.

-

The new 2022 stat data shows personal lines premium has grown year-over-year, but the loss ratios have been hit hard by catastrophes and loss cost inflation.

-

Allstate disclosed a $211mn catastrophe loss in February based on nine separate events.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The agency attributed the decision to a material deterioration in the company’s surplus position, as a result of challenging personal property insurance conditions in Florida.

-

2022 statutory data is now available, and results show winners and losers

-

Rate action for personal auto insurers has been increasing in 2023 to balance rising loss cost trends

-

The carrier’s equivalent bond placed last March secured $550mn of limit.

-

Of those, around $309mn were associated with nine events primarily in Texas and California, partially offset by favorable reserve re-estimates for prior events.

-

The firm’s playbook struggles provide valuable insights for its InsurTech competitors as they all navigate a challenging loss cost environment.

-

Part of the company's plan to improve auto insurance margins is to file for greater rate increases in 2023, along with lowering operating expenses and advertising spend.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm recorded a $282mn reserve charge in the quarter, of which $180mn was related to an increase in personal auto claim frequency attributable to prior accident years.

-

Five auto insurers receive approval to raise rates after 32-month halt by the California Department of Insurance.

-

After market close on Wednesday, the carrier disclosed an estimated combined ratio of 109.1% for the quarter, adding 10 points year on year.

-

For the same period in 2021, the company reported a combined ratio of 98.9%.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

Personal lines insurers see a vastly different outlook in 2022 than 2021 and their reserve development reflects this.

-

This price hike contributed to a premium increase of $695mn in the month, bringing the year-to-date impact of 2022 rate increases to $3.6bn.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

In Texas, the company expects roughly 50% rate increases, whereas in California, the company received approval for a 6.9% increase.

-

While Allstate may be beyond the worst of the reserve charges, execution of initiatives needs to go smoothly for it to get back on track.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company paid out $1.63bn for physical damage claims in the first nine months of the year, which exceeded earlier projections of $1.33bn.

-

The implemented price hikes added $307mn in new premium last month, driving the year-to-date rates implementation to $2.9bn.

-

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Amid record high economic inflation, continuing supply chain issues and proliferating nuclear verdicts, carrier CEOs have emphasized the need to keep rate above loss costs during Q3 conference calls.

-

Though still significantly elevated, the CPI appears to have peaked in the short term, which may give carriers a chance to catch up on rate.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The personal lines carrier expects to implement additional rate increases in the fourth quarter of this year, and into 2023.

-

Progressive’s superior digital distribution and widening auto margins put it far ahead of the competition.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

CEO Tom Wilson added that Allstate is expanding its plans to reduce personal lines insurance in states with “unacceptable auto and home insurance margins”.

-

The firm disclosed that ex-cat unfavorable prior year reserve reestimates totaled $875mn, of which $643mn were related to its personal auto unit.

-

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Last month’s rates implementation marked an acceleration from the 8.9% hikes announced in July, which resulted in overall premium impact of 1%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Market sources are suggesting inflation could require a wider group of US cedants to buy $10bn-$20bn of additional cat coverage for 2023.

-

Rizzo will take over on September 1. Jess Merten will also assume his role as CFO effective September 1.

-

Allstate CFO Mario Rizzo vowed to continue pushing through auto rate increases.

-

The personal lines insurer’s results were also impacted by the states’ regulatory climates and inflationary trends.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The executive was speaking during the company’s Q2 2022 earnings call, after it reported a 107.9% headline combined ratio for the period, marking a 12.2-point deterioration YoY.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company's net written premiums grew 11.5% to $11.5bn, compared to 10.2% in the first quarter.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company also said it expects a $408mn reserve charge, including $275mn related to personal auto and $91mn recorded for commercial auto.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Embedded insurance can help sidestep some of the challenges faced by InsurTech 1.0.

-

The carrier’s below-FHCF layer is 29% unplaced.

-

The losses were caused by 14 events, most notably wind and hail in Texas, the Midwest and Canada.

-

The personal auto writer’s partnership with the digital dealership should serve as a warning for other InsurTechs.

-

The figure includes around $17mn of unfavorable reserve re-estimates for prior period events.