Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Latest News

Latest Intact News from Insurance Insider US

Competitor news

What Your Competitors are Reading

Competitor news

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The regulations are designed to address long-term solvency concerns.

-

Erbig joins after more than 20 years in finance-related positions at Liberty Mutual.

-

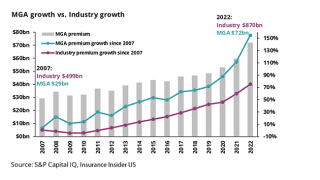

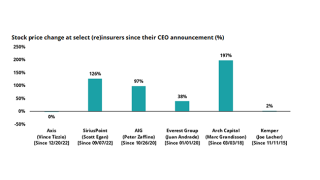

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Early Q3 earnings reports point to worsening market conditions.

-

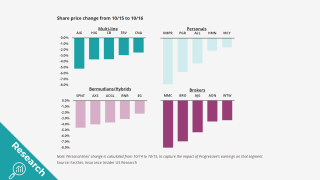

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The carrier reported favorable reserve development of $22mn compared to $126mn in Q3 last year.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

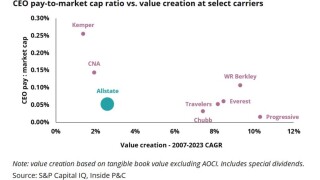

When owners are not paying attention, discipline and governance are not top priorities.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

The risk also ranked as a top three concern for companies of all sizes.

-

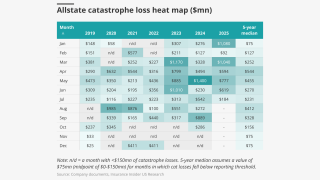

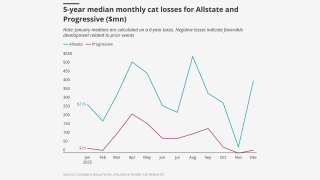

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

The ratings agency cited enhanced scale and diversification through organic growth.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The firm’s subsidiary in India paid $1.47mn in bribes to officials at state-owned banks and raised revenue of $9.2mn.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

The carrier agreed to acquire Liberty Mutual’s P&C firms in Thailand and Vietnam in March.

-

Court documents show Travelers subsidiary Northfield Insurance is the insurer.

-

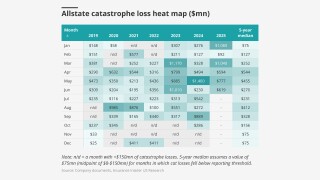

The research team presents the June cat heatmap.

-

Pricing slowdown and reserving concerns are the hot-button topics as earnings kick off.

-

The class can collectively challenge State Farm’s property claims calculations.

-

On the rate environment, Schnitzer said the amplitude of the pricing cycle is shrinking.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Cat losses declined to $927mn from over $1.5bn a year ago on windstorms and hailstorms.

-

Last month, Insurance Insider US revealed that former GTS Americas head Scott Pegram had left the company.

-

The broader legislation narrowly passed the Senate and now heads to the House.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

The partnership is being formed via Liberty Mutual’s Ironshore subsidiary.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Fallon will retire in January 2026 after 30 years at the company.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Scott Pegram had been at Liberty Mutual for over six years in various senior roles.

-

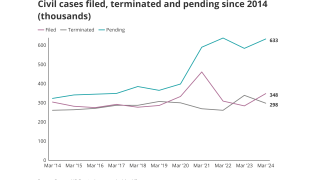

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Lara approved an interim rate increase for the company just weeks ago.

-

The deal leaves premier surety as Travelers' sole Canadian portfolio.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

The executive has been with the firm since 2011.

-

Two wind and hail events were responsible for 60% of the total.

-

State Farm will need to provide its CA subsidiary with a $400mn surplus note.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Hits to personal auto, workers’ compensation led to a drop in NWP.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

Insurers haven’t announced concrete steps – yet.

-

The Canadian conglomerate’s total cat losses in Q1 reached $781mn, including $692.1mn from the fires.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive has been with the firm’s underwriting team for over 12 years.

-

But automotive repair costs are likely to increase faster than home repair.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

The business insurance segment booked a CoR of 96.2%, up 2.9 points YoY.

-

Korte had been serving as interim president of the unit since December.

-

The carrier has received 12,300 claims as of 28 March.

-

The decision is the first of its kind under the new Trump administration.

-

The new CEO hints at expansion into MGA markets.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

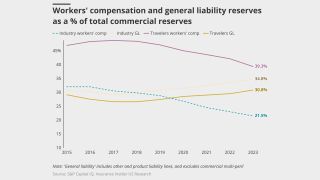

Executives see earnings benefits from workers’ comp beginning to diminish.

-

Debbie Chalkley has been appointed CFO of Fairfax India.

-

The carrier has seen increased legal system abuse in US small commercial and excess and umbrella.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Customers will keep their agent relationship and policies will not be impacted.

-

The carrier has also received 11,750 fire-related claims so far this year.

-

The company is seeking an emergency rate increase after the devastating Los Angeles wildfires.

-

State Farm General has asked California regulators for an emergency rate increase.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

A quick roundup of our best journalism for the week.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

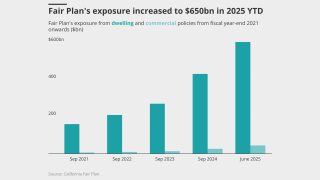

Sources said California regulators need to show they’re receptive to private insurer needs.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

The insurer is seeking a 22% interim raise, but the request is currently on hold.

-

Insurers have paid $6.9bn in Southern California wildfire claims in the first four weeks of recovery.

-

The insurance commissioner said the carrier has not shown the need for price increases.

-

The executive told analysts Fairfax has no plans of walking away from its current cat position.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

Its post-tax estimate of $1.3bn is net of reinsurance recoveries.

-

The carrier has not added new business in the state since 2007.

-

The carrier has been reducing its presence in the state since 2007.

-

The company says the recent wildfires will be the costliest in its history.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

The carrier has around $2.5bn-$4bn of reinsurance cover specifically for California risk.

-

The company received over 10,100 home and auto claims as of January 27.

-

The insurer’s strong Q4 results might not read across to the rest of its peer group.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Cat activity was a “modest” $175mn for Q4, but still up year over year.

-

The insurer also added $150mn cat coverage while reducing the total ceded premium for this treaty.

-

Cat losses rose to $175mn, fueled by Hurricane Milton and higher Helene estimated losses.

-

A state-mandated, one-year moratorium on non-renewals is also in place.

-

‘Emotionally driven’ claims by non-profits underscore their unique D&O exposures, according to Travelers' Nicole Murphy.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

Brian Young is now Fairfax president, while Carl Overy is Odyssey CEO.

-

The company has been buying out Omers’ shares since 2015.

-

The carrier has seen two other exits from its US tax team this year.

-

A quick roundup of our best journalism for the week.

-

Newcomers enter on the belief that they have a “better mousetrap”, said Donato Monaco.

-

The appointment will be effective January 1.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

The renewal book has auto, home, renters and condo policies, among others.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company has grown its premium base by 12% annually over the last five years.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Liberty Mutual expects $550mn in Helene losses versus Milton’s $250mn-$350mn.

-

Asbestos claims for exposed insurers could place more pressure on workers’ comp reserves.

-

Umbrella and commercial auto led Q3 rate hikes with double-digit increases.

-

The firm reported $547mn from Hurricane Helene losses.

-

Insurers are fighting to recoup claims they have paid out.

-

Top concerns also included medical cost inflation and employee benefit costs.

-

Fifteen events caused estimated losses of $306mn.

-

Civil case, nuclear verdict and claims count data show worrying trends.

-

Sources said LSM head of third party in Miami Humberto Pozo will serve as interim head of distribution.

-

The figure represents a quarterly increase of 102%.

-

Sanchez will report to Carolina Carmona, LSM’s head of financial lines in south Florida.

-

The news team runs you through this week’s key M&A deals.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

Total catastrophe losses stemmed from 20 events and were estimated at $587mn.

-

Travelers now holds around 6.2% of Fidelis, down from over 7.2%.

-

Year to date, casualty rates, excluding shared economy, are up roughly 10%, the executive said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

The report also noted that 35% of injuries occurred during an employee’s first year.

-

A quick roundup of today’s need-to-know news, including CrowdStrike and Slide’s IPO.

-

The company recorded an undiscounted CoR of 93.9% in Q2.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

NatGen allegedly collected $500mn associated with the fraud.

-

Julie Hasse is currently COO of Liberty Mutual Investments.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

The firm recently announced a restructure across its underwriting team.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

A quick round-up of today’s need-to-know news, including the Microsoft outage and Travelers' results.

-

The carrier purchased an additional $150mn of cover.

-

The firm strengthened GL reserves by $250mn, for AY 2021-2023.

-

The carrier’s underlying combined ratio improved 3.4 points year on year to 87.7%.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty, Marsh, Allstate.

-

Allstate’s total pre-tax cat losses for H1 2024 were $2.85bn versus an estimated $4.39bn in H1 2023.

-

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

This takes pre-tax year-to-date cat losses to $2.62bn.

-

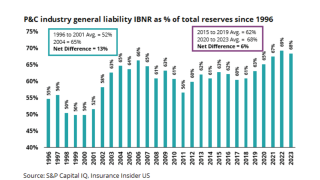

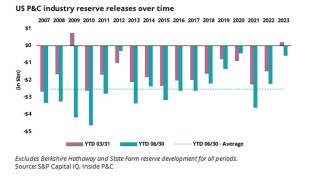

The discrepancy between rising claim counts and favorable reserves is cause for concern.

-

Spelman joins Hiscox from Liberty Mutual.

-

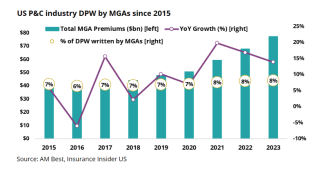

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

Recent contingency losses reflect a willingness of the market to go looking for premiums.

-

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The BMC-IBM judgment was insured for about $700mn on a heavily co-insured tower of around $1bn.

-

This takes pre-tax cat losses for the calendar year to $1.23bn

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The product was made through a partnership with technology provider Safehub.

-

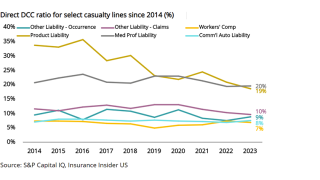

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

This follows February’s cat losses coming in below the $150mn reporting threshold.

-

Corrective actions revealed by Travelers in the first-quarter earnings could set the stage for similar moves from peers

-

The insurer is currently transitioning Corvus' ‘profitable’ $200mn book of business.

-

Underlying improvement was driven by a decrease in the personal lines core CoR.

-

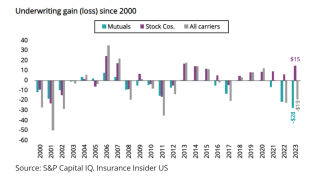

Mutuals struggle to react and adapt to a worsening loss environment.

-

The downgrade reflects the company’s balance sheet strength, which AM Best assessed as weak.

-

Chres Lee was previously M&A counsel for Liberty Global Transaction Solutions.

-

Based in Miami, the executive has worked at Liberty Mutual for nearly 13 years.

-

The carrier stopped accepting new HO business in the state last May.

-

This follows January pre-tax cat losses of $276mn.

-

-

The company has no immediate plans to re-deploy proceeds from recent sales in Europe and LatAm.

-

Personal lines rate filings are rising, even as some inflation drivers slow.

-

Increased cat losses in property offset auto improvements.

-

SEC filings show that Travelers’ equity ownership was valued at over $107mn in Q4.

-

The activist investor has accused Fairfax of “pulling levers” to produce “paper profits”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Two events comprised approximately 80% of the losses.

-

The company provides reinsurance to insurers in LatAm and the Caribbean.

-

The short seller has accused the company of manipulating asset values.

-

The company will hold its Q4 earnings call on Friday February 16.

-

The carrier expects to "get smaller in New Jersey" due to lack of rate adequacy.

-

Insurance Insider US runs you through the earnings results for the day.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

The carrier laid off approximately 850 staff late last year.

-

The percentage of cases that could lead to higher losses increased in 2023.

-

As part of Liberty Specialty Markets, John Krupczak will report to Manuel Moreno.

-

Shares rose to over $213 at one point – from their previous close of $198.35 – after this morning’s Q4 results, which included an 8.7 point combined ratio (CoR) improvement driven by a rebound in personal lines.

-

The carrier also renewed the 20% quota share with Fidelis, maintaining the same loss ratio cap the parties agreed in 2023.

-

The program’s retention remained the same at $3.5bn.

-

The personal insurance segment’s CoR slashed to 86.8% from 105.3% in the prior year quarter, as the contribution of cat losses declined by 7.3 points to 2%.

-

Unfavorable prior year reserve re-estimates, excluding catastrophes, totaled $199mn in Q4, with approximately $148mn related to personal auto, including costs for litigation claims.

-

In his new role Bolaños will report to both Matthew Moore, Liberty Global Risk Solutions (GRS) president of underwriting, and to Phil Hobbs, LSM president and MD.

-

In this new role, she will manage cyber product and underwriting strategy across the globe, reporting to Matthew Hogg, global product leader, cyber.

-

The announcement closes the $435mn-deal which was announced in early November.

-

The deal was announced in April, whereby the firm agreed to purchase a further 46% stake to take its shareholding to 90%.

-

Travelers is set to expand its core cat treaty by between $1bn and $1.5bn, in a further sign of increased demand for cat reinsurance coverage at 1 January, this publication can reveal.

-

For the month of November, Allstate brand’s auto rate increases totaled $262mn, after implementing $517mn and $1.49bn of rate increases in Q3 and Q2, respectively.

-

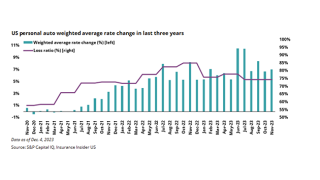

Cooling CPI metrics and improving loss ratios indicate a positive shift for the personal auto industry, but results are not yet back to where they need to be.

-

It is understood that the cuts are based on a review of five-year loss ratios, and that agents above 70% will be impacted.

-

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

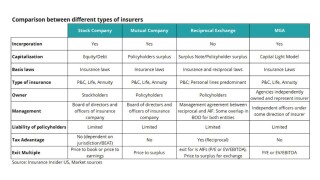

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

The underwriter will work in the retail property team at BHSI serving the central region.

-

Sources agree that there are others that could follow a similar playbook, but there are three key considerations to keep in mind when pursuing a strategic-on-InsurTech transaction.

-

As part of the US standard casualty team, she will develop and manage a portfolio of assumed casualty treaty reinsurance business.

-

Meanwhile, the company’s October cat losses came in below the reporting threshold of $150mn, compared eith $317mn of cat losses in September and nearly $1.2bn for Q3.

-

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Carriers have been dealing with elevated storm activity this year, whilst additional purchases to match inflating values had largely been parked in 2023.

-

The Inside P&C news team runs you through the earnings results for the day.

-

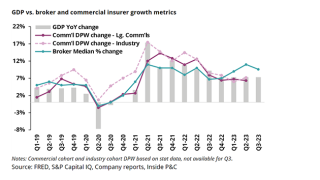

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

Liberty GTS noted a fall in the proportion of R&W notifications where the potential loss exceeds the retention in the last 12 months as compared to the preceding 12 months.

-

The transaction is expected to close in the first quarter of 2024, subject to regulatory approvals.

-

The Inside P&C news team runs you through the earnings results for the day.

-

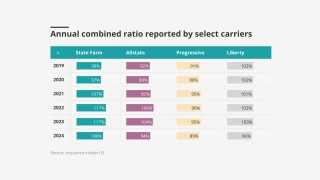

Three states — California, New Jersey, New York — were responsible for adding five points to YTD combined ratio for 2023.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The cuts amount to roughly 2% of the insurer’s US workforce.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

Most of the losses, around 80%, were the result of two wind and hail events.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

“In the next few weeks, the third chapter will begin and I am excited to engage with the new team. I can’t share the details just yet but will provide an update in the near future,” Joseph Meisinger announced.

-

The carrier booked net pre-tax unfavorable development of $154mn in Q3, primarily driven by $263mn of unfavorable development from its business insurance unit.

-

CFO Frey noted that there was “nothing terribly significant in this quarter” with regards to the company’s view of loss trends.

-

Catastrophe losses of $850mn were primarily the result of “numerous” severe wind and hail storms in multiple states, the company said.

-

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

The carrier has suffered five quarters of losses, largely spurred on by hefty natural catastrophe losses.

-

The survey found that a majority of Canadian businesses consider cyber threats their top concern and also believe they will eventually fall victim to a cyberattack.

-

This is the second downgrade faced by State Farm and its subsidiaries from AM Best in the last month.

-

The ratings agency affirmed its financial strength rating of A++ and long-term ICR of aa+ on the mutual and its affiliates.

-

-

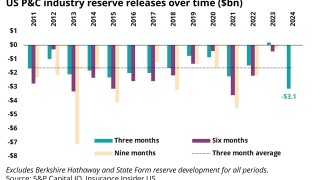

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

The executive has 15 years of underwriting experience and most recently led Liberty Mutual’s North America specialty primary casualty business.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In Partnership With AXISTools including raising deductibles and attachment points can help manage inflation challenges, says Jay Hamilton, head of A&H for AXIS

-

In Partnership with Moody'sJoin Insurance Insider for a free webinar, offered in partnership with Moody’s, at 10:30 EST/15:30 GMT on 22 January

-

How do struggling governments across the globe tackle stagnating economic growth?

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider US

Brown & Brown appoints Hearn to lead global operations

The executive has been serving as COO since February.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.