Brown & Brown

-

Success in the soft market will be had when careful preparation meets opportunity.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

The business is beginning to integrate following a $9.8bn acquisition.

-

The executive has been serving as COO since February.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

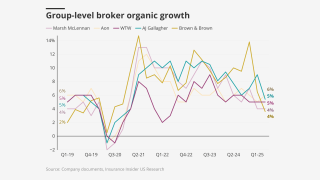

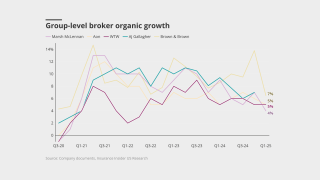

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Some E&S business is flowing back to the admitted market but so far it is “anecdotal”.

-

This is its second significant wholesale acquisition this year following the $54mn takeover of NBS.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Weatherbys Hamilton provides private client, bloodstock and farm coverage.

-

The broker is targeting run-rate synergies of $150mn by the end of 2028.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

The acquirer will carry out a ~$4bn equity placement to help finance the transaction.

-

Sources said that negotiations are proceeding well with a path to do a cash deal.

-

Q1 was the ninth consecutive quarter of below-average deal volume.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It will be tough to pull off prior goals despite management assurances.

-

The firm acquired total assets of $65mn and assumed liabilities of $11mn.

-

Q1 rates in most lines were consistent with prior quarters but slightly down on 2024.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

Sources said Brown & Brown has an advantage as it entered the process several weeks ago.

-

Sources said the Evercore-run Risk Strategies process has drawn the interest of Brown & Brown.

-

This publication revealed the appointment earlier today.

-

He will have to step down from his non-executive role on the board to take the job.

-

It was the broker’s second-largest deal in Q4 after it completed the takeover of Dutch brokerage Quintes.

-

The Nationwide subsidiary is a $750mn-premium wholesale brokerage that serves about 10,000 local agents.

-

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

Brown also said California needs a Marshall Plan-like strategy after the wildfires’ devastation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

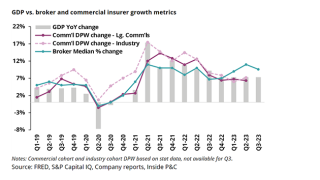

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

Casualty, general liability and excess will also see rate pressure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Mike Neal and Mark Abate have been elevated to senior leadership roles.

-

Hearn has held CEO positions with several other units of the Ardonagh Group.

-

Quintes' revenues for 2025 are projected in the $110mn-$120mn range.

-

Quintes will continue to be led by Gijsbert van de Nieuwegiessen, CEO and founder.

-

Property rates are under pressure, with some accounts seeing rate decreases.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Accounts with poor performance records are expected to see flat to 20% rate increases for cat coverage, according to Floridian broker Brown & Brown’s Q3 Market Trends report.

-

Cat rates meanwhile are seeing downward pressure from 'pricing fatigue’ and limit expansion.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The announcement was made in a securities filing Thursday morning.

-

The charity supports mental health causes such as research and education.

-

Insurance Insider US examines public brokers’ 2023 M&A.

-

The broker’s Q4 programs reinsurance change led to a one-time $19mn charge that will allow it to reduce its PML exposure.

-

Brown & Brown Q4 organic growth slows to 7.7% on programs deceleration

-

The executive retired from Zurich effective 31 December, 2023, most recently serving as chief transformation officer, after beginning her career with Zurich in 1991.

-

Founded in Volusia County, Florida in 1948, Caton Insurance merged with John Hosey agency in 1993 to create Caton-Hosey Insurance.

-

The Insurance Insider US news team runs you through some of the key M&A intelligence from the past week.

-

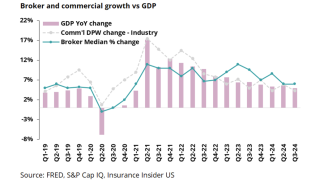

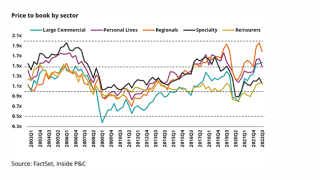

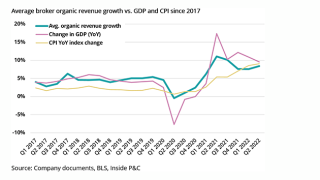

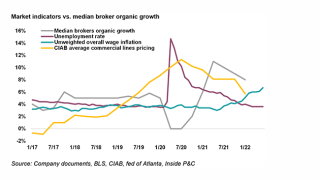

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

At least one carrier struck a note of caution during Q3 earnings about the ongoing rapid growth story in surplus lines.

-

The Brown & Brown CEO noted that property cat remains "the most challenging" line, while workers' comp decreases have continued to slow.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Mike Bruce was previously CEO for Global Risk Partners, acquired by Brown & Brown last year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Brown & Brown CEO will cycle 470 miles in seven days through the Alps, climbing 66,000 feet, with his brothers.

-

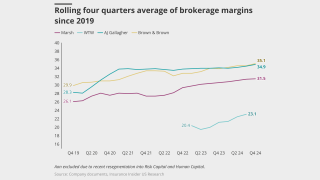

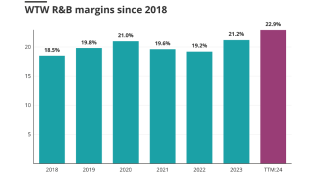

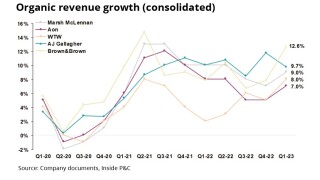

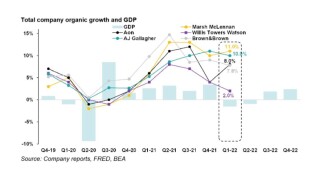

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

Still, the slowdown doesn't mean that a good business won't trade at high multiples, and the marketplace remains competitive for high-quality acquisitions, executives noted.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Krump retired from Chubb in January of this year, while Masojada retired from Hiscox in 2021.

-

The US retailer’s acquisition of the UK MGA and broking group will be mutually beneficial, according to executives.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The transaction is expected to close in the fourth quarter, subject to regulatory approvals. Financial details were not disclosed.

-

Though strong growth continues, the future is less clear as driving forces potentially run out of steam.

-

D&O (Inside P&C Daily lead story): There is hope that public D&O rates could stabilize in the second half of the year following a tough end to 2022 and an ongoing slump in Q1. Significant discounts granted in 2022 are unlikely to be repeated, and there are ongoing concerns around both economic and social inflation, sources said. In the meantime, rates remain pressured from ample capacity and muted demand as established providers and incumbents drawn to the hard market of past years compete for relatively stagnant demand. The collapse of SVB, while a shock, wasn’t the inflection point for D&O that some might have expected.

-

“In a business that’s $2bn+ of revenue, the impact of Florida today vs 15 years ago is much different,” president and CEO J Powell Brown said on a conference call.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

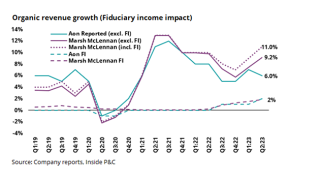

Competitor Marsh McLennan also reported a reacceleration of organic growth in the first quarter to 9%, coming above the 7% reported in Q4 2022.

-

Inside P&C takes a deep dive into public brokers’ M&A activity in 2022 as Q4 earnings season comes to an end.

-

The chief executive could receive up to 200% of that target amount, contingent on achievement of personal objectives, as well as the broker’s organic growth metrics and Ebitdac margins.

-

Property rates increased 20% to 40% in Q4, and some customers were unable to buy full limits and ended up increasing their deductibles or purchasing lower limits.

-

Consolidated organic growth on a year-on-year basis, however, fell by 1.2 points amid a slowdown in the broker's retail segment.

-

For nearly four years, Patel served as executive chairman at Perennial Climate following a three-year stint as CEO of Softbank-backed Brightstar Corp.

-

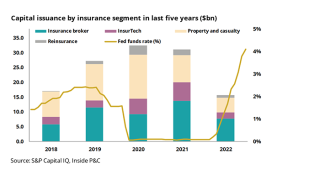

Increased interest rates and unfavorable market conditions led to reduction in capital issuance activity in the P&C insurance industry in 2022.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The transaction marks another step in the broker’s acquisition spree this year, including the $1.85bn GRP deal – closed on July 1 – and the $487mn takeover of MGA Orchid.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The firm’s contingent commissions were negatively impacted by $15mn while the captives division estimates $11.5mn of Ian-related losses.

-

Q3’s consolidated organic growth number marked the lowest organic expansion for the company since the last quarter of 2020, when it reported a 4.7% figure.

-

As the super-cycle slows and the economic landscape becomes more uncertain, brokers will face pressure, though a cooling labor market may aid margins.

-

The company also shifted former CEO Carlsen to EVP for National Programs; tapped Bowie as president and CUO.

-

While brokers continue to report positive earnings, the possibility of a downturn shouldn’t be discounted.

-

In a Q2 earnings call, J Powell Brown described the impact on the broker if issues in Florida “were to all go to hell in a handbasket”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker’s second-quarter adjusted diluted earnings per share rose by 6.3% to $0.51 per share, above analysts' average expectation of $0.48 per share.

-

Brokers may face pressure as the pricing cycle turns and estimates fail to keep up.

-

Rate rises in the commercial lines market have decelerated in most insurance markets, but executives expect increases to remain above loss costs for some time.

-

Brown & Brown CFO R Andy Watts has emphasized to Wall Street analysts that the mid-market broker is “not out of the M&A market”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Brown & Brown’s first-quarter earnings rose by 10% to $0.77 per share, roughly in line with analyst expectations.

-

Owad joins the Florida-based intermediary following almost three years at Amsure, where she served as assistant vice president based in Albany.

-

The US intermediary said it would pay roughly $2.5bn for the trio of acquisitions.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

GRP global CEO Mike Bruce will continue to lead the firm and will report to Brown & Brown president of retail segment Barrett Brown.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Orchid and CrossCover will report to Brown & Brown president of national programs Chris Walker.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The protracted firming phase of the cycle continues, with E&S firmer than the admitted market.

-

All of BdB’s subsidiaries and leadership team will join Brown & Brown’s roster following the acquisition.

-

The firm reported positive earnings results, but the GDP outlook could pose tough comps.

-

The broker sees slowing GDP, higher cost pressures on clients and rising loss costs that could be impediments to deals getting done as headwinds for the upcoming year.

-

Consolidated Ebitdac margins expanded by 210bps, helped by 420bps of margin expansion in national programs and 120bps of improvement in retail brokerage.

-

Mary Raveling becomes the second woman to join the now 14-member senior leadership team.

-

With the acquisition, struck through its subsidiary Brown & Brown Lone Star Insurance, the broker will expand its operations in Texas.

-

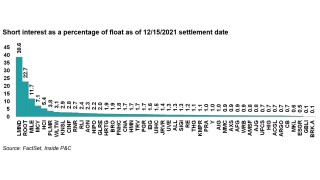

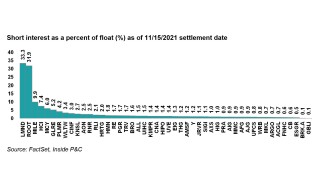

Lemonade, Root, and Metromile remain the focus of short sellers, as most firms see little short interest change.

-

Following the transaction, Corporate Insurance founder Mark Schwartz and his team will join Brown & Brown’s operations in Ft Lauderdale, Florida.

-

Lemonade and Root remain the focal points of short sellers, while Metromile’s stock loan fee rate increases (pending acquisition).

-

Short interest fell in InsurTechs, but not enough to ease the pressure on the sector.

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.

-

Following the acquisition, Heacock’s staff members will continue to operate from their Lakeland and Sebring offices, under the leadership of Stacey Heacock Weeks.

-

Root and Lemonade remain the highest-shorted stocks covered, as short interest in most firms remains flat in anticipation of earnings.

-

Quarterly results show the first signs of slower organic growth, suggesting its middle-market focus may leave it more sensitive to rate moderation.

-

James River stock tumbles, Brown & Brown slips, RenRe sees modest gains on Q3 results.

-

Despite headlines of major turnover across intermediaries, Brown & Brown’s CEO suggested retention had been as good as ever.

-

Retail organic growth picked up to 8.3%, while consolidated Ebitdac margins expanded by almost 300bps, to 35.6%.

-

The Daytona Beach-based broker expands its retail segment with the purchase of the pharmacy consulting service.

-

The Daytona Beach-based broker is to bring its retail segment under one brand name.

-

Howden is on the cusp of sealing its third major acquisition in 12 months, and its biggest to date.

-

The UK consolidator had been expected to be auctioned, but that process now looks set to be pre-empted.

-

Daytona Beach-based Brown & Brown buys benefits firm Agis Network and New Jersey wholesale broker Gremesco.

-

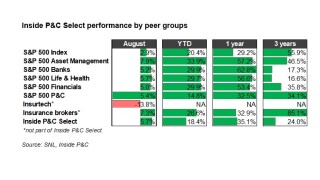

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.