Everest

-

The company announced four internal promotions this week.

-

Habayeb will start next May following Kociancic's retirement.

-

The move comes after Everest sold renewal rights for its global retail business to AIG.

-

The appointment follows Everest’s $2bn renewal rights sale of its commercial retail business to AIG.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

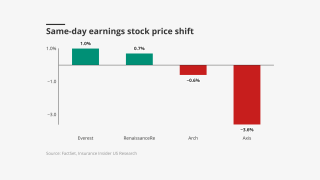

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

He joins the company after 22 years in casualty leadership roles at Chubb.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

The executive most recently served as head of North American treaty reinsurance.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

Specialty casualty now accounts for around 22.2% of its insurance business mix.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Jill Beggs was most recently COO for reinsurance.

-

Jim Williamson said litigation funding had evolved into an investment class.

-

The carrier has scaled up its international insurance offering in recent years.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The remediation process is on track for completion in the fourth quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

London-based US excess casualty writers are increasingly looking to attach lower in the tower.

-

The executive was named group CEO in January.

-

Joe Fobert will report to William Hazelton, EVP of Everest.

-

Jeanmarie Giordano joined the company last September.

-

The executive was Everest CEO from 1994 to 2013 and has served as board chair since 1994.

-

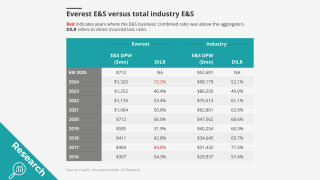

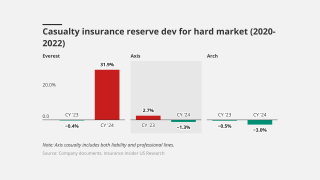

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

John Howard was appointed as an independent, non-executive member.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

The agency said it does not expect a “material impact” from the charge.

-

At January 1 renewals, prices dropped 5%-15% for loss-free programs.

-

The Bermudian’s wildfire loss estimate was based on an industry loss range of $35bn-$45bn.

-

The carrier’s year-end kitchen sink action is a make-or-break moment for a troubled franchise.

-

CEO Jim Williamson said social inflation was a “growing barrier” to a vibrant economy.

-

The (re)insurer recorded a reserve charge of nearly $1.3bn within its casualty insurance book.

-

He was appointed acting CEO earlier this month, after Andrade’s departure.

-

The appointment follows a series of moves across the Miami treaty sector over the past 12-18 months.

-

Carlos Becerra will succeed Delgado as Miami-based LatAm fac head.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

The carrier tapped the run-off market in Q4 for a US casualty insurance-focused portfolio.

-

He succeeds Wayne Peacock, who retires this year after four years of service.

-

Andrade is taking up a CEO role at another “prominent financial services firm”, Everest said.

-

The executive had joined the firm from Chubb in May.

-

Everest Group’s regulatory filing did not give a reason for the resignation.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

Both executives will be reporting to EVP Bill Hazelton.

-

She steps in to replace Phil Taylor, who left the company in September.

-

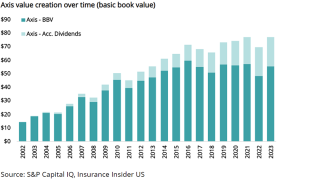

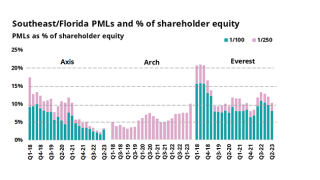

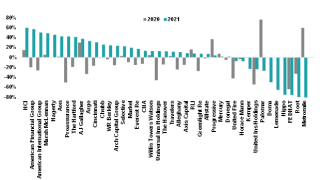

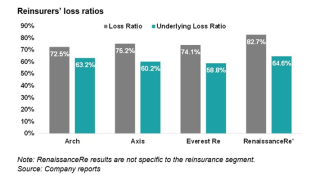

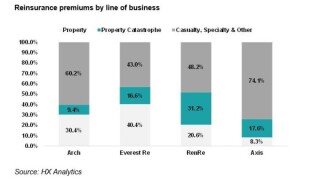

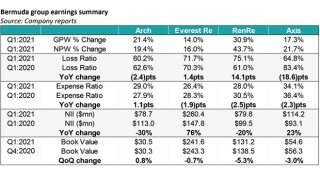

Arch stands out among hybrids, but Axis and Everest grind it out.

-

Andrade flagged expected 5% to 10% increases in the US and Europe.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In tandem, John Posa joins the primary casualty team as vice president.

-

This follows a spate of program manager deals Ryan Specialty has made.

-

This publication revealed last year that Ocampo will lead the Colombia unit.

-

Anthony Izzo has been appointed chief broking officer to lead the team.

-

He succeeds Rob Clark, who was appointed global broker account lead.

-

Stephen Buonpane will lead the division, with Danielle Stewart as COO.

-

Mike Mulray is leaving to pursue other opportunities.

-

In November, the company said it aimed to reach the goals between 2024-2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer also hired ex-Chubb SVP Lope Garcia as chief claims officer.

-

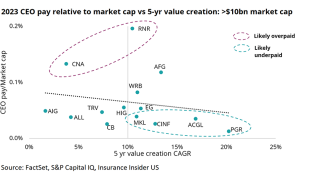

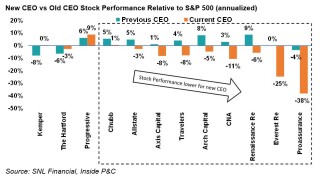

Analysis shows several CEOs with pay diverging from the trendline.

-

The executive was co-founder and chief insurance officer for MGA Shepherd.

-

Doshi takes over from Jiten Voralia, who was promoted to head of NA treaty reinsurance in February.

-

Industry trends show the Axis book value growth goal may be hard to hit.

-

Mexico is Everest’s second office in LatAm after the (re)insurer opened its regional headquarters in Chile.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

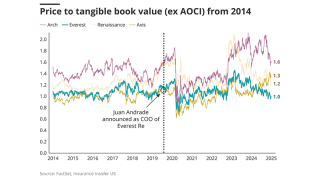

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

Craig Hanrahan joins as Northeastern region leader from Chubb.

-

The company plans to grow exposure for June 1 and July 1 renewals.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

-

Jill Beggs has been named chief operating officer for reinsurance.

-

The carrier said it has acted prudently on 2016-19 GL loss trends.

-

Insurance Insider US runs you through the earnings results for the day.

-

Chuck Volker has been with Everest for more than 20 years, most recently serving as SVP, head of US property and specialty.

-

Bill Hazelton replaces David Sandler, who is leaving Everest after six years.

-

The business will bring together aviation, marine, cyber, engineering and parametric solutions.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The executive will be responsible for all aspects of Everest’s retail, middle market and builder’s risk businesses.

-

Everest is targeting a combined ratio of 89%-91% for 2024-2026, compared to the 91%-93% target range from its previous investor day event in 2021.

-

This year, casualty pro-rata rates overall moved about 1 point, Everest’s Jim Williamson added, noting other deals in H2 where the numbers moved more than that.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

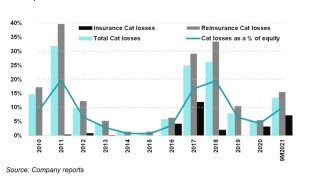

The company’s Q3 cat losses fell 77% to $170mn, compared to $730mn in the prior year quarter.

-

Everest North America insurance president Mike Mulray will head up the business on an interim basis while the carrier appoints a permanent unit leader.

-

In her new position, McDermott will report directly to Everest insurance CEO Mike Karmilowicz, effective immediately.

-

The executive has over 20 years of specialty insurance experience and most recently served as Everest’s head of financial and professional lines.

-

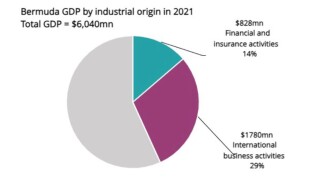

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

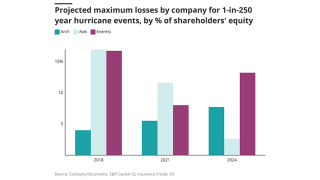

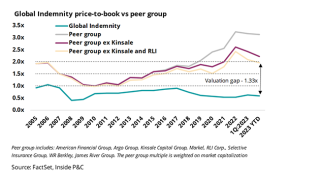

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

-

This will be the second senior appointment for Everest in LatAm after the (re)insurer hired Chubb’s Jaime Chaves as CEO in Mexico as part of its global build-out.

-

The chief executive also remarked on the strong rating environment in the property cat (re)insurance markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

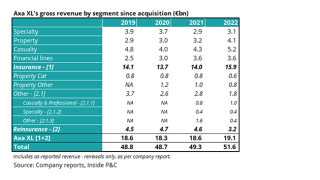

Axa’s lack of success in selling its more volatile XL Re segment has led the insurer to cut back on those lines, but the current rate environment makes this a good time to revisit a sale.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

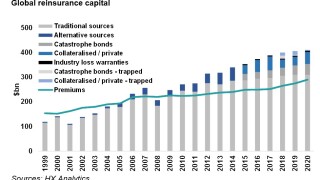

Reinsurers have mostly grown since before the Covid crisis, but the type and timing of growth affects value creation,

-

Interim CEO Luke Lichty will become head of commercial and specialty insurance for Canada.

-

Gallagher has over 25 years of insurance experience and joins Everest Re from AIG.

-

Recent top line growth and improved performance will need to be weighed against historical underperformance at group level, but the opportunity could attract a non-traditional buyer.

-

Everest Insurance has appointed Glen Browne as head of international corporate strategy.

-

Maritzen joins Everest after less than six months as head of underwriting for Berkshire Hathaway’s property program business.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the (re)insurer held an equity interest of approximately 20% in the Miami-based MGA.

-

Early private deals have provided far more stability in this year’s renewal than last.

-

Everest Re’s $1.5bn capital raise could be part of a continued pivot, or an early indicator of a shifting marketplace.

-

The company reiterated that net proceeds will be used for general corporate purposes, which may include expanding its existing business lines and operations.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The move follows a rebrand completed in November 2022.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The raise is a bullish signal from Everest on the returns available in the market but could be taken by some as another harbinger of easing market momentum.

-

Details of the placement are being closely guarded, but one source suggested the raise could be in the region of $1bn.

-

Returns from April 1 and May 1 were at or exceeded the return levels of January 1 renewals.

-

Most of the losses were sustained by the reinsurance segment, which reported $108mn in pre-tax cat losses, compared with $110mn in the prior year period.

-

In his new role, Mulray will lead all aspects of North America, the Insurance division’s largest portfolio, and report to Everest Insurance president and CEO Mike Karmilowicz.

-

Based in Mexico City, Chaves will report to Everest insurance Latin America regional president Pablo Korze, who is based in Chile.

-

It is understood that Everest acquired XL’s insurance license in Mexico from Axa, which already had one in the LatAm country when it acquired XL a few years ago.

-

The cat XoL rate increase in Europe was over 40%, while the average attachment point of the global property cat business increased “meaningfully,” he added.

-

The Bermudian reported $15mn in catastrophe losses for the quarter, down from $125mn in the same period last year.

-

It is understood that the Miami-based underwriter will continue operating with capacity from Bermudian carrier PartnerRe and Mexican reinsurer Patria Re.

-

Across the P&C industry, sentiment expressed on Q3 conference calls has improved since pandemic lows.

-

With a four-decade-long career in global financial services, McNeilage also serves on the boards of the Reinsurance Group of America and Scholarship America.

-

Sources said Miami-based Everest fac VP Sean Berry is set to move to London as head of international property.

-

In an interview, the CEO also addressed the carrier’s international expansion and portfolio remediation.

-

Axis’ pivot away from property reinsurance comes just as the sector reaches one of the biggest inflection points.

-

Discussion on Q3 earnings calls focused heavily on the supply-demand imbalance in cat capacity, as executives discussed how they would navigate a challenging January renewal.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive described the hardening property cat market as a “tremendous opportunity” for the Bermudian.

-

The Bermudian’s operating loss per share, however, grew nearly four times from the prior-year quarter to $5.28 per share.

-

The reinsurer attributed $600mn to Hurricane Ian, based on an estimate that the total insured industry losses would come to approximately $55bn.

-

The French operation will be led by Anne Charon, and the German unit by Bernd Wiemann. The two were appointed country heads earlier this year.

-

Based in New York, the executive will report directly to Everest Group COO and head of reinsurance Jim Williamson.

-

The pair will report to Artur Klinger and Paul Tester, respectively.

-

If the hurricane season continues to be mild, it could impact pricing momentum.

-

In the newly created position, Rudow will report to Everest North America reinsurance head Jill Beggs.

-

The carrier also recruited Danielle Stewart from Liberty Mutual as vice president and national head of wholesale distribution.

-

In his new position, the executive will focus on the firm’s expansion of its aviation insurance offerings.

-

CEO Juan Andrade said the carrier would be looking continually to expand and “bridge gaps”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

South African flood losses, Canadian and European storms and second-quarter events in the US were cited as contributors to the deterioration.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Everest Insurance has announced that its president of global property, Erik Nikodem, will retire in mid-July. The insurance arm of Everest Re also announced the appointments of three key leadership roles in its US and global property division.

-

In this newly created role, Joe Stuhl will lead the reinsurance organization’s global distribution strategy and address emerging needs.

-

The executive will report to Everest Group COO and head of reinsurance Jim Williamson.

-

The carrier received approval from local regulators to operate in Chile under the brand Everest Compañía de Seguros Generales Chile.

-

He moves from Axis Capital and will succeed Jon Levenson.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

He will replace the retiring Dennis Alba.

-

The move comes amid a number of senior appointment announcements in the Latin American market, including two senior hires from Marsh.

-

The firm said the conflict gave rise to uncertainty but at this stage losses appeared manageable.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The (re)insurer revealed it has “limited exposure” to the Ukraine-Russia conflict and did not make a loss provision due to the degree of uncertainty.

-

Scott Paddington and Russ Lewis will report to Jill Beggs, head of North America reinsurance at Everest.

-

Mango was a respected industry leader and played a key role in elevating the company’s culture of rigorous risk management.

-

A New Jersey judge writes a scathing decision criticizing hospitality firms for attempting to claim physical damage from virus and misinterpreting policy language.

-

The firm posted positive quarterly earnings results, but it's too soon view this this as a new trendline.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The reinsurer added $280mn in casualty pro rata premium in Q4, a 60% jump, while growing casualty XoL writings by 37%, or about $84mn in new premium.

-

The exit of key Florida insurers could spur rate increases.

-

Gross premiums leaped by 25%, to $3.43bn, from a 26% surge in reinsurance and 21% growth in insurance.

-

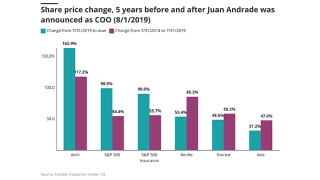

Inside P&C Research examines Juan Andrade’s rebalancing of the Bermudian towards insurance, and his efforts to tame the firm’s volatility.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The hires come as Everest continues its pivot towards primary business.

-

The insurer becomes the latest carrier to more heavily draw a distinction between its wholesale and retail units.

-

The UN’s Principles for Sustainable Insurance is helping to ensure ESG practices are embedded across all aspects of the insurance industry.

-

The company has also named Rui Marliere as head of its Latin America and Caribbean business.

-

The appointment follows the departure of Mike Hoffmann after a just over a year.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

The Mayfield Consumer Products candle factory is one of the two most high profile large individual risk losses from the quad state tornado to date.

-

Juan Andrade’s employment agreement has been extended through the end of 2023, with automatic annual extensions following this term.

-

Grace, who had originally left Everest in May, will be based in London, after previously working out of Boston.

-

The former president for specialty casualty insurance had moved into a senior casualty treaty role in Everest’s reinsurance division last month.

-

Reinsurers take stock of a changing catastrophe landscape and plot contradictory courses.

-

The underwriter’s exit comes after the reinsurer added Jill Beggs from Munich Re last week and promoted Peter Bell to be its new CEO in Bermuda in July.

-

The CEO also detailed the carrier’s efforts to capitalize on surging primary casualty rates through proportional treaty business.

-

The reinsurer grew GWP by 25% in the quarter to $3.5bn, while dropping its companywide attritional loss ratio by more than five points.

-

Everest Insurance head of specialty casualty will transition to the reinsurance division, reporting to Beggs.

-

New-Jersey based Everest has made multiple appointments in its underwriting operations this year.

-

The figure was lower as a proportion of shareholders’ equity compared to RenRe’s Q3 loss.

-

Diaz joined the company in 1991, where he took on various leadership roles to promote the company’s expansion internationally.

-

Guy Carpenter’s US facultative leader steps down after just eight months.

-

Everest Re recently outlined plans to lift gross premium by 10%-15% annually from 2021 to 2023.

-

Andrew McBride has also served as director of claims at QBE’s European operations and held various overseas roles managing claims at Aon and Axa.

-

From ESG to social inflation, systemic risk to cat risk, we highlight some of the top discussions from this year’s four-day virtual conference.

-

Modin will succeed David Whiting, who is retiring after a 45-year career in the reinsurance industry.

-

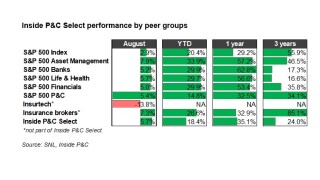

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

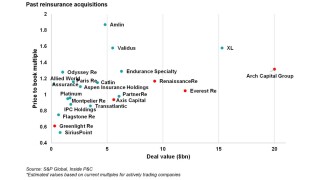

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

New Everest E&S casualty CUO Casey Hartley has over two decades of experience in the industry.

-

Good news may be temporary, no matter how good it is.

-

He suggested that the company might be willing to allow higher commissions.

-

The reinsurer grew its casualty pro rata reinsurance book by 64%, adding $218mn in GWP.

-

After their appointments, Ari Moskowitz and Peter Bell will report to Jim Williamson, Everest Re group COO and head of reinsurance.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

The company set aggressive targets for 2023 but was light on a deeper dive.

-

CEO Juan Andrade laid out the new targets in an investor day presentation in which he said the carrier will become a “digital first” (re)insurer.

-

Citi analyst Suneet Kamath wrote that P&C underwriters have more exposure to inflation pressures, due to higher claim costs compared with brokers and life insurers.

-

The case is the latest US suit regarding whether physical damage is required to trigger BI payouts.

-

The changing reinsurance market dynamics are impacting reinsurers' ability to raise rates.

-

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

The executive’s responsibilities will be taken on by chief operating officer Jim Williamson.

-

Maria Grace had been with Everest since 2016, and was previously an executive within AIG’s Lexington unit.

-

Several (re)insurer reporters do not anticipate the rate momentum to slow down materially even as they build on exposure growth.

-

Rates for Japanese wind treaties increased between 5% and 10% at the April renewal, while quake pricing was up 5%.

-

Premiums grew by 14%, led by 16% growth in reinsurance and a 14% expansion in insurance.

-

The carrier has also named Matt Gallagher as head of executive solutions and Ayesha West as head of cyber liability.

-

The insurance group says the Texas winter storms will likely cost the industry about $15bn in total.

-

The CEO said the company will become more balanced and diversified under his watch.

-

Michael Cipolla has worked at the carrier for nearly five years.

-

The executive has joined the carrier as senior vice president of management liability business.

-

She will report directly to Everest Re’s president and CEO Juan Andrade.

-

James Camerino worked at Everest Re for more than a decade and before that worked at Munich Re for 22 years.

-

Sources say he is succeeded in the role by Everest’s current deputy head of cyber Ayesha West.

-

Will the latest iteration of re-underwriting and management change improve the return profile of one of the largest (re)insurance franchises?

-

The company also said that it expects to grow underlying margins through underwriting actions that go beyond price improvement.