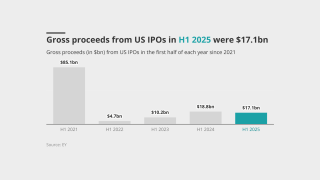

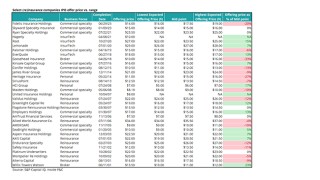

IPOs

-

The tech subsidiary applied to list its common stock on the New York Stock Exchange under the ticker symbol “XZO”.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

The oversubscribed IPO priced at the top end of expected $18-$20 per-share range.

-

Sources said they expect the carrier’s listing to raise about $100mn.

-

Sources said that the carrier’s listing is expected to raise around ~$100mn.

-

The company is estimating its IPO price at $18-$20 per share.

-

The company generated $71.4mn in revenue for H1 2025.

-

The PE-backed MGA has Morgan Stanley, Bank of America and JPMorgan advising.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.

-

As the IPO window opened, American Integrity, Slide, Ategrity and others followed Aspen.

-

Shares opened at $28.50 each, well above the $21 offer price.

-

The IPO was priced at $21 per share, up from the previous target range of $18-$20.

-

It is slim pickings for quality mega deals and the brokerage has an in-built need for speed.

-

The PE-backed MGA lined up Morgan Stanley, JP Morgan and Bank of America to advise.

-

The IPO price is expected to be $18-$20 per share.

-

The company resumed work on a public offering in September.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

Slide will also expand its footprint to New York and New Jersey towards the end of the year.

-

PwC reported that deal volume decreased to 209 deals from 297, but values climbed to $30bn from $20bn.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The Floridian is the third insurance company to go public in 2025.

-

The offering comes after Acrisure’s $2.1bn convertible pref share raise.

-

The company filed its S-1 in March, with a 2024 CoR of 93.9%.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.

-

Acrisure followed the recaps of Hub International and Broadstreet Partners.

-

This publication reported earlier today that the S-1 filing was imminent.

-

This publication reported earlier this year that the carrier is targeting a $250mn-$350mn raise.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Permanence and independence of a public company would be valuable, he told this publication.

-

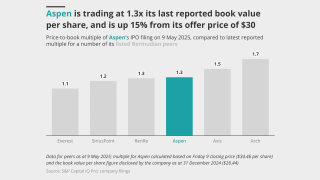

The company completed its upsized IPO last week and traded up to 1.3x book.

-

The Tampa-based insurer says it will use the capital for general corporate purposes.

-

The company’s upsized public offering priced at $30 per ordinary share.

-

The initial offering includes 6,875,000 shares of common stock.

-

The preferred shares will mandatorily convert to common equity on an IPO.

-

The offering launched last week with a valuation between $103mn and $116.8mn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The carrier is targeting an IPO valuation between $2.6bn and $2.9bn.

-

The initial offering will include 6,875,000 shares of common stock.

-

The carrier is offering shares priced at $29-$31.

-

Sources said JP Morgan and RBC are advising the brokerage.

-

The Floridian company applied to be traded on the NYSE.

-

Insurance Insider US examines potential tariffs’ impact on the PE-backed brokers amid the jammed conveyor belt.

-

There is a long waiting list of carriers looking to pull the IPO trigger, but market conditions remain tough.

-

The insurer has lined up Piper Sandler and KBW to run the process.

-

The SME-focused carrier reported $437mn 2024 GWP in its SEC filing.

-

A quick roundup of our best journalism for the week.

-

Slide lined up Morgan Stanley, Barclays and JP Morgan as lead bookrunners.

-

In October, this publication revealed that the carrier had resumed IPO preparations.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

The business put up strong H1 numbers, and has named Christian Dunleavy group president.

-

The move comes amid improving conditions in the IPO market for insurance companies.

-

The specialty insurer founded via a recapitalization of StarStone US is likely to go public in Q4.

-

A Q3 listing remains a possibility, but the timeline can change rapidly amid storm season.

-

The Texas-based broker will use proceeds to pay debt, consider acquisitions.

-

The Texas-based broker is aiming to raise gross proceeds of $187mn.

-

-

Underwriters will have the option to purchase an additional 1.6 million shares.

-

Insurance Insider US revealed last October that the broker was planning a 2024 IPO process.

-

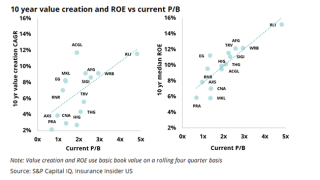

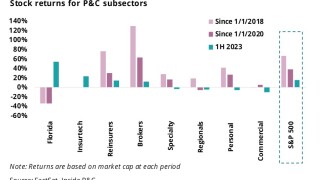

Analysis of company performance post-IPO shows varying trajectories over time

-

The firm’s underwriting performance is hard to piece together from the limited available data.

-

The firm has zero pre-2020 reserves, no MGA relationships, and management with a strong record.

-

Sources said that while a late June-early July IPO is still on the table, a Q4 or early 2025 listing is expected.

-

The company went public Thursday at a price of $17 per share.

-

The underwriters will receive a 30-day option for an additional one million shares.

-

From here on out, insurers will likely have to rely on the strength of their individual stories.

-

Sources said the company has halted its Q2 listing and will reassess the market next year.

-

The carrier will reassess the market in the fourth quarter, or early in 2025.

-

The filing comes four months after Insurance Insider US revealed Bowhead’s intentions to launch an IPO this year.

-

Challenges include integration, delevering, winning staff over and building a compelling equity story.

-

Sources said preparations for a 2024 IPO were halted, but work could resume later this year.

-

Sources said Stone Point and CD&R will each have stakes of around 35%.

-

Woodlands Financial Services listing is likely in Q2, but overall environment is subdued.

-

The company has applied to list on the NYSE under the symbol TFG.

-

Putting together two “show me” stories risks investor skepticism.

-

Sources said that the likeliest path for the business now is to prepare itself for an IPO, which would probably be unfeasible before 2025.

-

Sources said the fast-growing homeowners' Floridian is finalizing the process to retain investment banks with the aim for an equity event to take place in the first half of the year.

-

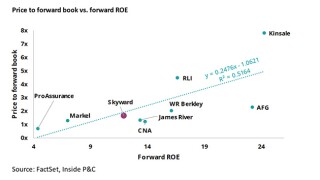

The Aspen IPO provides an opportunity to benefit from the specialty market without commensurate prior-year reserve risks due to an LPT cover.

-

Insurance Insider US dissects the largest and hottest deals of the year across broking, reinsurance and other segments of the industry.

-

The company also confirmed earlier reports from this publication that Goldman Sachs would be a leading bookrunner, along with Citigroup, Jefferies and Apollo Global Securities for its ~$4bn H1 2024 IPO in New York.

-

Sources said that the New York-based underwriter lined up JP Morgan and Morgan Stanley as lead bookrunners for the process.

-

The CEO emphasized that while trading conditions are favorable for the specialty segment, the company would make the decision to go public based on its own merit rather than market timing.

-

The announcement comes almost two months after this publication revealed that the carrier had lined up Goldman Sachs, Citibank and Jefferies to run its $4bn H1 IPO in New York.

-

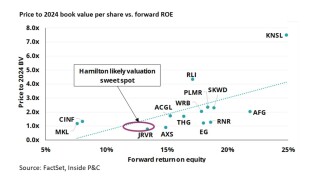

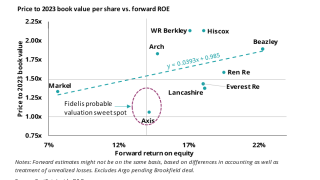

As this publication previously reported, the IPO pricing came in under book value but has still narrowed the gap on predecessor Fidelis, listing at 0.9x book value vs Fidelis’ 0.8x.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Hamilton’s IPO share price came in at the lower end of historical trends observed amongst insurers that have missed their target range upon listing.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier’s $15 per share listing came in below its $16.90 book value per share at the mid-year reporting point, or a 0.9x multiple.

-

The carrier is offering 15 million Class B common shares, according to a registration statement filed with the SEC.

-

Investors must weigh a differentiated investment strategy and true specialty opportunity against partial third-party investment control and historical losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Ongoing rate declines have been seen in recent renewals though the pace of decreases, particularly for established public companies, has slowed.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the roughly $2.7bn book value business is likely to target a valuation of 1.5x book or above — pointing to a valuation in excess of $4bn.

-

The carrier intends to list its common shares on the New York Stock Exchange under the ticker symbol “HG”.

-

Sources said the independent broker has lined up JP Morgan and Morgan Stanley as lead bookrunners in the IPO process.

-

Inside P&C has independently confirmed that the bank is working on a full sale of its insurance operation amid a challenging banking environment.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that Morgan Stanley was selected as lead underwriter in the process, with Q1 seen as the likeliest timing for a listing.

-

Last week, the Bermudian carrier filed its draft registration statement for a proposed IPO to the US Securities and Exchange Commission.

-

The carrier has not determined the number of common shares to be offered, nor the price range for its proposed IPO.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

In a recent report titled “TFC: Primed for activist”, Wells Fargo notes investor discontent and lists pressing issues to be addressed at Truist.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Underwriting income more than doubled to $77.5mn from $32mn as the company grew its top line largely through its specialty segment, reduced reinsurance exposure and lowered catastrophe and large losses.

-

The question of how to finance the private brokers no longer begins and ends with a PE flip.

-

The carrier could be the first tech-enabled underwriting business to test public investor appetite since the heady days of 2020.

-

Fidelis Insurance Group CEO Dan Burrows and Fidelis MGU counterpart Richard Brindle speak with Insurance Insider after the IPO.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the Atlanta-based InsurTech is likely to explore a dual track, with a potential sale looked at alongside the IPO.

-

Personal lines underperform predictions, while brokers and InsurTechs are a positive surprise (for now).

-

The proceeds will be used by the Bermudian to take advantage of rate hardening in key markets.

-

After pricing below the expected range at its IPO, the Fidelis stock price slipped on the first day of trading - here's how other (re)insurance IPOs have gone since 2000.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier has set its IPO price at between $16 and $19 per common share, and will trade on the New York Stock Exchange under the ticker FIHL.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The group’s returns have been driven by Two Sigma, but the total return model is perceived as toxic.

-

The Canadian investment company sold 3.85 million shares of common stock, priced at $23 per share.

-

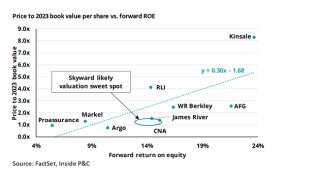

Skyward Specialty Insurance completed its initial public offering at the beginning of the year.

-

Strong results reflect tailwinds in the E&S space, but social inflation will be a trend to watch.

-

The Fidelis IPO has no clear precedent, but there is an appetite for investment in the specialty space, as seen earlier this year with the Skyward public listing.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer plans to be listed on the New York Stock Exchange.

-

Cutting a multi-billion carrier in two looks likely to be the preserve of a select group.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Alignment mechanisms include Fidelis MGU’s 9.9% stake in the balance sheet, personal MGU management stake and a significant profit commission.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the private broker retained advisory firm Solebury Capital for pre-work assistance in the process prior to investment banking engagement.

-

The insurer will continue growing via M&A and is looking for $50mn-$500mn specialty businesses with strong leadership to expand its portfolio.

-

The number of common shares to be offered and the price range for the proposed offering have not yet been determined.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurance group is being advised by JP Morgan and Barclays Capital.

-

A deal would give the broker the funds needed to finance its growth strategy, extending its IPO timeline at least into next year.

-

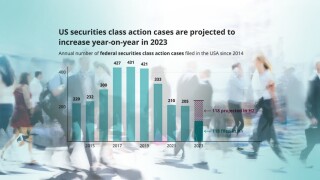

Established players are walking away from writing IPO, SPAC and de-SPAC accounts as increased capacity and falling demand in the sub-class causes rates to crater.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The acquisitive, Bain-backed retail broker has struck a deal with private equity firm Flexpoint Ford.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Skyward shares shot up over 27% this morning to $19.15 per share, a development which will likely be closely watched by some carriers with IPO aspirations.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

A total of 9.775 million shares will be offered, priced between $14 and $16.

-

2022 marked a reversal from last year’s unprecedented levels of global investment in InsurTech as the macroeconomic scenario flipped and investors put lossmaking companies under a magnifying glass.

-

Consistent underwriting performance, the completion of the exit from life, acquisitions, organic growth and succession planning will all be focuses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Skyward Specialty has indicated its intent to IPO at a time when investors may be looking for good entry points, though the window of opportunity may be closing.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The specialty insurer said the number of shares to be offered and the price range for the proposed offering have not yet been determined.

-

Core Specialty CEO Jeff Consolino noted that the recent Hallmark deal places the firm among the 20 largest E&S writers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.