Swiss Re

-

This was the second issuance completed by Farmers via its Bermuda reinsurance vehicle Topanga Re.

-

Los Angeles wildfires and SCS pushed US losses to $89bn.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Growth in the SME sector could help stabilize the market, however.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

The 127-acre corporate campus has been the reinsurer’s North America headquarters since 1999.

-

California wildfires account for $40bn of the insured loss tally in H1.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

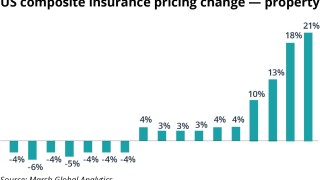

Rate gains are easing across many commercial and personal lines.

-

The reinsurer said US president Donald Trump’s policy was already impacting investment.

-

Separately, Caribbean market head Janine Seifert is leaving the reinsurer for BMS Re.

-

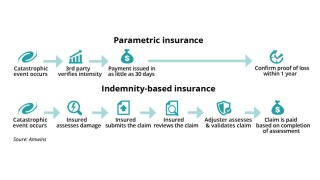

The once niche product is generating interest in a growing number of industries and sectors.

-

The reinsurer’s CFO cited a 1.5% net price reduction year to date.

-

Growing economic and population exposures are driving potentially larger insured losses.

-

The carrier forecasts stable profits, but tariffs are creating “high uncertainty”.

-

The tariffs could expose insurers to the risk of recession and shrinking income.

-

This follows the firm’s exit from primary aviation.

-

Katie McGrath is appointed CorSo CUO amid a restructure of the unit.

-

The executive has been with the firm for 27 years.

-

It estimated insured losses from nat cats on track to exceed $135bn in 2024.

-

This year’s top-line growth will be a decade high.

-

The market grew at a rate of 32% annually from 2017 to 2022.

-

The carrier’s Q3 net income will be around $100mn, far below consensus.

-

Pockets in the business are still experiencing significant stress, she added.

-

The company is currently “underweight” in that line of business, he added.

-

The reinsurer constructed a “social inflation index” for a new study.

-

The firm bolstered US liability reserves by $650mn in the H1 2024.

-

The insurance sector’s RoE is expected to exceed 10% next year.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

Commercial lines will remain bifurcated, with strong growth in property and weak growth in liability.

-

The US tallies $97bn in economic losses from major perils each year.

-

Effective immediately, Wolfe will help drive growth strategies across the region. He will also lead Guy Carpenter’s US facultative business alongside Frank Guerriero, chairman of Guy Carpenter Facultative.

-

The downgrade was driven by a change in the Swiss Insurance Supervision Act, which came into effect 1 January and is unrelated to the rating fundamentals of Swiss Re, according to the agency.

-

Darly Polenz will be working with Russ McGuire, head of origination, with a focus on accelerating BMS Re’s growth strategy with balance sheet businesses.

-

Separately, sources said Swiss Re Miami-based head of auto overseeing the motor portfolio for the LatAm region Carlos Ricci has also left the reinsurer.

-

Global cat-bond capacity has grown by about 4% annually over the last six years, according to a report by the Swiss Re Institute.

-

Losses from severe thunderstorms have increased by 7% annually in the last 30 years, according to the Swiss Re Institute.

-

Swiss Re says economic growth slowdown and elevated geopolitical uncertainty dampen the outlook for the primary insurance industry.

-

Rising counterparty risk from economic slowdown will support prices and growth.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The decision to align across business units had removed the need for the regional presidents' roles, the company said.

-

Insureds that have taken higher retentions or less limit due to increased cost could be exposed this year if there is a major cat event, according to Swiss Re’s Kyle Burnett.

-

AM Best said market hardening was likely to continue through 2024, given global market conditions.

-

A total of 10 events caused more than $1bn in losses each.

-

The industry’s ROE is expected to reach 8% in 2023 and 9.5% in 2024, up from 2.5% in 2022.

-

The global natural catastrophe protection gap stood at $368bn, with protection gaps being largest in emerging markets.

-

The report outlined 17 recurring and emerging risks (re)insurers should be aware of.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The comment comes after major US carriers pulled back from new business in wildfire-prone California.

-

He will join the North America regional management team, in addition to continuing to serve as a member of the company’s Canada management team.

-

Katie McGrath said the insurer continues to be deliberate in decision-making amid market opportunity.

-

Mayer will manage a global centre of excellence for parametric products and report to Paul Schultz, CEO of Aon Securities.

-

The Swiss reinsurer follows Munich Re, Hannover Re and Zurich in withdrawing from the alliance.

-

Everest Re’s $1.5bn capital raise could be part of a continued pivot, or an early indicator of a shifting marketplace.

-

Analysis of 2022 statutory data shows top US-exposed reinsurers grew assumed premiums 13% year-on-year in 2022.

-

The reinsurer has made a series of high-level reshuffles this month, including the appointment of Greg Schiffer as head of US national accounts.

-

Swiss Re has appointed Greg Schiffer its managing director, head of US national accounts.

-

Butera was previously head of P&C client markets US, in the company’s reinsurance division.

-

The reinsurer said cat reinsurance rates hit a 20-year high, driven by losses, inflation and financial markets.

-

Swiss Re estimates that inflation has peaked but is likely to remain persistent in 2023.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The appointments will be effective July 1, subject to regulatory approvals.

-

Chairman Kessler remains in place until the 2024 General Meeting when he will stand down on hitting the age limit of 72.

-

The executive had previously served as the company’s vice president and senior treaty underwriter, based in Mexico.

-

Cedants are grappling with rising rates while coverage narrows.

-

Based in New York, the executive will continue to report to Katie McGrath, CEO North America, Swiss Re Corporate Solutions.

-

The reinsurer emphasised the need for improved secondary peril models including predictive capabilities.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Real non-life premiums are forecast to grow by 1.8% in 2023 and 2.8% in 2024.

-

Global cyber premiums are expected to reach $23bn by 2025 but, with predicted global annual losses of around $945bn, roughly 90% of the risk remains uninsured.

-

The carrier is likely to book a Q3 net loss of $500mn for the storm.

-

The reinsurer said it will look to double rates and retentions and halve the amount of override on casualty quota shares.

-

The transport sector has the largest investment gap, needing an estimated $114tn to build greener infrastructure.

-

The storm is not expected to be a threat to the order of Jebi or Hagibis.

-

The carrier said geopolitical factors had given “new urgency” to the green transition.

-

Insured losses in 2021 alone hit $20bn.

-

If Hurricane Andrew were to hit the coastal regions of Florida today, insured losses would be nearly four times the $15.5bn borne by carriers 30 years ago.

-

Inside P&C revealed in late May that Luna was succeeding Juan Manuel Merchan, who stepped down earlier this year to become CEO at Seguros Equinoccial.

-

The carrier mapped out the future threat landscape for insurers as part of its annual Sonar report.

-

Sources said Luna will succeed Juan Merchan, who last month stepped down after over a year in the position to become CEO at Ecuadoran carrier Seguros Equinoccial.

-

Based in Boston, the executive will report to AGCS’ NA regional head of financial lines Joe Caruso.

-

Burnett joins Swiss Re from Axa XL, where he worked for over five years as E&S property head.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The first-of-its-kind deal blends bank financing with ILS funding.

-

David Presley joins Compre while the legacy carrier is targeting expansion in the US.

-

The broker said there was still a “big unknown” around the potential global economic impact of the conflict.

-

Swiss Re’s recent underwriting actions, model updates and risk repricing have prepared it to take on more secondary perils, according to its top team.

-

Continuing a trend of several years, secondary perils caused most insured losses at $81bn, or 73% of the total.

-

Katie McGrath replaces Ivan Gonzalez who has been appointed CEO reinsurance China and China country president.

-

Basil Louvrais and Avni Scerbo will set up the North America trade finance team.

-

The Hartford’s customers will have access to Swiss Re’s globally standardised property wordings and online platform.

-

The Buenos Aires, Argentina-based InsurTech will use the fresh funds to finance growth initiatives across the continent.

-

The transaction will expand the carrier’s reach in the US A&H market.

-

The Mayfield Consumer Products candle factory is one of the two most high profile large individual risk losses from the quad state tornado to date.

-

Hurricane Ida was the main loss-making event, but once again secondary perils generated more than half of global losses, according to the latest Sigma report.

-

The reinsurer and the tech firm will collaborate on driverless vehicle products.

-

Flood coverage is one area where the insurance industry can close protection gaps, but carriers and agents need to increase their efforts to educate clients about this peril, Swiss Re’s US P&C president told this publication.

-

The insurance marketplace aims to bridge the gap between insurance and capital markets.

-

The deal brings an end to Prudential’s participation in non-core legacy property and casual business.

-

The carrier also estimated its European flooding burden will be $520mn.

-

An increase in the frequency and severity of nat cats and cyber incidents is pushing up protection demand.

-

The reinsurer warns that climate risks could increase average weather-related property cat losses in advanced markets by more than 60%.

-

Coletti takes the role previously held by Anthony Cordonnier, who recently joined reinsurance broker Guy Carpenter.

-

Governments will need to think in the long term despite current Covid challenges.

-

A complex web of factors are creating uncertainty around the likely insured loss, but much early discussion centers on a $20bn-$25bn range.

-

The offering uses highest wind speeds at set locations as triggers for payouts.

-

Overall figure was driven by a deep winter freeze, hailstorms and wildfires and marked the second highest first-half figure behind 2011.

-

The carrier reported price improvements of 4% at the summer renewals.

-

The underwriter will likely oversee a brand-new team following the exodus of the prior team to Dual.

-

The pair will head up programs business in the Americas, Asia-Pacific and EMEA.

-

Head of crisis management Mark LeBlanc will lead the team.

-

The product uses Swiss Re's flood model for rating purposes and links it with policy forms developed by Flood Services Corporation.

-

Workers’ compensation InsurTech Foresight is on track to underwrite more than $50mn in annual gross premiums by the end of 2021, co-founder and CEO David Fontain has told Inside P&C.

-

The period when underwriters were over-reliant on submissions from clients is coming to an end.

-

Competition is intensifying, with increased London market appetite one of the drivers.

-

Reinsurers, corporations and states must redouble efforts towards net-zero emissions, the carrier says.

-

Interest in parametric coverages has increased among insurance buyers as a response to coverage gaps exposed by unanticipated losses and tightening traditional market capacity.

-

The reinsurer finds secondary perils accounted for over 70% of natural catastrophe claims.

-

Jones has worked at Swiss Re for over 13 years, having joined from Employers Re.

-

The new paper will be used to underwrite cyber and tech E&O risks in the US and Canadian markets.

-

The med-mal specialist’s results served as a memo to the state of the industry facing a plethora of challenges.

-

The Floridian has also incurred $23mn of net catastrophe losses in Q4 before tax.

-

Maya Bundt says insurers can do more to advise insureds to treat cyber like they would ESG concerns.

-

Natural catastrophe losses were up 40% year-on-year to $76bn, 7% above the 10-year average.

-

The executive will run the North America engineering and construction team after almost a decade with CorSo.

-

The new arrival at the M&A insurance specialist follows the departure of paper provider AGCS earlier this year.

-

China is expected to lead the upswing in business, with non-life premium growth of 10%.

-

Staggering changes in the casualty insurance market are feeding through to reinsurers, according to US P&C president Keith Wolfe.