Stocks

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The selloff may hint at headwinds for equity investors.

-

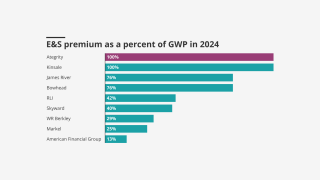

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

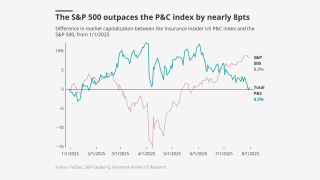

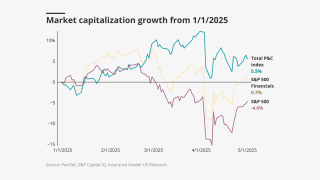

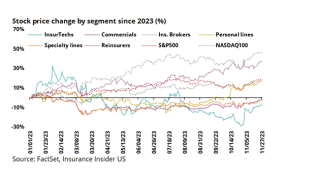

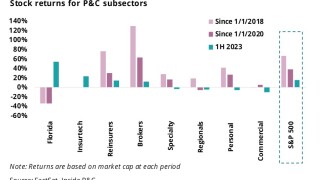

Industry stocks were firmly behind the S&P 500 in Q3.

-

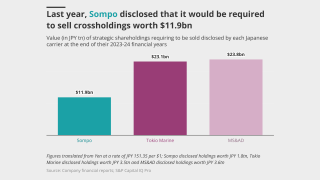

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

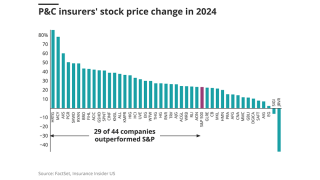

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

The president expects to see benefits from the deal in H2 2026.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The broker posted a 6.5% drop in organic growth YoY.

-

P&C’s outperformance lead dwindles, while specialty rises above other segments.

-

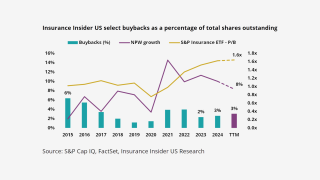

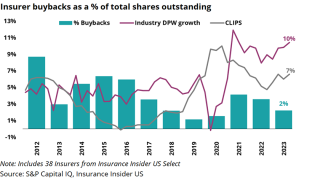

Additional buybacks are more feasible if P&C stocks slip and pricing moderates.

-

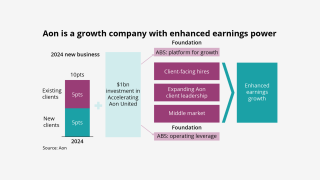

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

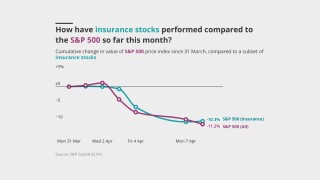

Insurance outperformance slows as markets recover from tariff shock.

-

The latest E&S player planning to IPO remains a “show me” story.

-

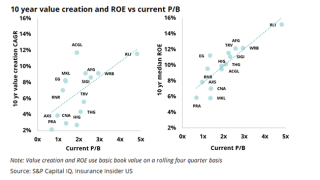

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

The program will succeed the previous buyback launched in 2023.

-

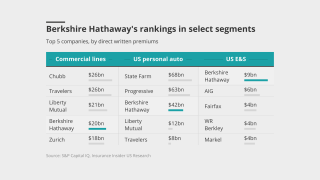

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

P&C held up better than the S&P 500, but there are causes for longer term concern.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

Inflection sets in for insurance stocks as macro albatross gets heavier.

-

Macroeconomic volatility could also create top-line headwinds.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Insurance’s demand inelasticity will be its greatest strength in 2025.

-

Insurance share prices were resilient amid today’s market meltdown.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

The company’s stock jumped 14% within 30 minutes of the market’s open.

-

The insurance market remains generally immune to tariff uncertainty, but not all is well.

-

On Monday, the firm reported a Q4 CoR of 155.1%, versus 98.1% a year ago.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

Insurance stocks are lukewarm amid earnings season, cats and political changes.

-

The board will lead the review following feedback from shareholders including activist investor Jana.

-

The PE firm held over 6.7 million Axis shares, around 8.2% of shares outstanding.

-

The carrier’s Q4 operating EPS declined to $0.41 from $0.77 in Q4 2023.

-

Most insurers outperformed the S&P 500 last year, but the trend is unlikely to continue.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

In June 2023, Hale Partnership got its license from the Cayman Islands Monetary Authority for HP Re.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

The firm had owned 3.45 million shares in Q2, then valued at over $256mn.

-

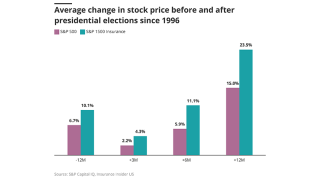

Republican tariffs and higher Democratic corporate taxes would hurt the sector.

-

The stock was hovering around $40 per share just before closing.

-

The Floridian insurer anticipates that it will remain profitable in Q3 and Q4 despite hurricane activity.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

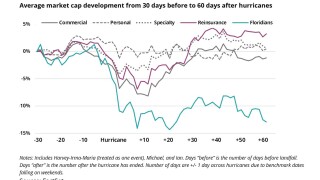

Milton’s significant but less-than-expected hit shifts our expectations for industry recovery.

-

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

The move comes less than a year after AssuredPartners’ sale process reached a stalemate.

-

While Republicans are typically perceived as best for business, there are several factors at play.

-

The move comes just days after the Warren Buffett-controlled conglomerate reached the $1tn market cap mark for the first time.

-

Westaim reported roughly $79mn in net proceeds from the sale.

-

Reagan Consulting has been retained to advise the ~$125mn Utah-based brokerage.

-

The conglomerate now owns around 27 million Chubb shares valued at roughly $6.9bn, compared to nearly 26 million in Q1.

-

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

S&P’s Insurance Select industry index had fallen by 2.7% at market close.

-

The funds were contributed to support the specialty carrier’s growth.

-

BHMS joins a group of Boost backers that includes Markel, Canopius US and management.

-

With the deal, 1970 secured capital to boost its liquidity management services for insured companies.

-

The Hartford and Aon also posted notable, though more muted, stock bumps.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

The news follows a string of deals that the stop-loss segment has seen in recent months.

-

The carrier’s CoR increased 15.9 points YoY to 116.1% on unfavorable GL development.

-

Longstanding investor Stone Point will continue as a partner and board member.

-

It is understood that the company expects to launch its Florida reciprocal in Q4.

-

Stable first half insufficient to counterbalance concerns on reserving trends.

-

Sources said the deal between the PE firms valued the broker at in excess of 16x Ebitda, or $4bn+.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

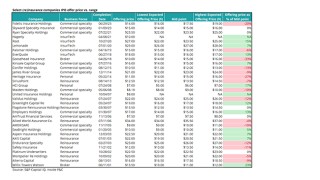

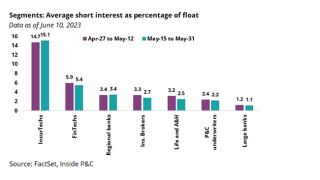

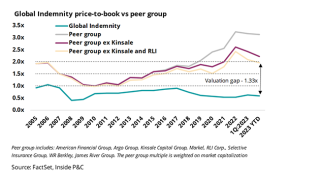

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

Insurance Insider US recently revealed the parties were in advanced sale talks.

-

The executive gave his view on the (re)insurance landscape and the impact of PE on the sector.

-

In January, this publication revealed that the Southern retailer retained Piper Sandler to run an auction to bring in a new PE investor.

-

Onex has proposed an alternative sale structure, which includes R&Q’s potential liquidation.

-

Analysis of company performance post-IPO shows varying trajectories over time

-

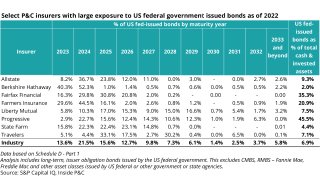

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The start-up's founder set out the new broker’s strategy, M&A goals and structure.

-

PE house Vistria will back the buy-and-build strategy in the independent agency space.

-

The $6.7bn Chubb investment is an outlier in the Berkshire portfolio.

-

The conglomerate exited its $620mn position in Markel, which it has held since 2022.

-

An overview of Q1 earnings shows upsides, but also plenty of concerns going into the rest of 2024.

-

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

The broker’s opening price on Friday was $272.10 per share, versus Thursday’s closing price of $306.

-

Earlier today, the carrier reported that its Q1 combined ratio came in at 88.8%, down from last Q1’s 90.6%.

-

Sources said Piper Sandler will run the auction for the CIVC-backed firm.

-

P&C buybacks have continued to decline, but large authorizations keep companies flexible.

-

It is understood that the company aims to launch in Q3 or Q4 of this year.

-

Sources said the process will target buyout firms and will not be open to trade bidders.

-

Hiscox, Intact Ventures, Weatherford and RPM Ventures participated in the fundraise.

-

Shares had fallen over 20% since Monday.

-

James River is suing Flemming Intermediate while a potential sale of the company is ongoing.

-

This publication revealed that the company was raising capital earlier this year.

-

The InsurTech’s shares gained over 50% in value on Thursday.

-

SEC filings show that Travelers’ equity ownership was valued at over $107mn in Q4.

-

The company would ideally like to target a minority investment.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

The company provides a platform for brokers to value, buy and sell books of business.

-

The company will hold its Q4 earnings call on Friday February 16.

-

The company's reinsurance panel has expanded to over a dozen risk capital providers.

-

Intact Ventures, Era Ventures, Greenlight Re and Spark Capital also participated.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

Last year, this publication revealed that TPA SCM and Rimkus launched sales processes.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

It is understood that the InsurTech began fundraising late last year.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

On Wednesday, the insurer reported 12% growth in net written premiums.

-

Sources said that the retailer will be marketed off an Ebitda of $40mn-$45mn, pointing to a potential valuation in the $650mn-$750mn range.

-

Participating in the funding round were Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners and Arch Capital.

-

The Aspen IPO provides an opportunity to benefit from the specialty market without commensurate prior-year reserve risks due to an LPT cover.

-

The agency said TRUE’s ratings will remain under review until there is additional clarity surrounding a new business plan.

-

TRUE will use the capital injection to provide underwriting capacity in Florida “at a crucial time” and to expand its footprint nationally, according to a statement.

-

Insurance Insider US dissects the largest and hottest deals of the year across broking, reinsurance and other segments of the industry.

-

The deal’s consideration consisted of a cash payment of $119mn and the 13.5% equity interest that Enstar held in Northshore, the parent of Lloyd’s underwriter Atrium.

-

Leading the decline was AJ Gallagher, with a 7.5% drop as of mid-afternoon, after having traded down over 8% earlier in the day.

-

Earlier this morning, SiriusPoint announced it had been informed that major shareholder CMIH had been taken into private receivership by lenders in Singapore.

-

The suspension of Global Indemnity’s effort to sell its E&S arm is likely specific to the franchise rather than an indicator of a dealmaking slowdown.

-

Sources said the Gemspring Capital-backed group retained investment bank Baird earlier this year as adviser in the sale process.

-

A quick roundup of this week’s biggest stories.

-

The latest short interest data shows continued pessimism on InsurTechs and Florida insurers.

-

The fundraise was led by Golub Capital and jointly arranged by Antares Capital, both existing lenders to Patriot Growth.

-

This latest funding round brings total committed capital for the collateralized reinsurer to $75mn.

-

In addition to Lightyear’s capital injection, current backer BHMS agreed to roll a material portion of its existing equity and made an additional investment alongside Lightyear.

-

The offering sold 3.6mn shares priced at $30.50 apiece and brought in approximately $104.9mn.

-

Amynta Ease-of-Business president Arthur Seifert said he expects MGAs to move away from the popular Dutch auction process and instead find one party that’s a good fit.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

SEC filings show that, in Q3, the activist shareholder liquidated its remaining 508,880 shares in WTW — worth around $120mn at the end of Q2.

-

With the fundraising, Skyward will capitalize on market opportunities within existing lines of business, but also continue to expand into new products.

-

Last month this publication reported that the 777 Partners-backed company was close to signing a deal with Charlesbank.

-

James River’s stock price plummeted more than 30% on Thursday, after the firm sustained downgrades from equity analysts over concerns around the insurer’s E&S casualty reserves.

-

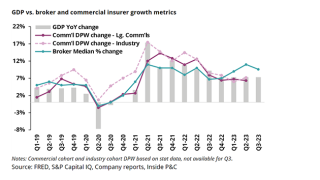

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

The challenging funding environment has left InsurTechs with limited options for capital raising and liquidity.

-

The pendulum that swung towards a focus on growth for the past few years is now swinging towards profitability and increased partnership.

-

Will this year be a repeat of a shift from “growth at all costs” to “flight to quality”, or will we see the InsurTech space bounce back in the direction of 2021 optimism?

-

As of 14:00 ET, the broker’s stock stood at $232.24 per share, 11.9% higher than the previous close of $207.74.

-

The new business unit will target firms with between $10mn and $50mn of Ebitda and will deploy up to $500mn of equity capital over time.

-

Sources said the PE heavyweight shelved the stake sale plans earlier this year as multiples in the adjusting segment remain under pressure.

-

White Mountains’ final stake could range between 62%-81% of Bamboo, and the Bermudian’s investment in connection with the deal could be around $246mn-$323mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

First-round bids for the company were due in late September.

-

The fronting carrier space is seeing increased M&A activity due to a rise in private equity interest over the past two years.

-

Backed by private equity firm 777 Partners since 2019, Sutton National booked $230mn DPW last year — up from $71mn in 2021 according to AM Best — ranking 13th among US fronting firms.

-

The carrier has suffered five quarters of losses, largely spurred on by hefty natural catastrophe losses.

-

Sources said the specialty underwriter retained boutique firm Insurance Advisory Partners earlier this year as an adviser.

-

Inside P&C’s news team brings you all the top news from the week.

-

Canopius’s investment was made as part of a broader round of financing with participation from a number of new and existing investors including RRE Ventures, Fin Capital, and IA Capital Group.

-

Now that the tides have turned from a “growth-only” to a “profitability first” mindset, companies are letting go of the additional hires and focusing on insurance fundamentals and insurance expertise.

-

Inside P&C’s news team brings you all the top news from the week.

-

A summary of commentary from the first day of Inside P&C New York, with insights on capital raising, E&S and reinsurance expectations.

-

As part of the deal, PE house Corsair Capital sold its stake in the company while Oakbridge leadership and employees retained a position in the broking firm.

-

Performance overall has been good, but there have been insurance M&A missteps and its share price has lagged.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This publication revealed last month that Doxa Insurance was preparing to launch a sale process after earlier attempts to reach a bilateral deal for the Century-backed MGA platform fell apart.

-

Yesterday, Inside P&C revealed that the secondary deal takes the total equity raised to $4.1bn, with ~30% of the equity set to change hands.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Investors include IA Capital Group, Blue Bear Capital, Gallatin Point Capital, and Avanta Ventures, among others

-

After dropping out of the strategic process in the spring, Blackstone has now come in as an investor.

-

With the deal, KKR purchased over half of USI shares held by Canadian investment firm CDPQ in addition to stock from other investors.

-

The reciprocal exchange received a consent order on Friday and is expected to begin underwriting in December

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Shifting economic winds make growth plays more attractive, causing insurer stock performance to lag though short interest remains flat.

-

-

Inside P&C’s news team runs you through the key highlights of the week.

-

In a recent report titled “TFC: Primed for activist”, Wells Fargo notes investor discontent and lists pressing issues to be addressed at Truist.

-

With the deal, Goldman Sachs will join Charlesbank Capital as co-lead equity investor in the Iselin, New Jersey-based retailer.

-

The Omaha conglomerate held its ~2.1% stake in Aon valued at nearly $1.5bn and its interest of over 3% in Markel, worth over $652mn at the end of Q2.

-

The investor’s stake in WTW is now valued at roughly $120mn, while its position the prior quarter was worth around $423mn, according to its Q1 13-F filed with the SEC.

-

The Americas saw the largest fall in M&A activity over the first half of 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Financial adviser Waller Helms has started contacting potential acquirers as Century Capital seeks to exit.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Sources said the private equity house is working with Bank of America and has approached institutional capital including PE firms and sovereign wealth funds.

-

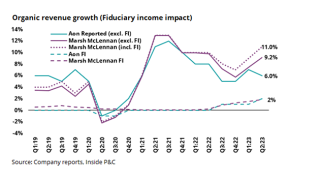

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

The Bermuda-based specialist said the capital injection will boost its talent acquisition and product development plans.

-

CinFin lead the outperformers, while Aon and The Hartford's shares dropped sharply.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

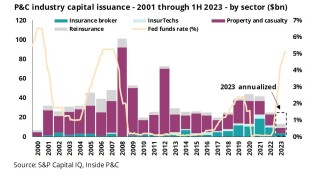

With the macro environment drying up capital streams M&A has slowed, but IPOs are reflective of pricing opportunities.

-

Personal lines underperform predictions, while brokers and InsurTechs are a positive surprise (for now).

-

After pricing below the expected range at its IPO, the Fidelis stock price slipped on the first day of trading - here's how other (re)insurance IPOs have gone since 2000.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Fidelis shares closed down from the $14 per share price set for the IPO, or a 0.8x multiple of its $17.19 book value per share at end of Q1 2023.

-

Bruce Lucas added that the company is no longer pursuing a Series B round.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The fundraising includes $80mn of convertible preferred equity, which closed on June 23rd, as well as $25mn of long-term debt financing for Hagerty Re.

-

The reciprocal’s purpose is to deliver additional US property catastrophe capacity to existing and new policyholders of Victor's subsidiary, International Catastrophe Insurance Managers LLC.

-

The credit facility builds on the funding Slide secured in its $105mn venture-backed Series A round, which closed in November 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This would be a premium to Root’s closing price on Tuesday of $6.02 per share, which gives the company a market value just north of $80mn, significantly below its peak of roughly $7.5bn.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

InsurTechs are still the most heavily shorted among P&C names, though they likely have been beneficiaries of a short squeeze for most of 2023.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Recent top line growth and improved performance will need to be weighed against historical underperformance at group level, but the opportunity could attract a non-traditional buyer.

-

The carrier is offering 65 million shares of common stock, out of approximately 648 million total shares outstanding.

-

Forecasts for “near-normal” activity may mean the chance at a reprieve for the Florida market, but a history of underestimates warrants caution.

-

Onex reduced its position in the wholesaler by almost two-thirds to nearly 3.7% from around 11.3%, while president Tim Turner sold ~700,000 of his nearly 4.9 million shares.

-

The current status of debt ceiling discussions, or lack thereof, are rattling markets, but select P&C insurers look strong in a relative sense.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Details of the placement are being closely guarded, but one source suggested the raise could be in the region of $1bn.

-

The intermediary employs over 150 staff members and has annual revenues of $15mn-$20mn.

-

The Dan Loeb-controlled investment firm reduced its position in AIG to 2.95 million shares, or ~0.4%, in Q1, from or 5.1 million shares, or around 0.7%, at the end of Q4.

-

Three months ago, Starboard trimmed its stake by almost 14% to 1,925,491 shares valued at over $470mn from 2,232,209 shares at the end of Q3.

-

Securities filings show the conglomerate’s ownership of Markel holdings was valued at over $600mn at the end of March.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Bermudian carrier SiriusPoint’s equity stake in D&O MGA Banyan Risk has been reduced to 49% from 100%, filings show.

-

Mega-round funding accounted for the smallest percentage of total funding since Q1 2020, according to Gallagher Re’s latest Global InsurTech Report.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

When a Grade A franchise like Hub refis at this kind of valuation, the read across to other assets is highly negative.

-

Inside P&C revealed in late March that Leonard Green was one of the two remaining parties in the process, with an enterprise value of under $25bn, based on bids of ~16x just under $1.5bn of Ebitda.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the executive had a minority ownership interest believed to be around 20%-30% of the operation.