Commercial E&S

-

The retail heavyweight uses around 1,000 trading partners to access the wholesale channel.

-

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

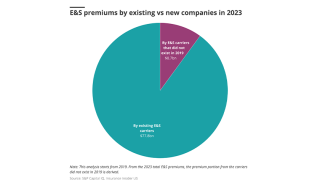

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Jason Keen joined Everest in 2022 as head of international.

-

APIP is one of the world’s largest property programs.

-

Haney will remain on board as a senior adviser.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Old Republic said the acquisition is expected to close in 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

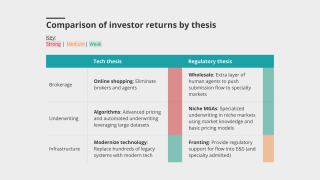

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The two executives join from Markel and Arch, respectively.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

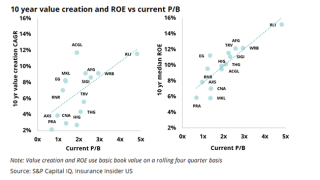

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

Casualty premiums grew 56.7% year on year in Q2 2025.

-

Appointments include leadership in transportation, energy, marine and others.

-

She joins the specialty insurer after working at Hamilton as CUO.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The segment is also seeing double-digit loss cost inflation.

-

Renewal rates fell, despite elevated catastrophe losses.

-

The company also encouraged insurers and brokers to support the initiative.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

Florida recorded premium growth in June after declines in May and April.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.

-

The company filed its S-1 in March, with a 2024 CoR of 93.9%.

-

The executive said he left the company in September.

-

The company’s credit ratings had been under review since early this year.

-

The once niche product is generating interest in a growing number of industries and sectors.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

Lloyd’s traditionally avoided US middle market property, but head of P&C Matt Keeping says times have changed.

-

The moves come as the company said it will "double down" on US E&S.

-

Rates have fallen an average of 10%, though changes can be highly specific to each property.

-

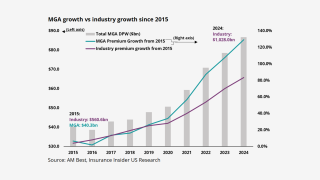

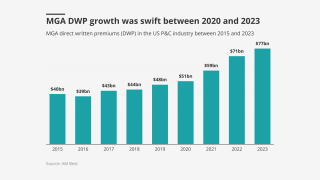

The MGA market now makes up 10% of the overall P&C market.

-

The company has reduced its exposure on large commercial auto and property.

-

Sills added that Bowhead doesn't expect a reversal of compressed limits being offered.

-

Richard Schmitzer will retire as E&S president and CEO, and Todd Sutherland will succeed him.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The standard market has not ‘meaningfully’ impacted the rate of flow in the aggregate.

-

Customers are demanding more in a larger move towards the E&S market.

-

The firm acquired total assets of $65mn and assumed liabilities of $11mn.

-

Secondary perils are no longer so secondary, but the losses are already priced in for commercial property.

-

The ex-Ategrity CEO launched Pivix Specialty in September 2024.

-

MGA growth is still strong but has passed its 2022 peak.

-

Everest’s US wholesale business is seeking to expand its market presence.

-

The program is being launched through subsidiary Southern Marine.

-

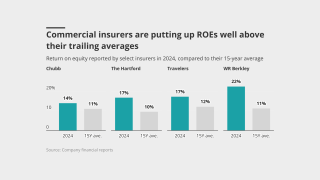

Despite elevated ROEs, insurers have remained disciplined.

-

California, Texas and Florida rose 15.7% in February and 29.1% in January.

-

Coverage will increase to $20mn per building.

-

The executive said AIG’s E&S arm can grow 20% a year and generate $4bn of new business.

-

After a period of business building, MGAs will likely spend more time optimizing.

-

Construction defects, GL and risk-managed professional liability lines saw the greatest headwinds.

-

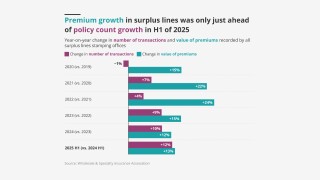

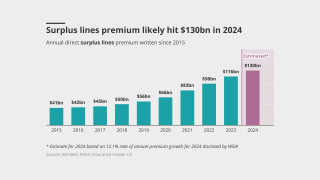

Surplus lines are still strong, but not the standout they used to be.

-

The partnership will launch a new umbrella excess insurance product.

-

Admitted insurer withdrawals and rising demand are pushing more entrants into E&S.

-

Insurers and distributors must adapt or risk irrelevance.

-

Industry veteran Tonya Courtney will lead the company’s newest E&S business.

-

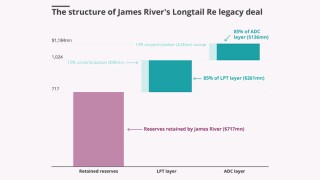

Q4 net retention was impacted by the previously announced ADC.

-

The group posted a 15.7% gain for February and 29.2% for January.

-

The first round of the E&S boom has already played out, but this is a long game.

-

Sources said that the MGA has been working with investment bank Waller Helms to find a potential investor.

-

The Nationwide subsidiary is a $750mn-premium wholesale brokerage that serves about 10,000 local agents.

-

The figure represents a 12.1% increase over full-year 2023.

-

Admitted carriers are dropping middle-market business due to large verdicts.

-

The group posted a 27.5% gain for January and 23.7% for December.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Finnis was formerly head of commercial lines at WTW.

-

The E&S lines division adds property, casualty and financial lines.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The company will now focus on growing its E&S and InsurSec offerings.

-

Piyush Patel and Sandra Russo have joined Dellwood as head of programs and AVP, respectively.

-

Rates are now falling, but submissions are still rising, according to wholesale brokers.

-

Irwin joins the firm from Beazley, where she’d worked since 2019.

-

Brokerage co-presidents Jeff McNatt and Sam Baig discussed the E&S market, rates and M&A.

-

At Zurich, Hirs served as group head of M&A and CFO for North America.

-

The review follows Velocity’s acquisition by FM Group.

-

The change comes after an ownership restructuring.

-

A look back at the stories that defined the year in P&C for 2024.

-

Overall, the “Golden Age” of E&S continues, but with a few new caveats, such as moderation in property pricing.

-

Shawn Parker takes up Gatt’s previous role as COO of Westchester Programs.

-

Florida is a state where the company is seeing more capacity in the market, especially admitted availability.

-

Rate inadequacy and inflationary pressures represent significant headwinds, however.

-

The 2025 State of the Market report also touched on E&S and MGA growth.

-

The group posted a 15.1% gain for October and 27.4% for September.

-

This would allow the former Truist Insurance to place binders on its MGAs itself and open other growth opportunities in EC3.

-

Enstar and Gallatin’s move into the common equity is a bull sign, but it will take years to know if the ADC will hold.

-

James River also amended the convertible preferred equity held by Gallatin Point and closed its strategic review.

-

Casualty submissions rose over 70% while property increased over 20% YoY in Q3.

-

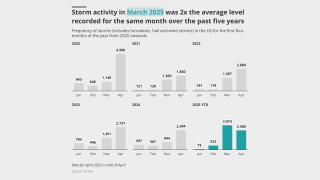

The average for October was roughly half of that for September.

-

Management is showcasing its ambition, but it’s also dialing up risk.

-

Sources said the E&S insurer is seeking to draw a line and trade forward as an independent business.

-

Westhoff will also spearhead the launch of QBE’s E&S property offering.

-

The agreement will bolster Asic’s surplus and expand underwriting capacity.

-

The two senior positions will be based in London.

-

A large number of new entrants and the growth of litigation finance challenge E&S enthusiasm.

-

Attendees concurred that they don’t expect the “Golden Age of E&S” to end anytime soon.

-

Admitted markets are not coming back to property as strongly as in past cycles, the executive said.

-

In Q2, median property price increases decelerated to 2.3%.

-

The carrier’s initial casualty offering will be wholesale-only, the executive said.

-

Coverage options will extend up to $5mn.

-

Andrew Rowland will oversee the portfolio, offering up to $7mn per risk.

-

The deal provides Honeycomb with up to $24mn of capacity.

-

The future of E&S, the wholesale landscape and casualty pricing are topics up for discussion.

-

The 17.4% DWP growth, however, was a deceleration from 2021’s 25% peak.

-

Andrew Knight will fill the newly created role of country manager.

-

Expansion of the middle-market book is an ongoing focus.

-

The top three states averaged a 3.7% year-over-year gain, compared to July's 16.1%.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

-

Negotiations come after Insurance Insider US revealed that the Bermudian was running an auction.

-

The top four lines posted low-single digit to high-single digit policy count growth.

-

The CEO said there’s only one public pure wholesale broker, Ryan Specialty, and its IPO was in “favorable conditions”.

-

Stephen Buonpane will lead the division, with Danielle Stewart as COO.

-

James River will also oppose a Fleming motion to uncover additional documents.

-

Commercial liability and commercial property continue to dominate.

-

Dellwood claims allegations in AIG’s latest filing are still barred by res judicata.

-

The top three states averaged a 14% YoY gain, compared to June’s 3.3%.

-

As property momentum slows, personal lines excess and surplus could start outperforming.

-

The CEO estimated that the loss trend is running in the high 5% range, slightly below the carrier’s rate increase.

-

The arrangement enables PCS to expedite growth.

-

Axa's newly formed teams join the company's "complex cyber" unit.

-

Executives flagged elevated packaged auto loss activity in Q2.

-

For many, it could be a “wake-up call” to the systematic exposures inherent in cyber.

-

Average rate increases went to 5.6% in June 2024 from 28.2% in June 2023 .

-

The Longtail Re deal buys the specialty insurer time to secure its future, or an exit for shareholders.

-

Fleming files claims against James River, its CEO Frank D’Orazio and group CFO Sarah Doran.

-

The tower now represents a 47% increase from 2023.

-

State National is providing $160mn of adverse development reinsurance coverage.

-

It is understood that the executive will report to Scott Meyer, now COO for NA Insurance.

-

Dellwood recently appointed Aspen’s Felicia Rawlin as head of property.

-

The top three states averaged a 3.3% YoY gain, down from May’s 15.8%.

-

Tara Hill launched last month and is headed by Core Specialty’s Peter McKeegan.

-

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

AM Best assessed Dellwood’s balance sheet strength as “very strong”.

-

Industry veteran Peter McKeegan will lead the firm.

-

Ryan Specialty CEO Pat Ryan opened the event, which was held last week in New York.

-

In high-capacity, global E&S property, London has continued to be aggressive.

-

Kinsale CEO Mike Kehoe said social inflation is unabating, but losses fuel the industry.

-

Ryan Specialty’s CEO opened the Insurance Insider US 2024 conference.

-

State National has been lined up to front for the vehicle, which would be a rare example of third-party capital in this space.

-

In an interview with Insurance Insider US, Robinson spoke about life after the IPO, talent, litigation financing and cat.

-

His experience includes HPR engineering, facultative reinsurance and E&S underwriting.

-

The acquisition allows AM Specialty to expand its E&S offerings.

-

The review reflects the group’s ongoing ownership-level restructuring.

-

The H2 rate predictions mark a slight moderation from those in H1.

-

Latin America and the Caribbean accounted for 4.6% of GWP for Lloyd's in 2023.

-

The move comes as the wait for a deal for the whole group passes the six-month mark.

-

Business written in California, Florida and Texas averaged a 15.2% YoY gain.

-

The firm has zero pre-2020 reserves, no MGA relationships, and management with a strong record.

-

The distribution model itself prioritizes the need for due diligence.

-

An overview of Q1 earnings shows upsides, but also plenty of concerns going into the rest of 2024.

-

The carrier’s goal for its specialty arm is to achieve $10bn in written premiums and a sub-90% CoR by 2030.

-

The firm will no longer have to compete with one hand tied behind its back.

-

The partnership will increase K2's capacity for US hurricane and earthquake exposure.

-

The appointment is part of Axa XL's plans for a more client-centric approach.

-

Business written in California, Florida, and Texas averaged a 22.7% YoY gain last month.

-

The policy offering expands third-party liability coverage and wage and hour liability.

-

The company reported 25.5% increase in GWP, down from the 40% growth in prior years.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

The US large property team will support middle-market and corporate clients.

-

Focus on reserves to continue as gap between cautious reservists and others emerges.

-

The casualty segment posted $18mn of favorable reserve development across multiple accident years.

-

The MGA’s underwriting capacity for casualty programs now totals $17mn.

-

The unit has hired Everest’s Chris Curtin and Axa XL’s Brian Quinn.

-

Current CEO John Mulvihill is retiring after 34 years with the specialty insurer.

-

Westchester’s Kyle Garrett was named VP, executive underwriter for property.

-

California, Florida and Texas all saw year-over-year declines in premium growth.

-

The oversubscription may signal additional capacity waiting on the sidelines.

-

The global insurer also alleges breach of contract and fiduciary duty in the federal suit.

-

The announcement confirms earlier reports from this publication.

-

As admitted carriers pull out of riskier plays, E&S continues to expand and thrive.

-

The leadership team includes Spinnaker co-founders Dave and Ken Ingrey and ex-CUO Miles Allkins.

-

Joe Morrello joined the firm in 2022 after serving as E&S property head at Beazley.

-

Social inflation is driving “cat-type” losses, with an increase in $50mn-plus verdicts.

-

A cleaned-up combined entity could make for an attractive investment in a few years.

-

Joy had previously set up the casualty practice at Global Indemnity.

-

Cove Street is 14th largest investor in Global Indemnity.

-

Sources said that the E&S carriers are now poised to enter due diligence.

-

Sure is the first Demotech-rated insurer to offer surplus lines homeowners.

-

-

Lockton broker Gary Giulietti said the size of the bond is "rarely, if ever, seen".

-

Catch up with the latest developments in this rapidly growing segment.

-

Cycle management is key to the long-term success of any start-up carrier.

-

Twin Maples is expected to make its market debut in the next few months.

-

Bridge Specialty president Boyd and RT director Dawson join board.

-

The Bermudian posted 18.5% top line growth in its first year as a public company.

-

This continues a consecutive quarterly gain of over 6%.

-

The business has raised $250mn from backers including PartnerRe, RenRe, Starr and Amwins.

-

The Truist-owned cat MGA had reduced its line size to $50mn last year.

-

Florida again saw the largest increase, up 66.2% year-over-year.

-

The (re)insurer’s Q4 CoR rose 15.2 points to 81.4% on satellite failure, D&F losses.

-

The company’s board continues evaluating strategic options, including a full sale.

-

The carrier’s sales process is ongoing, and it will provide an update “in due course”.

-

The deals completed in 2023 represented over $140mn of annual historic revenue, Ryan said.

-

London underwriters are getting aggressive in the US.

-

Both executives will report to Jim Wallace, head of E&S property.

-

The executive was most recently president of Vouch Specialty.

-

The firm’s Q4 GWP grew over 21% fueled by surety, transactional E&S and captives.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

Given a number of complexities, the landing zone on a take-out price is small.

-

Earlier in the process, sources linked Sentry Insurance with a bid for the E&S insurer.

-

The new line is in addition to its existing Bermuda and US excess casualty products.

-

This follows a record-breaking $63bn of premium and 24.1% growth for 2022.

-

RPS saw organic growth of 12% in Q4 of last year.

-

At market close, WTW shares were up almost $18.

-

Laura Johnson most recently served as head of E&S primary casualty.

-

Florida saw the largest increase, up 18.5% year-over-year for January.

-

Tom Bredahl, president of the surplus and specialty division at Crum & Forster, said the company has received more E&S submissions in the last 12 months than in the company’s entire history.

-

The US market’s messaging around E&S growth means the sector will likely face ever-greater scrutiny in 2024.

-

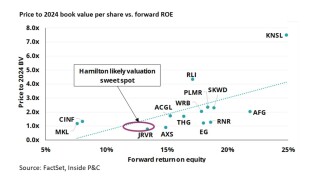

The Aspen IPO provides an opportunity to benefit from the specialty market without commensurate prior-year reserve risks due to an LPT cover.

-

Michael Kehoe will relinquish the president’s role to COO Brian Haney and assume board chairmanship but will remain company CEO.

-

December premiums were up for all three of the top E&S states, with California posting the largest percentage increase at 44.2% YoY.

-

2024 is likely to be another challenging year for the industry, and commercial in particular, though improvement in personal lines may soften the blow.

-

The revision reflects Ategrity’s pivot away from more volatile property cat business to focus on medium-sized commercial clients.

-

For some time now, property has been doing the heavy lifting around growth and rate rises in E&S.

-

The suspension of Global Indemnity’s effort to sell its E&S arm is likely specific to the franchise rather than an indicator of a dealmaking slowdown.

-

The ratings agency cited persistently strong underwriting results throughout the pandemic and amid substantial economic and capital markets volatility as being among the reasons for maintaining the outlook at stable.

-

Underwriters’ concern surrounding the volatility of secondary perils is sustaining caution over rate adequacy.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

November premiums were up for all three of the top E&S states, with Florida posting the largest percentage increase at 21.8% YoY.

-

Issues over reinsurance pricing and capacity continued to plague commercial property.

-

Chief of IRS Criminal Investigation said Tysers had "eroded the process of fair and open competition".

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

The offering sold 3.6mn shares priced at $30.50 apiece and brought in approximately $104.9mn.

-

The bill removes a previous Farm Bill requirement mandating that carriers purchase unlimited catastrophic reinsurance. Instead, companies can purchase “adequate” catastrophic reinsurance.

-

Amynta Ease-of-Business president Arthur Seifert said he expects MGAs to move away from the popular Dutch auction process and instead find one party that’s a good fit.

-

RPS said higher excess layers in the E&S property sector are still seeing increases north of 50% while primary and lower buffer layers are seeing average increases of 10%-15%.

-

Sutton’s financial strength rating and long-term issuer credit rating are both under review by Best, with negative implications.

-

A quick roundup of this week’s biggest stories.

-

Around 85% of companies mistakenly believe that their property insurance covers some, all or most types of flooding.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company targets specialty markets that it believes are underserved by larger insurers and focuses on niche business lines and fee-oriented services.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The ratings agency cited increased business due to declining capacity in commercial lines and some personal lines markets.

-

The carrier is now working with Stonybrook Capital on a mix of equity and debt as it looks to expand its capital base beyond $100mn.

-

California E&S premiums, however, fell 20% year over year for the month and declined 1% for the first 10 months of 2023.

-

At least one carrier struck a note of caution during Q3 earnings about the ongoing rapid growth story in surplus lines.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The stock closed at $342.87 per share, down 19.56% from yesterday’s close of $426.22.

-

Investors must weigh a differentiated investment strategy and true specialty opportunity against partial third-party investment control and historical losses.

-

The Brown & Brown CEO noted that property cat remains "the most challenging" line, while workers' comp decreases have continued to slow.

-

With record attendance, the conference was a reflection of how much the MGA space has grown and continues to grow.

-

Parent Cowbell Cyber launched the E&S carrier a little over a year ago as part of Cowbell’s transition from an MGA to a full-stack insurance carrier.

-

The broker’s “State of the Market: Real Estate” report says little change is expected in the property insurance marketplace for the rest of the year, but talk of more moderate rate increases in 2024 is “gaining momentum” specific to loss-free, properly valued and attractive accounts.

-

Carlton Maner is stepping down after having served at AXIS for almost 22 years.

-

The executive will lead a new specialty business line focused on global credit and political risk.

-

The rating reflects “the entity’s role and strategic importance to Beazley as an excess and surplus writer in the United States”, AM Best said.

-

A 19-year veteran of the insurance industry, he has held executive positions in finance, operations and underwriting within property and casualty lines of business.

-

An RPS report cites a drop in demand from Covid highs, along with increasing competition among carriers and near-record capacity as among the challenges currently facing transportation insurers.

-

Inside P&C explores topics that will likely be addressed at the Target Markets 2023 annual conference.

-

Inside P&C’s news team brings you all the top news from the week.

-

Broker consolidation, angst about loss trends in long-tail lines and the confidence of the E&S market were key themes in Colorado Springs.

-

Nearly half of the over 300 small business owners and CEOs surveyed say the US economy has improved.

-

Inside P&C takes a closer look at the NY construction market, which represents a unique challenge to insurers and insureds due to density and strict labor laws.

-

AM Best recorded 2022 US E&S direct written premium at just under $100bn in another year of strong growth.

-

Inside P&C’s news team brings you all the top news from the week.

-

A summary of commentary from the first day of Inside P&C New York, with insights on capital raising, E&S and reinsurance expectations.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Performance overall has been good, but there have been insurance M&A missteps and its share price has lagged.

-

Besides Vesttoo’s downfall, other hot topics during this year’s WSIA were talent, competition in the E&S sector and commercial auto.

-

In addition to price, E&S insurers need to pay close attention to terms and conditions, as well as quality of risk.

-

Secondary perils are adding uncertainty, while modelling is still relatively unsophisticated.

-

A typical cat year should now be thought of more as a $100bn-$150bn potential loss, as volatility leads to surplus lines growth.

-

-

Insureds that have taken higher retentions or less limit due to increased cost could be exposed this year if there is a major cat event, according to Swiss Re’s Kyle Burnett.

-

Everest is expecting to appoint a leader to head up the new wholesale operations over the next 30 to 45 days.

-

Inside P&C considers some key themes attendees at this year’s conference should be considering on the boats and marinas of San Diego’s harborside.

-

Everest North America insurance president Mike Mulray will head up the business on an interim basis while the carrier appoints a permanent unit leader.

-

Ratings agency AM Best has revised its outlook to negative for Realign Insurance Group, which includes American Summit, National Summit and Summit Specialty Insurance.

-

However, data also shows that the pace of growth overall in the E&S market has slowed in recent years in terms of premium and number of transactions.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

It is more dependent on property, and its longevity is uncertain.

-

-

Florida posted 8% growth for August, marking a stark decline from 48.8% in July, while Texas’s surplus line premium grew 16.7% year-on-year, down from 28.1% the previous month.