-

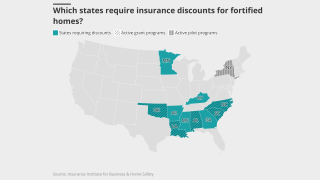

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

September’s medical care index increase follows a 0.2% drop in August.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The insurer booked a $950mn policyholder credit expense in September.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Superintendent Harris is stepping down this month after four years of service.

-

The executive has been with ASG since it was formed in 2016.

-

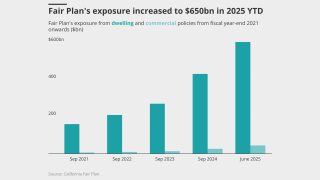

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

Sources said momentum around resiliency laws is growing at the state and local level.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

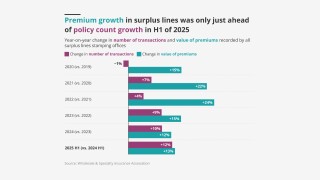

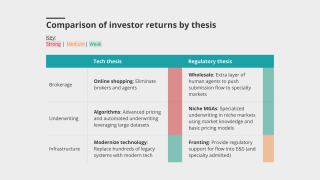

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

The Delaware high court’s reasoning could find application in other cases.

-

This is the first rate filing to use the recently approved Verisk model.

-

July’s medical care increase was up from June’s o.6%.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

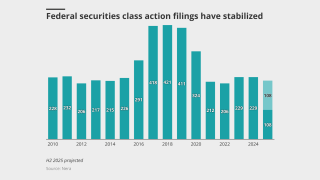

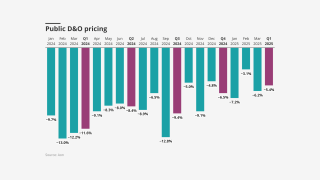

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The company adjusts its rate options to expand California business under the new cat model.

-

Insurers must write policies in high-risk areas in order to incorporate the model.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

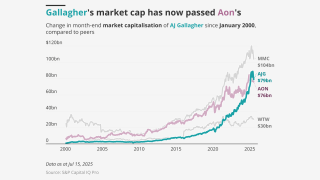

Succession, heavyweight M&A and expanding beyond its core will all test the broker.

-

The Floridian has been approved to potentially assume 81,000 policies total.

-

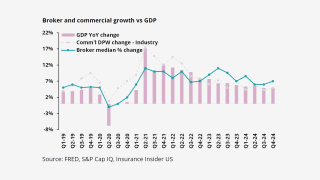

The broker has emerged as the emphatic winner of the supercycle, but new tests are coming.

-

The suit claims billions of dollars are being illegally withheld.

-

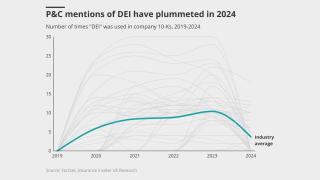

Top companies eliminated or heavily modified language related to DEI this year, analysis shows.

-

State legislation has led to major strides in rate adequacy.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

The FTC granted early termination of the waiting period, leaving the acquisition on track to finish in early 2026.

-

Under the new law, vehicles will only be required to carry $100,000 in PIP per person.

-

The broader legislation narrowly passed the Senate and now heads to the House.

-

The measure could have landed insurers with extra tax on US business.

-

There are now 14 new companies writing homeowners’ policies in the state.

-

The ruling comes as insurers face growing legal pressures following the January blazes.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

The rules would require paid rest breaks, among other measures.

-

The ratings agency cited support from parent company MSI for the upgrade.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

The regulatory body is also looking at AI rulemaking and catastrophe resiliency.

-

Florida regulators have also approved takeouts for Mangrove and Slide.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Rates need to be fair but also should not be “destructive of competition”.

-

Marsh McLennan CEO Doyle dubbed legal system abuse a "tax” on US economy.

-

Lara approved an interim rate increase for the company just weeks ago.

-

The suit, filed in Florida federal court, is Uber’s second Rico case.

-

The regulator said further measures could still be passed in this session.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

Insurers have termed the Democrat-backed legislation “flawed”.

-

The legislature did pass Twia reforms, however.

-

The company’s credit ratings had been under review since early this year.

-

The collective CoR of 45 Floridians hit 93.1% in 2024

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

The Peak Re subsidiary mainly writes US motor and casualty reinsurance.

-

One measure could give regulators greater leeway to deny rate requests.

-

Florida’s top regulator says he’s eyeing eventual tweaks to the state’s cat fund, too.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

Kirsh was involved in launching an industrywide “legal system abuse coalition”, which now has 350 participants.

-

"Smoke damage is real damage," Commissioner Lara said.

-

The assumption date for the combined 16,250 policies is August 19.

-

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

Litigation funding is a frequent bogeyman for the insurance industry. The feeling isn’t mutual.

-

State Farm will need to provide its CA subsidiary with a $400mn surplus note.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

The reforms limit liability for some small businesses in the state.

-

Growth in construction projects is increasing the need for coverage.

-

Insurers haven’t announced concrete steps – yet.

-

The impact could also raise home-building costs by $10,000 per unit.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

A first-of-its-kind resolution adopted this week says subrogation can reduce insurance costs.

-

The carrier forecasts stable profits, but tariffs are creating “high uncertainty”.

-

The law imposes limits on third-party litigation funding, among other changes.

-

The BRIC program helped fund local resiliency programs, which can reduce loss costs.

-

Howard and Moore were among a group to receive letters over links to prior insurance insolvencies.

-

The suit seeks to block insurers from passing through assessment costs.

-

A one-time impact would be a mid-single digit increase to physical injury auto severity.

-

The release followed the filing of an updated Plan of Operation.

-

The deal had HSR approval and was waiting on approval from the UK.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

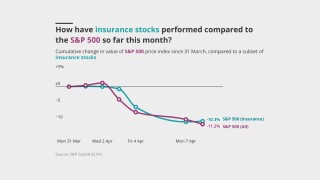

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

P&C has strengths that will help it survive this crisis, but not without some pain.

-

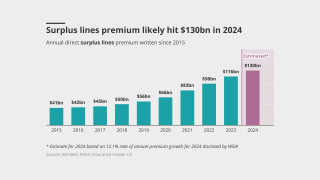

This is shaping up to be a record year, building on momentum in 2024.

-

Carriers surveyed cited access to niche markets as a key strength.

-

Universal submitted allegedly ineligible claims to the Florida fund.

-

Capital funding new litigation dropped 16% YoY, however.

-

The bill being considered would effectively eliminate personal injury protection.

-

Coverage will increase to $20mn per building.

-

The decision comes after the agency refused to block a climate related vote at Travelers.

-

Both bills are now on Governor Kemp’s desk awaiting signatures.

-

RBC reports can help regulators identify weakly capitalized companies.

-

The decision is the first of its kind under the new Trump administration.

-

The bill also creates a governing board comprising insurance and consumer reps.

-

The Georgia verdict is one of many legal battles over Monsanto’s herbicide.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

The letter said the FIO is in “direct conflict” with the role of state regulators.

-

The commissioner is eyeing transparency in billing, comparative fault and non-economic damages changes.

-

The regulatory changes have been championed by Governor Brian Kemp.

-

Gallagher already has HSR approval for the $1.2bn Woodruff Sawyer acquisition.

-

Mangrove can take out up to 81,040 polices while Slide’s limit is 15,000.

-

Colorado and New York have already passed regulations regarding insurer AI use.

-

The agency collects gold standard data and conducts research. Without that, there’s more uncertainty.

-

Commissioner Lara also proposed a $500mn cash infusion from parent State Farm.

-

The Democratic senator said increased federal oversight of insurance is not the answer.

-

CEO Greenberg cited ‘competing priorities’ in his annual letter to shareholders.

-

“We do not have the luxury of time,” he said during the Bermuda Risk Summit.

-

Four cat modelers have also submitted their tech for regulatory review.

-

“They've been focused on this for more than 10 years,” said Bermuda’s CIT Agency CEO Mervyn Skeet.

-

There are signs that Florida’s insurance industry is coming under increasing legislative scrutiny.

-

The commissioner said in a legal bulletin that smoke claims can’t be “summarily denied”.

-

The company said it now expects the transaction to close in H2 2025.

-

Insurers and distributors must adapt or risk irrelevance.

-

The ratings agency noted “significant” underwriting improvement in 2023-24.

-

RAA president Frank Nutter says he hasn’t been able to get an update on the project from the now Trump-led NOAA.

-

Florida House speaker Daniel Perez is seeking an investigation into the charge.

-

The company is seeking an emergency rate increase after the devastating Los Angeles wildfires.

-

The first round of the E&S boom has already played out, but this is a long game.

-

State Farm General has asked California regulators for an emergency rate increase.

-

In the absence of interim action, the segment could face an “availability crisis”.

-

Big tort reform packages are on the table, but California steals the show, for now.

-

The carrier has paid $1.75bn on around 9,500 claims filed from the wildfires.

-

The proposed reforms are championed by Governor Brian Kemp.

-

Berkshire Hathaway’s "float" rose to $171bn in 2024 from $169bn in 2023 as Buffett praised Geico’s Todd Combs.

-

Priorities include risk-based capital modernization and cybersecurity issues.

-

The bill was introduced shortly after a similar bill failed in Mississippi.

-

A quick roundup of our best journalism for the week.

-

Sources said California regulators need to show they’re receptive to private insurer needs.

-

The insurer is seeking a 22% interim raise, but the request is currently on hold.

-

Commissioner Lara calls the 10 bills a ‘comprehensive legislative package.’

-

At the first Insurance Insider US Miami Forum, Floridian industry players pointed to signs of stability.

-

The bill seeks prompt claims payments and settlements, and greater transparency.

-

The insurer disclosed the estimates as it seeks emergency rate hikes from regulators.

-

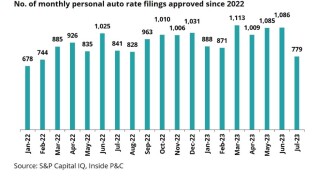

A report from the reinsurance broker said fast rate approvals are key to stabilizing the California marketplace.

-

The NFIP’s strategy is to use "short-term borrowings" to meet what could be $10bn in claims.

-

Citizens approved an average 8.6% rate hike and decreases for one-fifth of policyholders.

-

The state is building an insurer of last resort from scratch, taking notes from California.

-

The Florida of 2022 lacked stability and saw many carrier insolvencies.

-

Democrats pushed back during the hearing, urging rules to encourage mitigation.

-

The agency said it does not expect a “material impact” from the charge.

-

The company says the recent wildfires will be the costliest in its history.

-

Included are tweaks to state premises liability law and reforms to trial procedure.

-

Commissioner Lara said 31,000 claims have been filed for disaster-related needs.

-

James Keating received 20 months in prison and three years of supervised release.

-

The NFIP and NOAA were both targets in the Project 2025 crosshairs.

-

Legal experts say the bill, SB 222, stands a good chance of becoming law.

-

The bill would put new restrictions on bad faith claims, close loopholes.

-

The FIO has limited power, but it has attracted fierce industry opposition.

-

The laws mandating payments were enacted after devastating fires in 2018.

-

It is among the first bills to pass the House during Donald Trump’s presidency.

-

The much-anticipated creation of a DOGE office is already being challenged in court.

-

The regulator also emphasized the need for private flood insurance after hurricane Helene.

-

The all-items index posted a 2.9% rise for the last 12 months.

-

Many are confident the regulatory changes will still stabilize the market in the near-term.

-

America’s longest-serving insurance commissioner was one of the first regulators to focus on climate.

-

III also denies its CEO made anti-gay remarks or harassed a gay employee.

-

CA insurers can now use forward-looking cat models in ratemaking.

-

Insurers are also required to increase coverage in wildfire-prone areas.

-

California’s crisis spurred the biggest reforms in decades.

-

The FIO is “entirely devoid of usefulness and duplicitous in its actions”, the letter to DOGE leadership reads.

-

A separate Senate report found climate change is also increasing non-renewals.

-

Homeowners’ insurance rates have spiked almost 60% since 2018.

-

The insurance industry countered that the committee ignored a “toxic mix” of risks driving up costs.

-

CEO Trevor Carvey said the revision reflected Conduit’s “favourable reception”.

-

The Federal Insurance Office has data collected from over 300 insurers.

-

Most US states have been silent on the regulation of parametric insurance.

-

The regulations are part of a state effort to expand wildfire coverage.

-

The law takes effect January 1.

-

The decision reflects CNA’s “consistently positive” operating performance.

-

TDI is urging legislators to incentivize more resilient housing construction.

-

The firm said the UK hub demonstrates its commitment to expanding in Europe.

-

Elevated casualty and high property claims are concerns, however.

-

Cybersecurity basics could reduce cyberattack costs by up to ~75%.

-

Other key leaders come from Virginia, Rhode Island and Utah.

-

Insurers and their allies hope to capitalize on increased attention to pass a slew of reforms.

-

The regulation is a key component of Lara’s effort to stabilize the state’s sputtering property market.

-

The company said Helene claims have surpassed those of Hurricane Ian.

-

The expectation – and strong hope – is that deregulation will spur growth and bring benefits to the D&O line.

-

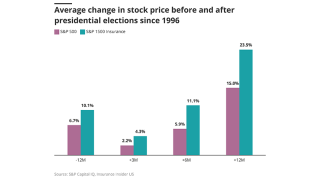

Experts see the president-elect’s position as potentially positive force on taxes, antitrust and noncompete concerns.

-

Industry campaign cash favors Republicans, except when it comes to the presidential election.

-

The NFIP can take on more debt, but climate-fueled disasters aren’t going anywhere.

-

In an interview with this publication, Lara said "everything’s on the table" for future reforms.

-

A bill in Congress would expand a similar pilot tried earlier in New York City.

-

The plaintiff claims he was terminated for testifying to anti-gay harassment.

-

The looming collapse of the city’s biggest livery insurer may not be cause for national concern.

-

Current efforts to battle third-party litigation funding are focused on disclosure.

-

The government flood insurance program now carries $21bn in debt.

-

October 17 has been set as the deadline for written comment.

-

The residual insurer’s pricing is far from rate adequacy, and it is undercutting the commercial market.

-

While Republicans are typically perceived as best for business, there are several factors at play.

-

State regulators have been monitoring climate risk for over a decade.

-

The effort will draw from California’s research and higher education communities.

-

The Heritage Foundation think tank behind the plan argues that the private sector could do things better.

-

The ratings reflect the balance sheet strength of parent Core Specialty.

-

Citizens’ auto-renewal controls were down from February 2023 to August 2023.

-

The ratings agency also assigned the insurer an a- issuer credit rating.

-

States are grappling with first responder claims litigation as some move to expand presumptions to more worker types.

-

The decision comes weeks before the rule was set to take effect in September.

-

House Bill 672 adds regulation to the Louisiana MGA market.

-

The regulations have been officially published online, with a hearing to be held next month.

-

The ruling only applies to a Florida retirement community.

-

Insurance industry representatives meanwhile say they’re common sense and necessary.

-

A letter wants an update on progress towards addressing climate-related financial risks.

-

Commissioner Andrew Mais said AI is also a priority for regulators.

-

Reforms would seek to tamp down legal costs that can drive insurance costs up.

-

The action follows the completed acquisition of Accredited by Onex Partners.

-

The measures include stricter timelines for rate application approvals and follow-ups.

-

A quick roundup of today’s need-to-know news, including CrowdStrike and Slide’s IPO.

-

-

Three states passed restrictions on commercial litigation funding in 2024.

-

The reforms will be included in a new plan of operation for the state’s insurer of last resort.

-

A roundup of today’s need-to-know news, including Commissioner Lara’s FAIR plan reforms.

-

The proposed class says the plan does not cover smoke damage.

-

House Bill 672 will take effect on August 1.

-

Underwriters are getting increasingly granular, rewarding mitigation and prevention with better terms.

-

-

A draft bill would require the disclosure of third-party financing in federal courts.

-

The all-items CPI increased 3% year-over-year, down from 3.3% in May.

-

The standard is a ‘step forward’, but cross-company comparisons are difficult.

-

The groups highlighted technical hurdles to implementation at a Wednesday hearing.

-

The Bermuda courts will assess Onex’s lower, revised offer for the fronting unit.

-

In high-capacity, global E&S property, London has continued to be aggressive.

-

Commercial and residential carriers have different requirements.

-

The all-items CPI has increased 3.3% over the last 12 months.

-

The long-term issuer credit rating on Fairfax Financial Holdings was revised to BBB+ from BBB.

-

Excess capacity rebounded in June 2023 after hitting a decade-low just 12 months earlier.

-

Regulatory compliance risks were listed as the third-greatest concern.

-

Of that total, $312.5mn was allocated to resolve the PFAS claims.

-

Ten companies have filed a 0% increase and at least eight companies have filed a rate decrease to take effect in 2024.

-

The CEO is one of more than 20 executives who received letters from Floir citing Statute 624.4073.

-

The CEO said companies are still taking charges on years 2013 to 2019.

-

The ratings agency flagged the “increasingly favourable” underwriting results.

-

The market has advanced in sophistication but must tackle talent, tax and diversification issues.

-

Concern about vague cat modeling language was a theme at a Tuesday workshop.

-

Existing non-competes for senior executives can remain in force, however.

-

A total of 8% of issuers under criteria observation received negative rating actions.

-

A litany of underwriting and quoting constraints has made it much harder to write business.

-

The ratings agency cited erosion in the company’s surplus position, among other developments.

-

FHCF rates are also projected to decrease by a statewide average of 7.38%.

-

Ten states joined in the original suit.

-

The deal will create a personal lines firm controlling £3bn in premiums.

-

Bermuda liquidators had earlier objected to out-of-court agreements between parties.

-

A more business-friendly approach will be offset by increased uncertainty.

-

The body’s budget committee is again pressing Citizens over solvency concerns.

-

Long-term confidence in the market depends on the details of the new tax rule.

-

-

May and June takeout requests for Citizens are exceeding expectations.

-

AM Best then withdrew its ratings at the company’s request.

-

Existing taxes could be lowered under a potential new structure.

-

The agency stressed the physical impact of climate risk on companies.

-

The SEC says it is not requiring Scope 3 emissions disclosures "at this time".

-

The approval takes account of several out-of-court settlements.

-

The outlook for its financial strength rating was unchanged at stable.

-

The end of the waiting period effectively clears the path to close in the US.

-

The move followed improvement in CEA’s claims-paying capacity.

-

A hearing with the Florida Office of Insurance is scheduled for February 21.

-

Priorities include climate and cyber risk, insurer financial transparency, and inclusion.

-

CSAA writes over 70% of its business in the Golden State.

-

The changes will be up for discussion at a March 26 public hearing.

-

All parties interested in the case have agreed to participate in the process.

-

As last year’s reforms shake out, only a few changes are pending for 2024.

-

Rates are generally cheaper than the admitted market.

-

The source of the funding is one of the most problematic elements for sources who spoke with this publication following the draft bill’s release on Friday.

-

Organic growth will slow from historically elevated levels and the increased cost of debt will take its toll.

-

The legislation would make all residences with dwelling replacement costs between $700,000 and $1mn eligible for coverage through the state insurer if denied by the private market.

-

Participating insurers would be required to provide all-perils property insurance for residential and commercial policyholders.

-

The ratings agency assigned a group financial strength rating of A, with a stable outlook, to three new member companies of Builders Insurance.

-

2024 is likely to be another challenging year for the industry, and commercial in particular, though improvement in personal lines may soften the blow.

-

The outlooks on IMT Insurance Company and its affiliate, Wadena Insurance Company – both domiciled in West Des Moines, Iowa, and collectively referred to as IMT Insurance Companies – were downgraded to negative.

-

The reforms are working for claims filed after December 2022, but attorneys are still litigating claims filed prior to the legislation.

-

Under the proposal, the tax would be effective from 2025.

-

At a Tuesday hearing, California's assembly committee on insurance quizzed insurance commissioner Ricardo Lara on the finer points of his sustainable insurance plan.

-

An affiliate of the Chinese investment group has a 33% shareholding in the carrier.

-

The ratings agency also downgraded carrier’s Long-Term Issuer Credit Ratings (Long-Term ICR).

-

The ratings agency cited persistently strong underwriting results throughout the pandemic and amid substantial economic and capital markets volatility as being among the reasons for maintaining the outlook at stable.

-

The state is already experiencing affordability challenges, and regulators are concerned that an availability crisis is brewing.

-

The ratings agency cites ongoing deterioration in results for personal auto and homeowners’ lines, along with rising loss costs, driven by inflationary pressures.

-

The Senate Budget Committee, chaired by Democratic Senator Sheldon Whitehouse, is seeking information on plans to address increased underwriting losses from extreme weather events.

-

Commissioner Lara’s 2019 mandate, ordering FAIR to offer a more comprehensive insurance package beyond its historical “fire-only” coverage, has now survived a second court challenge.

-

The proposal comes as part of the OECD’s framework for taxing global corporations.

-

The DoJ also hit rival reinsurance broker Tysers with a $36mn penalty and administrative forfeiture of around $10.5mn.

-

Insurance Insider US’s morning summary of the key stories to get you up to speed fast.

-

Clear Blue has successfully moved active programs to either new reinsurers or the reinsurers on its existing panels have taken higher percentages, the agency said.

-

The office also said it has approved the assumption of 650,399 policies from Florida Citizens so far this year, a more than 800% increase from the previous year.

-

The probe determined that Syed Baghdadi and Gator falsified information and misappropriated premiums, leaving multiple customers uncovered.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The move follows a “considerable decline in the group’s key balance sheet strength metrics” through the end of September, the ratings agency said in a statement Friday.

-

The government funding bill signed by Biden on November 16 contains provisions extending National Flood Insurance Program to February 2, 2024.

-

Missouri-based Cameron Mutual and Arkansas-based United Home Insurance Company were placed into court-ordered liquidation this week after struggling to pay claims from severe convective storms.

-

The bill would spur development of a crop insurance policy to cover losses caused by cold exposure and freezes.

-

The move reflects years of weak profitability caused by high cost inflation and cat losses.

-

Insurers have paid out $673.3mn in claims through September 30 for residential losses related to the August fires.

-

Susan Arnold, co-vice chair of NAIC’s P&C Insurance Committee, also urged passage of legislation exempting mitigation grants from taxation.

-

The Z-Fire modeling tool factors wildfire mitigation efforts into the rate-setting process, potentially lowering insurance premiums.

-

Marsh cites its primary listing on the NYSE, along with the costs and administrative burdens of listing on LSE, as reasons for delisting.

-

The most important factors driving insured losses over the years include hurricanes, other weather-related events, inflation, and excess litigation.

-

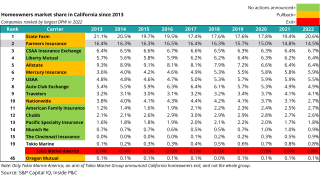

Insurance regulators in California and other states signed off much-needed personal lines rate hikes in September.

-

Inside P&C’s news team brings you all the top news from the week.

-

A summary of commentary from the second day of Inside P&C New York, with insights on InsurTechs, MGAs and Vesttoo.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Survey participants said "much work remains post-implementation".

-

“They’re playing Moneyball,” Petrelli told attendees during the Inside P&C conference in New York, decrying the increasingly sophisticated ability of law firms to attract clients and parse effective litigation strategies.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Lawmakers were discussing legislation that would have facilitated insurance commissioner Ricardo Lara’s ability to implement more insurer-friendly regulations, but talks stalled with just one week left in the 2023 legislative session

-

The independent brokerage, founded in 2019, will now be able to sell reinsurance risks from across Latin America directly to London underwriters.

-

Meanwhile, the FTC’s proposal has been delayed until April 2024 to give the agency time to consider all concerns about the rule because it faced strong opposition.

-

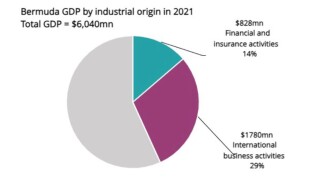

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

Board members voted five to four in favor of rate increases but fell short of the two-thirds majority required.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

At the same time, insurers are assessing the level needed to address loss cost trends.

-

The agency said it will take rating actions where warranted.

-

The letter also called out California insurance companies for investing more than $536bn in the fossil-fuel industry in 2019 alone.

-

Farmers Insurance becomes the latest major national carrier to pump the brakes in California, limiting new business to only 7,000 policies per month, signaling further problems in the state’s homeowners’ market.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

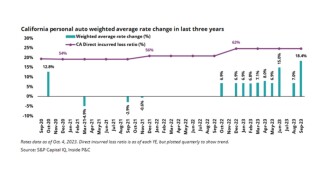

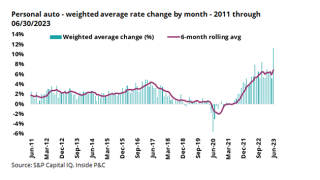

Rates continue to rise through June, with the homeowners’ weighted average rate change coming in at 8% for the month, while auto rates increased by a significant 11.3%.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

New homeowners' policies in wildfire-prone areas will have to flow to the non-admitted market or the state’s last resort, the California Fair Plan.

-

Inside P&C’s news team runs you through the key highlights of the week.