Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Latest News

Latest news from Insurance Insider US

Competitor news

Competitor news

Competitor news

-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Whether Clement's promotion was influenced by an inappropriate relationship is in scope.

-

The timing is unhelpful as the global insurer tries to get on the front foot with M&A.

-

The executive joined the company from Zurich last year.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

Underwriting income for North America quadrupled to $384mn, and the segment recorded a CoR of 82.6%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

A re-focus on reinsurance nearly brings Everest back where it started.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

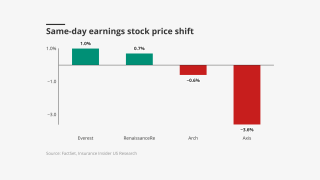

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

The company will implement a new leadership structure after his departure.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

He was appointed CUO of casualty, Americas, in July last year.

-

Ransomware claims have made up the majority of recent large losses.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

Equidad earlier sold its soccer team to group of US investors that includes actor Ryan Reynolds.

-

The Delaware high court’s reasoning could find application in other cases.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

The former executive passed away following a 40-year career in insurance.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

Submissions flow at E&S arm Lexington increased 28% year-over-year in Q2.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Reinsurers are mostly aligned on cat reinsurance, but goals are otherwise diverse.

-

The Bermudian said its pursuit of SMEs through M&A will provide sustainable improvements to its bottom line.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive had previously worked four years as head of trade credit for AIG.

-

The former Everest executive has more than 30 years of A&H experience.

-

The move consolidates the company’s leadership of primary and excess construction casualty lines.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

He has pleaded not guilty to the criminal charges, which carry potential life sentences.

-

The appointments will be effective as of August 1.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The unit will include both ocean and inland marine coverage.

-

Ed Short was previously VP, digital partners, at Arch.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

Sources said MarshBerry was retained earlier this year to run the sale.

-

He will lead AIG’s business across Latin America and the Caribbean.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

The result has been a sharp increase in the use of captives.

-

The exec said if he were a carrier CEO, now is the time he would start looking for deals.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The California wildfires in January accounted for $460mn of Q1 cat activity.

-

The days of 30%+ growth are probably behind the firm, he said.

-

Overall, the company’s underwriting income fell 43% to $417mn in the first quarter.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

A US buy would have to be easily integrated, the CEO stated.

-

The carrier laid out its business mix for the newly launched reinsurance syndicate.

-

AIG veteran Kevin Bidney will focus on North American marine.

-

The executive said AIG’s E&S arm can grow 20% a year and generate $4bn of new business.

-

The judge noted similarities in Dellwood’s business plan and AIG’s.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

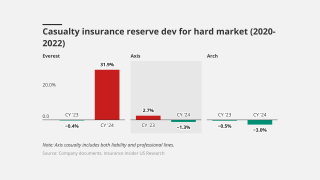

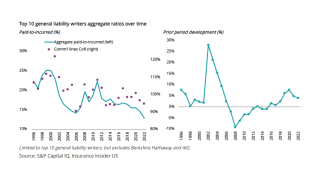

GAAP reserve triangles reveal the struggles of some hybrid franchises.

-

Delegated underwriters are seeing an opportunity to write in the PVT market as an add-on to property coverage.

-

Insurers could absorb as much as 90% of this year’s already elevated losses given shifts in attachment points.

-

Alexandra Furth has more than 20 years of claims and legal leadership experience.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier reshaped its portfolio in 2024, cutting costs and investing in Gen AI and LLM technology, CEO Peter Zaffino told staff.

-

The company, meanwhile, is bullish on E&S US casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The AIG subsidiary says it has no obligation to “defend or indemnify” McKinsey.

-

The executive joins after 20 years with Lexington.

-

The carrier is restructuring the business into three segments.

-

The exec previously spent over 12 years at Aon, recently as chief innovation officer, commercial risk NA.

-

Robin Hamilton has been appointed head of energy and marine liability.

-

New CEO Williamson will likely continue walking the hybrid path, with an emphasis on fixing US casualty.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

Christopher Flatt succeeds Christopher Schaper, who was appointed CRO of AIG in November.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

Tim Watson most recently served as a senior credit and political risk underwriter.

-

Sonville’s hire was reported by Insurance Insider US last week.

-

Sources said the executive will join AJ Gallagher in a regional leadership position.

-

The carrier has used Lloyd’s London Bridge 2 structure for the launch.

-

AIG launched an IPO of Corebridge Financial in September 2022.

-

The sale of the business was confirmed in June.

-

The AIG and Stone Point-owned MGU will also look to move up-market, increase its weighting to E&S and add third-party paper.

-

Jelle Ouwehand joined Arch from Marsh, where he was a senior terrorism, PV and war broker.

-

Mr Cooper Group said it was the target of a 2023 hacking attack.

-

The firm had owned 3.45 million shares in Q2, then valued at over $256mn.

-

A signal around Q4 adverse development has brought the carrier into the spotlight.

-

This publication revealed that Chris Schaper would move into the role on an interim basis in July.

-

Both appointments are effective immediately.

-

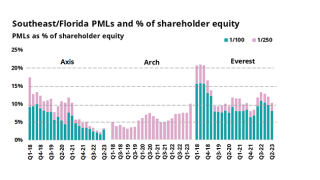

Arch stands out among hybrids, but Axis and Everest grind it out.

-

Casualty submissions rose over 70% while property increased over 20% YoY in Q3.

-

The carrier reported a “large closeout transaction” that benefited the CoR but created a 0.7-point headwind for the loss ratio.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Arch is assuming an industry loss related to Helene in the $12bn-$14bn range.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Coverages include missed bid reimbursement, contingent bodily and property damage, and drone use violations.

-

The insurer will move its Atlanta-area assets to a new "innovation hub".

-

Axa XL Re has hired former Swiss Re executive Greg Schiffer as its North America CEO, effective from 11 November.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

The chief executive will also receive a yearly bonus of 200% of base salary.

-

Arch announced the retirement of CEO Marc Grandisson on Monday, with immediate effect.

-

The executive has been group CUO since 2021.

-

He replaces Richard Goldfarb, who will remain as head of strategy.

-

Based in New York, he joins the firm after seven years as Marsh CFO.

-

Chris Caponigro will be responsible for expanding Axa XL’s product offering and investor base.

-

The executive has resigned from AIG to fill the vacant CEO role at the large corporate unit of the German carrier.

-

The insurer said Dellwood’s "spin" isn’t enough to dismiss the litigation.

-

Last week, the insurer placed ~450 staff at risk of redundancy in its international business.

-

Expansion of the middle-market book is an ongoing focus.

-

Zaffino said the divested crop and travel businesses needed scale to be more profitable.

-

The move is the latest phase of the operational transformation program, AIG Next.

-

The PVT market has seen a recent spike in staff movements, as new capacity enters the space.

-

The carrier writes all of its E&S business in the state through Arch Specialty Insurance Company.

-

The carrier has made several recent high-level promotions.

-

Dellwood claims allegations in AIG’s latest filing are still barred by res judicata.

-

This expansion will protect against risks faced by transportation and logistics businesses.

-

The impact on AIG’s top line will be around $750mn of net written premium within NA personal lines.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty and Skyward Specialty.

-

AIG recorded favorable excess casualty reserve development for AY prior to 2016 of $33mn.

-

Mark Lange, chief middle-market executive, will oversee the new businesses.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Q2 cat losses of $325mn included $156mn in NA mainly from US SCS and $169mn overseas.

-

The slowdown was based on a conviction of “higher likelihood of frequency events” this year.

-

A quick roundup of today’s need-to-know news, including AIG's earnings.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The arrangement enables PCS to expedite growth.

-

Axa's newly formed teams join the company's "complex cyber" unit.

-

The executive has had a 40-year career at AIG, Berkshire Hathaway and Lloyd’s.

-

Both parties expect to close the transaction on August 1, 2024.

-

A quick round-up of today’s need-to-know news, including the Microsoft outage and Travelers' results.

-

-

AIG says new details support case that former execs launched Dellwood using confidential business information.

-

A roundup of today’s need-to-know news, including leadership changes at Chubb.

-

Former Chesterfield managing director James Stevenson moves to exec chair.

-

It made several new appointments in its large commercial business unit, as well as its client and distribution team.

-

Gittler joined Axa XL in 2012 and had led the cyber underwriting team since 2021.

-

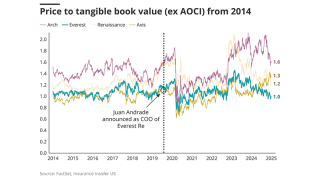

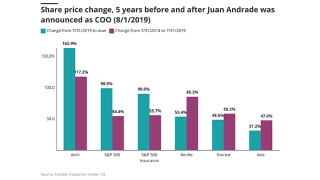

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

This publication reported yesterday that the two carriers were nearing a deal.

-

The disposal is the latest milestone in AIG’s work to reposition itself as a commercial lines insurer.

-

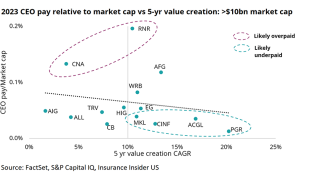

Analysis shows several CEOs with pay diverging from the trendline.

-

A standalone syndicate could offer capital, trading, and licensing advantages.

-

Lee and Barker were promoted to underwriting and distribution leadership.

-

The company now owns around 48.35% of Corebridge Financial’s stock.

-

The appointment is part of a reorganization of the Americas business.

-

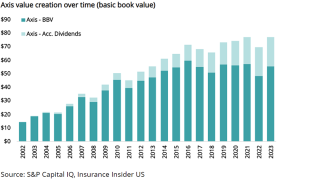

Industry trends show the Axis book value growth goal may be hard to hit.

-

-

The realignment will bring together more product lines for Axa’s mid-size clients.

-

AIG is maintaining its initial 'unlawful misappropriation' suit against Dellwood.

-

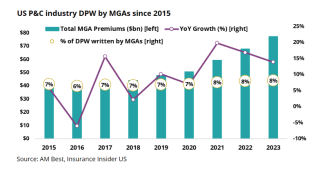

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

The executive’s experience centers on program design for complex risk.

-

Browne joins from Allianz Global Corporate & Specialty, where he was head of specialty.

-

The executive announced last month that he was leaving Parsyl, where he had worked since 2021.

-

The deal represents a major milestone in AIG’s repositioning as a pure-play P&C insurer.

-

The executive is to pursue “a different entrepreneurial path”, according to an internal memo.

-

Analysis of 2023 statutory data shows that Californian insurers are leaning more heavily on reinsurers but at a nationwide level, premium cessions were more stable.

-

Michael Yeats will now lead the automatic reinsurance facilities division in the US.

-

Strack has worked at Arch for close to four years.

-

The appointment is part of Axa XL's plans for a more client-centric approach.

-

AIG sees improvement from tightened underwriting, though value creation has yet to catch up.

-

In certain classes like energy or cat, AIG switched “a bit” to XoL from quota share.

-

The carrier reported an E&S property slowdown but “massive” submission activity in casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

North America commercial lines' adjusted NWP grew 4% YoY on higher rates and new business.

-

There was no material development on long-tail casualty lines across all years, he said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Kirsten Valder has been with Arch for 10 years and before then was a partner at Kennedys Law.

-

The executive is to step back for personal reasons.

-

Will Arch’s new acquisition be another success story, or more trouble than it’s worth?

-

The group is looking to realize $500mn of run-rate savings through AIG Next.

-

The deal includes an LPT of ~$2bn loss reserves for 2016-2023 years with Arch Re.

-

This is the second recent deal in the US crop sector after the $240mn AIG-AFG transaction.

-

The global insurer also alleges breach of contract and fiduciary duty in the federal suit.

-

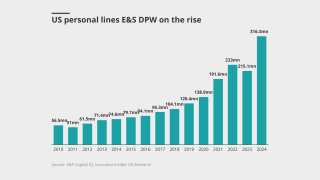

As admitted carriers pull out of riskier plays, E&S continues to expand and thrive.

-

Doppstadt and Paglia have served on the board for 14 and 10 years, respectively.

-

Joe Morrello joined the firm in 2022 after serving as E&S property head at Beazley.

-

Glatfelter CEO Chris Flatt will become interim chief executive.

-

-

Vanessa Hardy Pickering and Lester Pun have also been promoted.

-

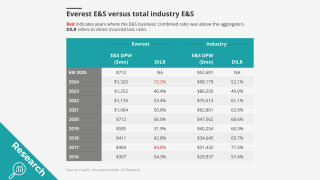

A review of commercial lines loss picks for AIG vs the industry

-

CEO Grandisson described Arch as "bullish" in its prospects for 2024.

-

Ross Bowie joins the MGA after serving as CUO at Orchid Insurance for two years.

-

Given a number of complexities, the landing zone on a take-out price is small.

-

For 2016 and 2017, in particular, the loss picks were raised to 91% and 96%, respectively.

-

Its property cat aggregate cover renewed with improved coverage.

-

Earlier in the process, sources linked Sentry Insurance with a bid for the E&S insurer.

-

Insurance Insider US runs you through the earnings results for the day.

-

NA commercial lines Q4 CoR increased 0.7 points to 85.1%.

-

The company provides reinsurance to insurers in LatAm and the Caribbean.

-

With mixed results in the reinsurance space, the specialty pivot remains a "show-me" story.

-

Duties will include setting strategic direction in marine, aerospace, and specialty niche lines.

-

Chris Inglis served as the first US Senate-confirmed national cyber director.

-

Laura Johnson most recently served as head of E&S primary casualty.

-

Between 2009 and 2012, Therese Vaughan served as CEO at NAIC.

-

She has over 15 years’ experience managing PL and cyber portfolios.

-

The upgrade recognizes improving operating performance.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

Participating in the funding round were Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners and Arch Capital.

-

John Schwirtz will report to Matt Waters, head of Axa XL's US mid-market business, and build out a mid-market underwriting team.

-

The deal follows this publication’s report that the Bank of America-run sale process of Castel was drawing robust interest.

-

His last day will be December 2023, according to an internal memo seen by this publication.

-

Sources said the executive will join Mitsui Sumitomo in a leadership position based in Brazil.

-

James Dunne is vice chairman and senior managing principal of investment bank Piper Sandler.

-

AIG offered 35 million existing shares of Corebridge common stock priced at $20.50 per share Friday, out of 630 million total shares outstanding.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The executive will oversee AIG’s global technology and cybersecurity strategy and lead the insurer’s cloud strategy, along with other modernization technologies.

-

The consideration is expected to be around $140mn plus a $25mn dividend.

-

The low multiple shapes the decision set of the management team, negatively impacts staff, and creates potential opportunities for rivals.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

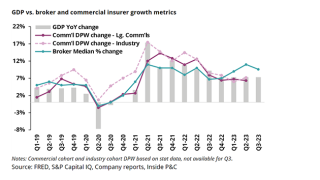

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

The five-person underwriting team will be led by Ian Lewis, who has been named head of intangible assets.

-

The carrier is offering 50 million existing shares of common stock and granted a 30-day option for underwriters to purchase up to an additional 7.5 million shares.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Excluding programs, the E&S insurer grew around 25% in the quarter, led by 33% growth in wholesale casualty.

-

-

The Inside P&C news team runs you through the earnings results for the day.

-

The firm booked catastrophe losses of $462mn — largely from Lahaina Wildfire and Hurricane Idalia — down from $655mn in Q3 last year, which was affected by Hurricane Ian.

-

The deal was announced in late May, with RenRe taking over AIG’s treaty business, including AlphaCat Managers, and all renewal rights to Talbot’s reinsurance treaty unit.

-

The executive noted “increasing evidence [that] casualty rates widely underpriced and oversold during the last soft market need to increase.”

-

The Inside P&C news team runs you through the earnings results for the day.

-

The executive left the company in June following a period of medical leave.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The departure of the president of North America retail was disclosed in an internal company memo.

-

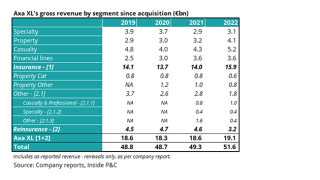

AIG’s combined ratio improved to 92.6% in 2022 from an average of 106% between 2018 and 2020.

-

The move follows another incredibly soft year for the all-risk market as aviation war continues to harden.

-

Jon Hancock has also been named as international insurance CEO.

-

The executive will oversee all aspects of managing direct insurance operations at the business.

-

Patin will oversee Somers’ overall investment strategy and direct its investment managers.

-

Having joined AIG in 2000, Poux was one of the Private Client Group’s founding members.

-

Based in New York, the executive will report to Axa XL CUO Libby Benet.

-

-

The former general counsel and communications chief will move to the role on 1 October.

-

The insurer has been working to build a reputation for favorable reserve development after past sins.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Pilko will succeed Joseph Tocco, who is retiring after more than 12 years with the company. He will remain as special adviser for the remainder of the year.

-

In addition, Arch Re global CUO Pierre Jal moved to Zurich to take over as Europe CUO, while president Matthew Dragonetti expanded his scope to lead client-centric initiatives.

-

AIG has been course-correcting since 2008, but recent efforts including AIG 200 seem to have finally set it in the right direction.

-

Having already served in the role in an interim capacity, Hopkinson will now permanently head up the company’s insurance operations north of the border.

-

The executive will be responsible for overall performance of the company’s insurance operations in the region and report to Axa XL’s US country manager Matt O’Malley.

-

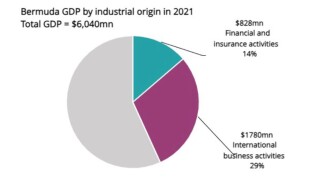

A 15% tax is in the works, but appears manageable, and with (re)insurance being Bermuda’s largest industry, the territory will take steps to keep companies where they are.

-

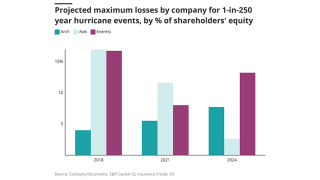

Differences in reinsurer strategies and risk management lead to differentiation in stock multiples and long-term value creation.

-

AIG expects to add new capital providers to its recently launched HNW MGA “in the coming quarters”.

-

AIG decided to buy additional retrocessional protection for Validus Re and a low XoL reinsurance placement for its Private Client Group ahead of the wind season.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

AIG grew GI NWP in NA by 17% to nearly $4bn as both commercial lines and personal lines NWP rose 17% to over $3.4bn and $563mn, respectively.

-

CFO Morin said Arch was able to deploy more capacity, resulting in a significant premium growth for property lines.

-

-

Sources suggest that, based on a multiple of 15x-17x Ebitda, the business could be valued at £300mn-£375mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Mark Sperring’s promotion comes just a few months after AIG’s former head of global aerospace, Steve Eccles, left the carrier.

-

The executive, based in Morristown, New Jersey, will be responsible for the company’s US reinsurance operations.

-

At CNA, the executive managed a $500mn P&L for mid-market business out of New York.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Axa’s lack of success in selling its more volatile XL Re segment has led the insurer to cut back on those lines, but the current rate environment makes this a good time to revisit a sale.

-

Under terms of the partnership, Arch Capital has acquired a minority stake in the Bermuda-based MGA.

-

The French carrier is exploring the spin-off of the XL Re operations via a private sale or stock market listing, according to Reuters.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The first signs of limit expansion, growing appetite in the admitted market, and retail brokers' impatience with wholesalers are all evident.

-

In addition, the insurer completed the $240mn sale of its agribusiness unit Crop Risk Services to American Financial Group (AFG).

-

Inside P&C’s news team runs you through the key highlights of the week.

-

At this week's Bermuda Climate Summit, speakers heralded the Island's future as a centre of excellence for climate-related innovation and risk transfer.

-

Before joining AIG, the executive had served as chief underwriting officer of marine at The Hartford.

-

Reinsurers have mostly grown since before the Covid crisis, but the type and timing of growth affects value creation,

-

Formerly head of AIG’s separation management unit, Tarpey joined Corebridge last August.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the company decided to outsource its claims function to Sedgwick, a third-party administrator in which Stone Point Capital is a minority investor.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Purtill became interim CFO in January after AIG terminated Mark Lyons, saying the executive violated his confidentiality/non-disclosure obligations to the firm.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG offered 65 million existing shares of common stock, or about 10% of approximately 648 million total shares outstanding.

-

The carrier is offering 65 million shares of common stock, out of approximately 648 million total shares outstanding.

-

Marcial will take over the position left vacant after the departure of Juan Costa, who moved to Berkshire Hathaway as casualty VP in Atlanta.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

How do you harmonise distribution strategies in a rapidly evolving marketplace?

-

In Partnership with AXISMichael McKenna, Head of North America Specialty Insurance, AXIS, outlines the key trends shaping the industry as 2025 comes to a close and underscores that talent acquisition and rapid technology integration will be critical for specialty insurance in 2026.

-

In Partnership with AXISLooking ahead to 2026, Michael Silas, Head of Global Credit, AXIS, sees mildly positive global growth driven by tech and infrastructure, but says credit sentiment remains cautious and reinsurers must still price to long‑term tail risk.

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider US

Brown & Brown appoints Hearn to lead global operations

The executive has been serving as COO since February.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.