Allstate

-

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

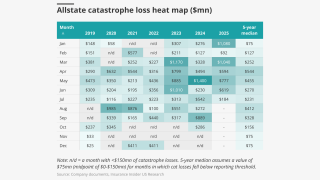

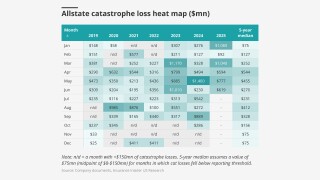

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

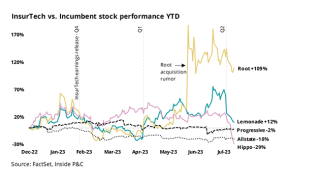

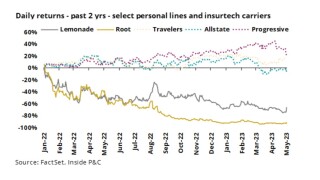

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The research team presents the June cat heatmap.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Two wind and hail events were responsible for 60% of the total.

-

Insurers haven’t announced concrete steps – yet.

-

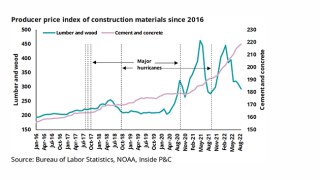

But automotive repair costs are likely to increase faster than home repair.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

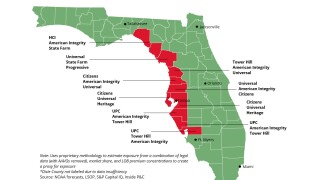

The carrier has not added new business in the state since 2007.

-

The carrier has been reducing its presence in the state since 2007.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

Insurers are fighting to recoup claims they have paid out.

-

Fifteen events caused estimated losses of $306mn.

-

The news team runs you through this week’s key M&A deals.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

Total catastrophe losses stemmed from 20 events and were estimated at $587mn.

-

NatGen allegedly collected $500mn associated with the fraud.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty, Marsh, Allstate.

-

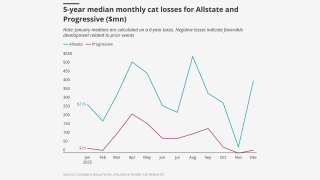

Allstate’s total pre-tax cat losses for H1 2024 were $2.85bn versus an estimated $4.39bn in H1 2023.

-

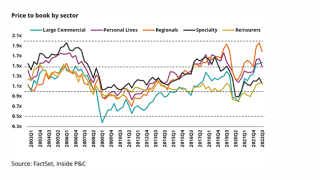

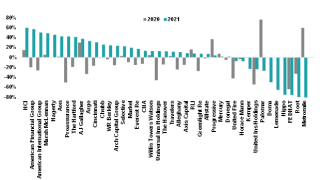

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

This takes pre-tax year-to-date cat losses to $2.62bn.

-

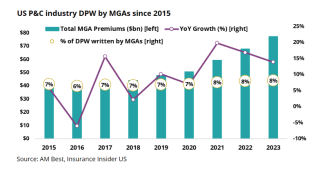

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

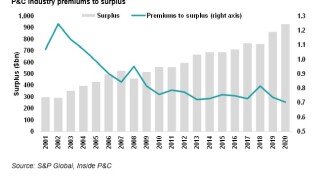

Changes in investment strategy and strong results show carriers can weather financial storms.

-

This takes pre-tax cat losses for the calendar year to $1.23bn

-

This follows February’s cat losses coming in below the $150mn reporting threshold.

-

This follows January pre-tax cat losses of $276mn.

-

Two events comprised approximately 80% of the losses.

-

The carrier expects to "get smaller in New Jersey" due to lack of rate adequacy.

-

Insurance Insider US runs you through the earnings results for the day.

-

Unfavorable prior year reserve re-estimates, excluding catastrophes, totaled $199mn in Q4, with approximately $148mn related to personal auto, including costs for litigation claims.

-

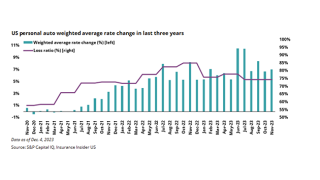

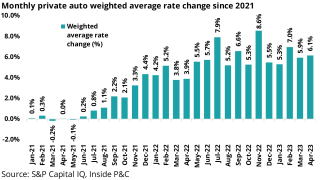

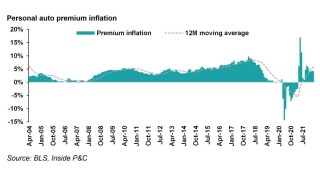

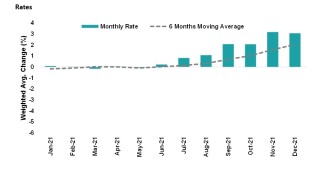

For the month of November, Allstate brand’s auto rate increases totaled $262mn, after implementing $517mn and $1.49bn of rate increases in Q3 and Q2, respectively.

-

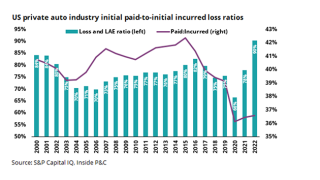

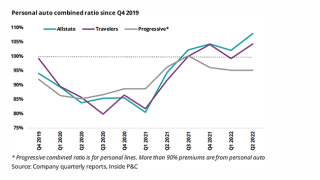

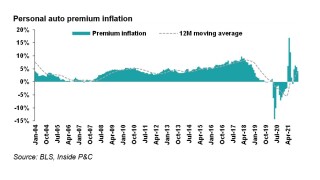

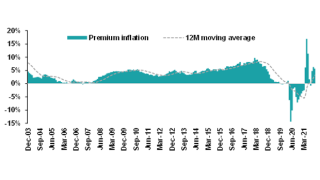

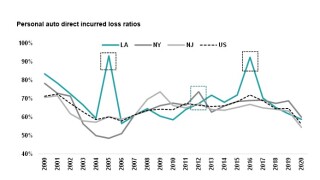

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

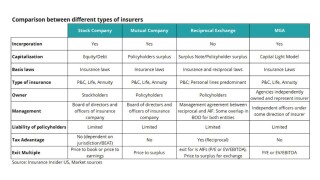

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

Meanwhile, the company’s October cat losses came in below the reporting threshold of $150mn, compared eith $317mn of cat losses in September and nearly $1.2bn for Q3.

-

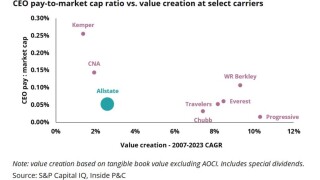

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

Three states — California, New Jersey, New York — were responsible for adding five points to YTD combined ratio for 2023.

-

The Inside P&C news team runs you through the earnings results for the day.

-

A clear commonality is already emerging much as it did in the previous quarter, when severe convective storms – particularly hail – also dominated.

-

Most of the losses, around 80%, were the result of two wind and hail events.

-

Allstate’s underperformance in results and value creation may be an opportunity for activist investor Trian, but history suggests it will have its work cut out.

-

The carrier has suffered five quarters of losses, largely spurred on by hefty natural catastrophe losses.

-

-

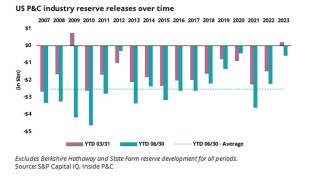

Differing trends in short- and long-tail lines offset each other to create a net positive for the industry, though the releases are slowing significantly.

-

The settlement would resolve claims that Allstate defrauded shareholders by underreporting “skyrocketing” auto claims to artificially boost the stock price, which later crashed.

-

Allstate reported cat losses of $1bn and $885mn for June and May.

-

On the surface, InsurTech results were better than the noise from incumbents, but caution is needed to ascertain the quality of new business coming in during a time when even industry leaders stumble.

-

The downgrades reflect the negative impact of challenging macro-economic trends on underwriting results and risk-adjusted capitalization.

-

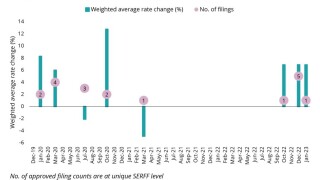

In California, the carrier filed for a 35% increase this quarter after implementing a 6.9% rate hike in April.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Q2 cat losses reported by most carriers were significantly higher than a year ago owing to the number of US convective storms and likely higher carrier retentions at reinsurance renewals.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Nearly $148mn of the unfavorable reserve development was related to National General, primarily driven by personal auto injury coverages.

-

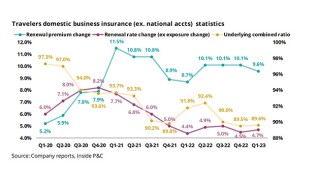

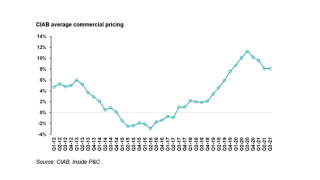

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

An uneven loss environment in personal lines calls for a cautious reading of reserves.

-

California Insurance Commissioner Ricardo Lara was speaking about climate change's impact on insurance pricing at the Bermuda Climate Summit.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier said 70% of the claims stemmed from two wind and hail events.

-

CPI figures show loss costs are cooling, and if rate levels cannot reach adequacy we are likely to see more pausing from the industry beyond State Farm, Allstate and Nationwide.

-

The company reportedly recently applied for a rate increase of about 40% on California homeowners’ business.

-

The loss for the month was 60% comprising losses from two wind and hail events.

-

InsurTech carriers pivot to profitability vs growth.

-

The carrier will continue to push for more auto rates through 2023 as drivers of severity continue to persist.

-

The carrier shifted retentions up and made use of multi-year contracts.

-

Personal lines rates ticked up in April compared to the prior month as insurers try to stay ahead of rising loss costs.

-

The carrier contended with 10 events over the month, with 75% of its losses stemming from three wind events.

-

Travelers posts strong results boosted by better pricing, personal lines performance, and favorable development.

-

The new 2022 stat data shows personal lines premium has grown year-over-year, but the loss ratios have been hit hard by catastrophes and loss cost inflation.

-

Allstate disclosed a $211mn catastrophe loss in February based on nine separate events.

-

The collapse of Silicon Valley Bank is creating investor fear across the global financial services sector.

-

The agency attributed the decision to a material deterioration in the company’s surplus position, as a result of challenging personal property insurance conditions in Florida.

-

2022 statutory data is now available, and results show winners and losers

-

Rate action for personal auto insurers has been increasing in 2023 to balance rising loss cost trends

-

The carrier’s equivalent bond placed last March secured $550mn of limit.

-

Of those, around $309mn were associated with nine events primarily in Texas and California, partially offset by favorable reserve re-estimates for prior events.

-

The firm’s playbook struggles provide valuable insights for its InsurTech competitors as they all navigate a challenging loss cost environment.

-

Part of the company's plan to improve auto insurance margins is to file for greater rate increases in 2023, along with lowering operating expenses and advertising spend.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm recorded a $282mn reserve charge in the quarter, of which $180mn was related to an increase in personal auto claim frequency attributable to prior accident years.

-

Five auto insurers receive approval to raise rates after 32-month halt by the California Department of Insurance.

-

After market close on Wednesday, the carrier disclosed an estimated combined ratio of 109.1% for the quarter, adding 10 points year on year.

-

For the same period in 2021, the company reported a combined ratio of 98.9%.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

Personal lines insurers see a vastly different outlook in 2022 than 2021 and their reserve development reflects this.

-

This price hike contributed to a premium increase of $695mn in the month, bringing the year-to-date impact of 2022 rate increases to $3.6bn.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

In Texas, the company expects roughly 50% rate increases, whereas in California, the company received approval for a 6.9% increase.

-

While Allstate may be beyond the worst of the reserve charges, execution of initiatives needs to go smoothly for it to get back on track.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company paid out $1.63bn for physical damage claims in the first nine months of the year, which exceeded earlier projections of $1.33bn.

-

The implemented price hikes added $307mn in new premium last month, driving the year-to-date rates implementation to $2.9bn.

-

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Amid record high economic inflation, continuing supply chain issues and proliferating nuclear verdicts, carrier CEOs have emphasized the need to keep rate above loss costs during Q3 conference calls.

-

Though still significantly elevated, the CPI appears to have peaked in the short term, which may give carriers a chance to catch up on rate.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The personal lines carrier expects to implement additional rate increases in the fourth quarter of this year, and into 2023.

-

Progressive’s superior digital distribution and widening auto margins put it far ahead of the competition.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

CEO Tom Wilson added that Allstate is expanding its plans to reduce personal lines insurance in states with “unacceptable auto and home insurance margins”.

-

The firm disclosed that ex-cat unfavorable prior year reserve reestimates totaled $875mn, of which $643mn were related to its personal auto unit.

-

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Last month’s rates implementation marked an acceleration from the 8.9% hikes announced in July, which resulted in overall premium impact of 1%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Market sources are suggesting inflation could require a wider group of US cedants to buy $10bn-$20bn of additional cat coverage for 2023.

-

Rizzo will take over on September 1. Jess Merten will also assume his role as CFO effective September 1.

-

Allstate CFO Mario Rizzo vowed to continue pushing through auto rate increases.

-

The personal lines insurer’s results were also impacted by the states’ regulatory climates and inflationary trends.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The executive was speaking during the company’s Q2 2022 earnings call, after it reported a 107.9% headline combined ratio for the period, marking a 12.2-point deterioration YoY.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company's net written premiums grew 11.5% to $11.5bn, compared to 10.2% in the first quarter.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company also said it expects a $408mn reserve charge, including $275mn related to personal auto and $91mn recorded for commercial auto.

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Embedded insurance can help sidestep some of the challenges faced by InsurTech 1.0.

-

The carrier’s below-FHCF layer is 29% unplaced.

-

The losses were caused by 14 events, most notably wind and hail in Texas, the Midwest and Canada.

-

The personal auto writer’s partnership with the digital dealership should serve as a warning for other InsurTechs.

-

The figure includes around $17mn of unfavorable reserve re-estimates for prior period events.

-

The firm has a similar market share to peers in states with high fatalities and new vehicle registrations.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Shapiro noted that the Allstate brand incurred severity for property damage is expected to increase about 11% in 2022, compared to the year before.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The 2022 reinsurance program will support cat losses exceeding $2.5bn, compared to $2bn in the corresponding period last year.

-

Sequentially, the combined ratio improved 1.6 points from 98.9% in Q4 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The personal lines giant reported Q1 unfavorable non-cat prior year reserve re-estimates of approximately $160mn, driven by auto physical damage and bodily injury severity.

-

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer plans to take more rate throughout the year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm reported quarterly earnings featuring disappointing personal auto loss cost trends.

-

The carrier shifted to average Q3 rate hikes of 7.1%, after trimming rates to start 2021 in response to drop in frequency, improvements to expense structure.

-

The insurer also took a $187mn reserve charge, as it's core loss ratio spiked, and catastrophe losses rose from Q4 in 2020.

-

Colorado’s Marshall Fire is expected to cost the company $218mn, while the convective storm that devastated four states, including Kentucky, will contribute around $79mn in claims.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.

-

Data from Apple and Google show that Omicron has slowed the return to driving in some of the largest states by premiums.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

The monthly CPI report shows that inflation continues to push severity higher as carriers take rate in response.

-

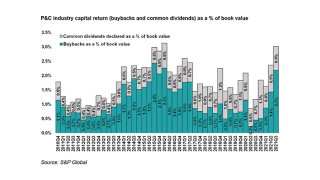

The higher level of repurchases seen in Q3 will likely last longer than expected.

-

Citing increased work-from-home arrangements among its workers, Allstate announces the sale of its campus, which it has occupied since 1967.

-

Progressive races for rate, with Allstate slightly slower to account for a recent acquisition and restructuring.

-

Personal lines giant Allstate is increasing rates for its auto insurance business in response to rising loss severity that has hit the segment, the firm’s CEO Tom Wilson said.

-

The company was also hit with a $162mn reserve charge, which included an $111mn increase in old asbestos and environmental claims, though net written premiums increased by 17% to $11bn overall.

-

The carrier also signalled unfavourable reserve developments linked to asbestos and environmental exposures.

-

Trucking companies, having already increased self-insured retentions by millions, will need to contend with further rate increases into 2024.

-

The carrier also expects to close Allstate Life Insurance sale to Blackstone-backed Everlake later this year.

-

It said the hurricane would cost it $1.4bn of gross losses, with just over half going to reinsurers.

-

Ida soaks the tri-state – and has the potential to affect personal auto carriers more than comparable storms of the past.

-

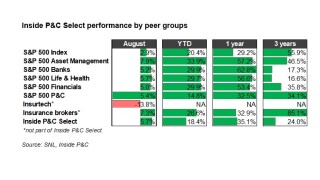

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

A complex web of factors are creating uncertainty around the likely insured loss, but much early discussion centers on a $20bn-$25bn range.

-

With predicted $20bn in losses, KBW doesn’t see meaningful change to the rate increase trajectory.

-

Texas’s objection to Progressive’s recent rate filings garnered attention, calling rates “excessive” and suggesting rebates instead.

-

The newcomers are finding it more difficult to disrupt the sector than they had expected.

-

The accelerated repurchase agreement is a part of Allstate’s $5bn buyback program, which was announced in early August.

-

Excluding prior-period reserve charges, the Illinois-based company estimated total cat losses at $211mn from 18 events.

-

The company’s combined ratio rose by 5.9 points to 95.7%, as lower second quarter catastrophes and a better expense ratio helped mitigate the impact of the higher attritional loss activity.

-

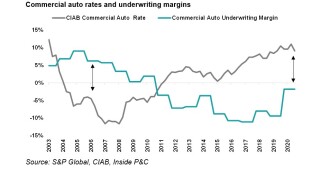

While the pandemic offered some relief to commercial auto insurers, maintaining margins will be tricky to achieve given rate moderation.

-

Catastrophe losses for the month fell to $195mn, a sharp drop from the prior year’s $752mn.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

Travelers, Liberty Mutual, State Farm and Allstate announced suspension of donations in January, but have now re-started financial backing for elected officials.

-

The personal lines giant's best approach to growth may be sticking to its proven strengths.

-

The executive pointed out to attendees that the cost differences between direct-to-consumer tech platforms and an agency force need to be weighed against different levels of service.

-

The figure was significantly down on the prior month’s $544mn, and also came in 39% below the year-ago loss tally.

-

Personal auto carriers lowered rates in response to 2020’s loss cost trends, but chasing market share now could be a mistake.

-

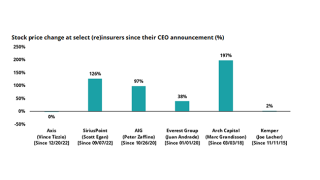

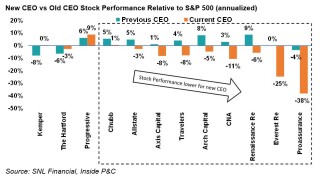

New CEOs were not able to consistently create higher book value growth than their predecessors, and any growth achieved wasn’t maintained after five years.

-

The personal lines giant announced a $300mn deal last night to buy non-standard auto writer SafeAuto.

-

Activist investor Carl Icahn now owns $400mn of Allstate shares.

-

Continued capital depletion could result in additional pressure on management teams with regard to executing their original business plans.

-

The monthly tally came in 14% lower than the $632mn reported a year ago.

-

Any faster-than-anticipated re-opening could have a negative impact on loss cost trends.

-

Allstate will keep the brand going while putting advertising dollars behind its core direct business.

-

Net investment income surged more than threefold to $673mn.

-

Reinsurance recoveries and subrogation payouts helped to minimize retained cat losses to $466mn, post-tax.

-

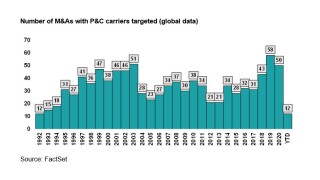

The next few years could prove to be more active in consolidation than normal for underwriters.

-

On a forward basis, frequency estimates could look high with base figures in 2020 being significantly impacted by initial lockdown measures.

-

The transaction will free up around $1.7bn in deployable capital.

-

Independent agency distribution remains incredibly robust, despite the Covid-19 pandemic and the emergence of direct-to-consumer InsurTechs.

-

The insurer will take a pre-tax net hit of $567mn from the winter loss, implying roughly $700mn of reinsurance recoveries before the impact of reinstatement premiums.

-

State Farm wrote $1.8bn in premium in 2019, representing 18.3% of the market.

-

InsurTech won’t knock incumbents off their pedestal just yet, said the Allstate CEO.

-

Carriers too cautious on pricing could see retention trade-offs.

-

Rate reductions were driven by a reduction in auto accident frequency and expense savings from cost-cutting measures.

-

The carrier dropped its combined ratio by almost five points, despite a rise in cat losses and its first premium drop in 2020.

-

Reduced accident development led to a prior underestimate in the December frequency benefit.

-

The carrier says the divestment will reduce its GAAP reserves by $23bn.

-

Karfunkel family shareholders had sold a roughly 40% NatGen stake as part of the $4bn deal.

-

The early January close rests on achieving regulatory approvals by the end of December.

-

Plaintiffs including State Farm, USAA and Allstate argued the fires were the fault of the US National Park Service.

-

Almost all losses stemmed from hurricanes Delta and Zeta.

-

The personal lines giant's growth is in focus as the market looks for progress on its embrace of the direct channel.

-

The carrier’s $990mn catastrophe loss in Q3 is net of $495mn in subrogation from a settlement with PG&E.

-

The carrier's Hurricane Laura loss has risen close to its occurrence treaty trigger.

-

The rideshare company has also deepened its existing partnership with Progressive.

-

The vote follows the news that Allstate is cutting 3,800 jobs across its business.

-

The personal lines giant is making the cuts in a bid to keep its expense ratio down.

-

Three shareholder complaints maintain the merger proxy statement was misleading.

-

The agreement is part of a $3bn share repurchase program announced in February.

-

Hurricane Laura made up the bulk of the losses, at $430mn pre-tax, followed by Hurricane Isaias at $200mn.

-

The July deal put the Karfunkel family in line for a payout of more than $1.5bn.

-

Subrogation recoveries from 2017 and 2018 wildfires put the carrier’s overall July catastrophe bill in credit to the tune of $334mn.

-

The “empty-street” economy has left auto exposed names in a relatively favorable position, highlighted by a second quarter of strong earnings growth and beats when compared to street estimates.

-

The move comes amid reduced auto loss frequency due to Covid-19 lockdowns.

-

The firm’s loss ratio fell 15.9 points to 45%, offsetting premium rebates and lower NII.

-

The firm repurchased 460,000 shares during the second quarter.

-

June losses from wind and hail events in Texas, Pennsylvania and Alberta total $181mn.

-

NatGen’s long-term issuer credit rating has been placed under review, with positive implications, as is customary in such takeovers.

-

Earlier this week, Allstate announced the $4bn acquisition of National General, the latest step in its efforts to improve its omni-channel presence and compete for market share.

-

Chris Cole has worked on Allstate deals since the 1990s, when he advised on a raft of asset disposals.

-

The transaction is expected to raise the insurer's market share to around four percent for business acquired through independent agents.

-

Major carrier M&A has resumed as the impediments of March's stock market crash and Covid-19 eased, with Allstate striking a deal late yesterday to acquire National General Holdings for $4bn in cash.

-

The deal will generate proceeds of more than $1.5bn for the Karfunkel family and including a dividend is pitched at 69 percent more than Tuesday's close.

-

Four severe weather events in Texas and the Midwest generate about 80 percent of the claims.

-

Media reports suggested Allstate is preparing to lay off potentially thousands of its employees.

-

Allstate has extended its 15% premium rebate by a month. Notably, a few other companies have also added to their original rebates including State Farm, USAA and American Family.

-

More than half the losses came from two major wind and hail storms.

-

The “empty-street” economy has left auto-exposed names in a relatively favorable position – so much so that they have been returning premiums to clients.

-

Two of the largest carriers’ Q1 calls highlighted significant declines in miles driven and accident frequency, in line with our previous findings.

-

In the quarter, Allstate’s 15% premium refund contributed 2.4pts to its headline combined ratio.

-

The insurer added $121mn to its catastrophe treaty, covering it for up to $5bn of losses.

-

Yesterday, National General discussed Q1 results which included operating EPS of $0.91, up 18.2% YoY, and a headline combined ratio of 87.8% compared with 89% last year.

-

Kemper today become the latest carrier to announce a partial refund for customers.

-

Yesterday, Allstate and American Family announced a plan to partially refund personal auto premiums. We expect these to be the opening bids in a protracted battle with regulators.

-

The carrier will hand $600mn in premiums back to auto customers to reflect the decline in driving due to the Covid-19 crisis.

-

The S&P 500 insurance industry index rose by 2.8 percent as lawmakers neared a vote on a coronavirus economic relief package.