SiriusPoint

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

The search for a CFO had been underway since last July.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

The company will continue its capacity partnership with the MGA until 2030.

-

The company has also expanded its relationships with US and UK MGAs.

-

The carrier also benefitted from favourable reserve development in property and A&H.

-

Andrew Pryde succeeds Andreas Kull, who will stay on until September.

-

Philip Enan joins following 11 years at Chubb.

-

Space pricing experienced double-digit increases after the 2023 capacity retreat.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The agency cited SiriusPoint’s recent management moves including lower cat exposure as a driver of the change.

-

ISA is part of Ryan Specialty National Programs, which launched last month.

-

SiriusPoint will provide capacity for a new construction liability program.

-

The partnership will launch a new umbrella excess insurance product.

-

The ratings agency noted “significant” underwriting improvement in 2023-24.

-

Meanwhile, SiriusPoint’s property book grew 25% in full-year 2024.

-

The firm’s core CoR improved 3.2 points to 90.2%.

-

After two payments, the transaction is expected to be complete in February 2025.

-

Shapella will also join the company’s executive leadership team.

-

The firm is still operating within its catastrophe budget for the year, CEO Scott Egan said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is expanding its MGA partnerships and has invested in its marine team.

-

The executive will replace Habib Kattan, who joined the company last summer.

-

A quick roundup of today’s need-to-know news, including the CrowdStrike outage and a hire at SiriusPoint.

-

-

The Irish MGA will be able to underwrite commercial property risk up to EUR10mn.

-

SiriusPoint becomes sole carrier partner for Euclid’s liability program.

-

Tara Hill launched last month and is headed by Core Specialty’s Peter McKeegan.

-

She has also been a director of Enstar Group since October 2020.

-

Steve Yendall is stepping down after 18 months as SiriusPoint CFO.

-

The executive has worked as a casualty treaty underwriter at QBE Re and Scor.

-

This publication revealed that the firm is working with Jefferies on the sale of its A&H MGA Armada.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sources said the Bermuda carrier has been working with Jefferies on the sale.

-

-

Larson and Godlis will be based in New York and Mohamed will be based in London.

-

Instead, the firm’s core segments reported $13.5mn in full-year cat losses.

-

The carrier will prioritise underwriting profits over growth in 2024.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Putting together two “show me” stories risks investor skepticism.

-

It remains unclear whether there could be reputational damage after key shareholder CM Bermuda’s parent, CMIG International Holding, was taken into receivership.

-

Earlier this morning, SiriusPoint announced it had been informed that major shareholder CMIH had been taken into private receivership by lenders in Singapore.

-

An affiliate of the Chinese investment group has a 33% shareholding in the carrier.

-

InsurTech Nirvana plans to expand its offerings with a program designed for fleets with fewer than 10 units.

-

Based in Philadelphia, ProVerity provides specialty products to underserved areas of professional liability business.

-

Ratings could be lowered by one notch depending on regulatory restrictions on cash flow from Bermuda operating entities to non-operating holding companies, the ratings agency said.

-

The positive results in Q3 are starting to form a “track record” of improvement as the carrier moves away from “a place of underperformance”, the executive told this publication.

-

The ratings agency said the change reflected its expectation that the carrier would post improving underwriting results in the next two years.

-

In 2021, SiriusPoint acquired a “significant ownership stake” in the firm, which meant the specialty insurer and reinsurer providing multi-year capacity and paper to the ILS house.

-

The move follows an earlier announcement in May, when SiriusPoint disclosed that its equity stake in the Bermuda-based MGA was reduced to 49% from 100%.

-

The incoming deputy CUO spent 10 years at AIG, holding roles such as global head of portfolio analytics and chief risk officer for financial and liability lines.

-

The activist investor agreed not to acquire more than 9.5% of the outstanding shares of the company or an amount of ownership requiring regulatory approval.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Kattan’s role will include establishing the strategy and structure of SiriusPoint’s global ceded reinsurance function, managing the ceded team based in Stockholm and overseeing all reinsurance placements.

-

Rees joins from Chord Re, where he was head of casualty for nearly two years.

-

The underwriter replaces Stuart Liddell, who is leaving the business.

-

The aviation programme manager will exclusively use SiriusPoint’s paper across the US.

-

Bronek Masojada served as CEO of Hiscox until January 2022 and was appointed to SiriusPoint’s board in May.

-

Egan will receive an annual base salary of $1.1mn and an annual target bonus equal to 140% of his salary.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The company has been weakened somewhat, and the base case now is a return to grinding out new CEO Scott Egan’s refined strategy.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Howden Tiger is advising the Bermudian as it seeks to realize value from its portfolio and simplify its story for investors.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Loeb revealed his intention to take SiriusPoint private last month, saying that it would better position the company to execute its turnaround strategy.

-

Bermudian carrier SiriusPoint’s equity stake in D&O MGA Banyan Risk has been reduced to 49% from 100%, filings show.

-

While SiriusPoint CEO Scott Egan said the committee of independent directors will examine any acquisition proposals, he added that there’s “no assurance” any deal will be executed.

-

Following the departure of Gretchen Hayes and the appointment of Masojada, SiriusPoint board will consist of nine directors, six of whom are independent.

-

The Bermudian disclosed that its board has established a special committee of independent directors to review any acquisition proposal by Dan Loeb.

-

The affirmation follows an SEC filing by activist investor and Third Point Re founder Dan Loeb last week, in which he disclosed intentions to take the company private.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The billionaire’s mooted take-private will hinder CEO Egan’s efforts to steady the ship.

-

Shares, which have long underperformed, were trading up 13% following the regulatory announcement.

-

The revision reflects SiriusPoint’s improved underwriting performance under a revamped management team.

-

SiriusPoint said the deal would allow Arcadian to “significantly scale” its business.

-

Last week, SiriusPoint and Compre signed an LPT deal covering $1.3bn of reserves.

-

The deal is the latest incidence of bumper transaction size in the legacy space.

-

The executive didn’t provide a target for the number of investments it expects to keep, but said SiriusPoint will not be an active acquirer in the near term.

-

The company posted its first net investment gain in a year, driven by $45.5mn of gains in its bonds portfolio and $26.4mn from short-term investments.

-

Maddi Morris will be responsible for overseeing the growth and refinement of the insurer’s marine and energy liability account.

-

Former CEO Monica Cramér Manhem is to retire after 38 years with the business and its predecessor.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The transaction would have involved a partnership with Mosaic and a managing agent sale.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The impact of Ian losses on SiriusPoint’s total equity was ~3.5%, lower than RenRe and Everest, and in line with Axis.

-

SiriusPoint International CEO Monica Cramér Manhem has decided to retire from the business.

-

The executive will report directly to SiriusPoint CEO Scott Egan, who joined SiriusPoint from RSA in early September.

-

Bobby Heerasing joined SiriusPoint in October 2021 as head of international strategic development before being promoted to UK country manager earlier this year.

-

The carrier argued it paid the executive the first installment of a $400,000 retention award in March 2020 and the second half in March 2021.

-

The Bermudian will also collaborate with Insurate in developing and underwriting products in the medium- to high-hazard workers’ compensation segment.

-

The appointment comes after the sudden departure of previous chief Sid Sankaran in May.

-

The executive reiterated SiriusPoint’s intentions to continue with strategic partnerships, pointing to the firm’s “robust pipeline of deal activity”.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The (re)insurer’s investment results were fueled by a net loss of $57.3mn from its investment in the TP Enhanced Fund.

-

The two carriers have injected a further $100mn into the underwriting project.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The MGA writes management liability, professional indemnity, crime and cyber risk.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Bermuda-based (re)insurer currently has an A- long-term financial strength rating and a BBB long-term issuer credit rating.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The leadership shake up comes less than three weeks after Sankaran’s departure and the appointment of Third Point head Dan Loeb to the carrier’s board.

-

The announcement comes soon after SiriusPoint CEO Sid Sankaran departed and activist Daniel Loeb joined the board.

-

Inside P&C’s news team takes you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Third Point hedge fund chief’s appointment to the board will provoke investor scrutiny of potential conflicts of interest.

-

Inside P&C’s news team takes you through the key developments from the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company named former Third Point Re CEO and former global distribution president Daniel Malloy as interim CEO.

-

The executive will be responsible for underwriting strategy for the London and international casualty book.

-

Avinew, which launched in 2016, directly underwrites semi-autonomous and autonomous vehicle usage.

-

The investment returns were driven by growth-oriented positions in the enterprise technology and financial services sectors at Third Point Enhanced Fund.

-

The commercial insurance firm will use the funds to increase its sales capacity, enhance its technology platform and develop new offerings.

-

In addition to Malloy’s departure, Mark Parkin notified the reinsurer of his intent to resign from the board of directors for personal reasons.

-

The move will enable Players Health to make insurance and risk management more accessible to amateur sports organisations.

-

CEO Sankaran and COO Gangu are looking to use the firm’s capital, platforms and licensing to create value beyond reinsurance.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

As part of the deal, all staff working for the MGA will join Mosaic, while SiriusPoint will become a strategic investor in the carrier.

-

Jason Robart previously founded Seae Ventures, a venture capital firm.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

The (re)insurer completed a $450mn redemption from hedge fund exposures, to be deployed in cash and fixed income, with an additional $100mn redemption in January 2022.

-

The reinsurance unit's combined ratio plummeted to 91.2% from 129.4%, outweighing the increase in the insurance services combined ratio, which spiked to 98% from 55.5%.

-

The deal makes SiriusPoint the lead underwriting capacity provider for Honeycomb.

-

The business has attracted $110mn in its latest funding round and is valued at over $1.3bn.

-

Ari Chester joined SiriusPoint in early 2021 and most recently served as Americas reinsurance COO.

-

The hire follows the addition of former Berkshire Hathaway executive Michael Densham to expand the MGA’s Canadian operations.

-

In his new role at the specialist D&O MGA, Densham will report to Banyan founder and CEO Tim Usher-Jones.

-

The transaction grants SiriusPoint direct access to the life (re)insurance market in Canada.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

LuckyTruck aims to expand across the US and solidify partnerships with MGAs, carriers and trucking groups.

-

The carrier will make takeout offers to a selection of Citizens’ customers.

-

In an interview with Inside P&C, Prashanth Gangu also argued that InsurTechs should stay private for as long as possible, and InsurTech MGAs should not rush to transition to full stack until they prove that their business models work.

-

Based in Zurich, Kull will oversee SiriusPoint’s risk management strategy.

-

The partnership will provide LimitFi with capacity to provide credit insurance, and SiriusPoint with immediate access to credit insurance opportunities.

-

The (re)insurer remains committed to cutting volatility and adjusting its risk profile by moving to specialty segments and repricing businesses where margins are inadequate.

-

The (re)insurer’s combined ratio spiked to 152% after taking $132mn in losses from the European floods and $100mn in claims from Hurricane Ida.

-

The speciality insurer is also providing multi-year capacity and paper to the climate risk shop.

-

Speakers and panelists pondered the future – specifically InsurTechs, social inflation and low investment yields.

-

As head of Americas P&C, Patrick Charles will expand strategic partnerships and oversee the launch of products and services.

-

Brendan will be responsible for global reserving, pricing and improving the company’s underwriting profitability.

-

The deal will allow Corvus to write up to $100mn in new business over the next 12 months, with SiriusPoint initially providing all the program’s reinsurance capacity.

-

The Silicon Valley-based Vouch, launched in 2019, raised $90mn at a $550mn valuation in its Series C round.

-

The upward revision reflected significantly increased industry expectations, it said.

-

Value can be created on both sides by merging the expertise of both sectors, the CEO explained.

-

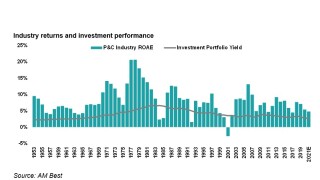

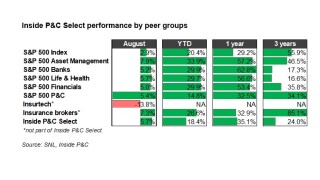

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

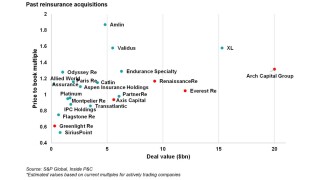

The drivers that led to the consolidation in the reinsurance industry might not replicate for a while.

-

The carrier’s combined ratio improved by seven percentage points thanks to reduced loss and acquisition costs.

-

The deal follows a $37mn reserve charge taken by Third Point Re just ahead of the closing of its merger with Sirius International in February.

-

In an interview, the former AIG executive said the SME market is “crying out” for a more efficient solution, creating “tremendous opportunity” for her start-up.

-

The business will be headed up by Tim Usher-Jones, a former Chubb D&O executive in the Canadian market.

-

The former AIG CFO spoke to Inside P&C as part of its Unreserved podcast series.

-

SiriusPoint’s partnership with Outdoorsy subsidiary InsurTech Roamly will seek to help the company grow.

-

SiriusPoint posted higher underwriting income in the first quarter than a year ago and lowered its combined ratio to 96.6% from 98.6% in what was a heavy cat quarter for the industry.

-

Darryl Siry joins with immediate effect and will launch an InsurTech incubator for the carrier.

-

He is based in the New York area and joins the carrier from RFIB.

-

The newly formed (re)insurer is to support the start-up led by AmTrust alumni.

-

The start-up is aiming for a July 1 launch, initially offering non-admitted property coverage in the Northeast and Midwest, before expanding into other lines.

-

Third Point Re also confirmed Tim Mardon as global property head and named Rachael Dugan as general counsel.

-

The executive will join the reinsurer ahead of the close of its merger with Sirius International later this month.

-

The company expects reinsurance to provide 78% of its $2.5bn gross written premium target.

-

Coleman will act as interim chief accounting officer until May 2021.

-

The structure simplifies access to Sirius E&S capacity for brokers.

-

Sirius shareholders favour the deal but dissent on compensation proposal.

-

Across the P&C market, share prices outstripped the 1.16% uptick in the S&P 500 index and the 2.28% rise in S&P 500 financials.

-

Loeb will lose rights including the ability to veto important company decisions and to select a board observer.

-

The hedge fund reinsurer offered to merge with Sirius in May 2018, before the company’s listing on the Nasdaq exchange.

-

The work finalises a restructure spearheaded by former Travelers executive Beth Boucher.

-

Junius joins October 1 as COO, becoming CFO of SiriusPoint at the transaction’s close.

-

The move follows Third Point’s $788mn takeover agreement for the (re)insurer.

-

The group’s combined ratio improved by 9.5 points to 95.9%.

-

Third Point’s current CEO Malloy called the timing of the deal ‘critical’ as the 1.1 renewal looms.

-

Sankaran will need to land a difficult integration and shrug off the total return reinsurer label.