WTW

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

-

Former head of construction Bill Creedon will assume the role of chairman.

-

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

-

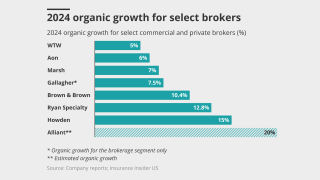

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

She joins the brokerage after 18 years at Canada’s Intact.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The Bermuda-based team is led by John Fletcher.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It will be tough to pull off prior goals despite management assurances.

-

The pair add to the roster of aviation-focused hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

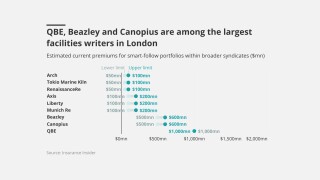

The big brokers are lining up London capacity to write follow lines on US risks.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

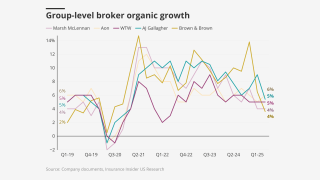

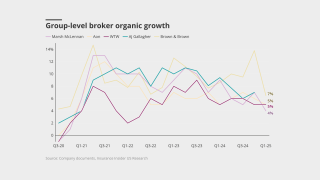

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

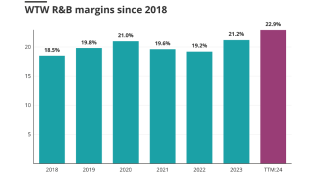

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Starr-leads the WTW-placed all-risks cover for American Airlines.

-

Bradley was construction team leader for US casualty at WTW.

-

The Willis name, which dates back to 1828, will be used with clients and markets.

-

He succeeds Hugo Wegbrans, who becomes head of CRB for Europe.

-

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

CMP and BOP reached their highest levels in over a decade.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

A quick roundup of our best journalism for the week.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

Adam Garrard will cover his responsibilities on an interim basis.

-

WTW will hold a significant minority stake in the start-up with an option to acquire complete ownership over time.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The global market is stabilising and softening, and casualty and specialty lines are generally stable, the CEO said.

-

The broker posted a net loss of $1.67bn including pre-tax non-cash losses.

-

He brings over 25 years of experience in PE and transactions solutions.

-

The broker will take a charge of $1.6bn-$2.1bn relating to the sale.

-

Baudouin is transitioning to a chairman position in Mexico.

-

Commercial auto and excess umbrella continue to face upward pressure.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

The two parties are targeting a launch by the end of the year, with scope for WTW to buy the start-up at maturity.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

The company yesterday promoted Jenna Ziomek to P&C leader for PE and M&A.

-

Ziomek joined WTW in 2021 and has 17 years of industry experience.

-

The new broking president added that hundreds of Marsh staff would not show up tomorrow at WTW.

-

The broker said achieving profitability “remains challenging” for insurers.

-

CRB NA growth was driven by specialty lines, including natural resources, construction and real estate.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The broker raised the low end of its 2024 target ranges for adjusted operating margin and adjusted EPS.

-

A quick roundup of today’s need-to-know news, including the CrowdStrike outage and a hire at SiriusPoint.

-

Alongside the appointment, Adam Garrard will take on the new role of chairman of risk and broking.

-

-

Jorgen Andersson and Peter Galla will serve as deputy heads of the division.

-

The executive previously led the excess casualty practice at Aon.

-

He brings more than 20 years of industry experience to the role.

-

Quarterly price increases of around 6% have remained steady since the pandemic.

-

deLaricheliere will report to WTW head of FIPS Brad Messinger.

-

The executive said expansion was driven by retention and new business.

-

CEO Carl Hess hailed a “solid” first quarter of results.

-

Prior to her stint at Lockton, the executive worked at Marsh.

-

The firm reportedly parted ways with 120-130 employees as part of the cuts.

-

The executive joins from regional insurer ASSA, where he spent almost 16 years.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

The US regulator faces litigation from both sides of the climate issue.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

Graham Knight will become chairman of natural resources.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

WTW said adverse development “is evident” in auto liability lines from 2015 to present.

-

WTW hired Kolos for transactional solutions, Chin for tax insurance and Kesack for contingent solutions.

-

The facility offers a range of $25mn to $50mn in excess capacity.

-

Insurance Insider US runs you through the earnings results for the day.

-

At market close, WTW shares were up almost $18.

-

The CEO said winning back clients had “validated” the broker’s approach.

-

Risk and broking was driven by new business, client retention and rates.

-

The role marks Miranda Rodriguez’s return to WTW from Brookfield Asset Management, where she was vice president of risk and insurance.

-

In October 2023, it was announced that Powell was leaving Marsh to join WTW as the broker’s global chief claims officer.

-

The broker said there was a “record level of dry powder” waiting to be deployed.

-

Joining WTW in 2010, Despina Buganski has served as COO for the Ppersonal lines business since 2015.

-

Tyson Stevenson will be responsible for producing new business and driving growth in WTW’s real estate portfolio for 2024.

-

Commercial Property experienced the greatest rate increase, with a double-digit surge that came in slightly lower than the previous quarter.

-

The appointment comes two weeks after this publication revealed that the executive had resigned from Lockton to join the rival broker.

-

The broker said reinsurance capacity has contracted over the past 18 months, and the once-diamond-hard aviation war market has started to soften.

-

WTW also said private equity will continue to dominate the M&A landscape in 2024, with firms sitting on “over $2tn in dry powder” which is ready to deploy.

-

The broker said it anticipated new entrants in the downstream class following a profitable 2023.

-

A quick roundup of this week’s biggest stories.

-

The executive joined family-owned Lockton in 2020, as director of energy within the South Florida-based Latin America and Caribbean team.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

SEC filings show that, in Q3, the activist shareholder liquidated its remaining 508,880 shares in WTW — worth around $120mn at the end of Q2.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

The broker has not been acquisitive since the deal to create the group in 2015, and has divested a number of its units in that time.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

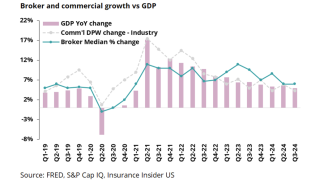

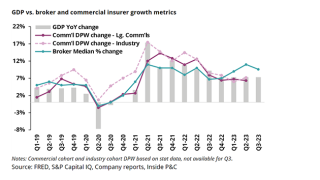

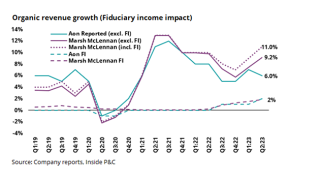

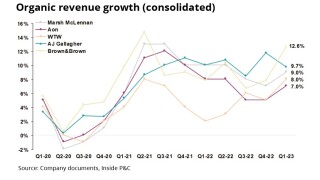

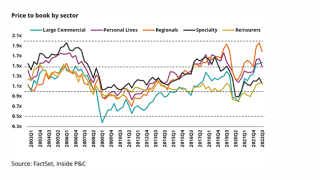

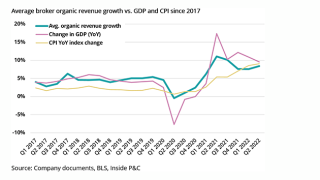

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Work is at an exploratory stage, with efforts focused on London specialty and US P&C mid-market expertise.

-

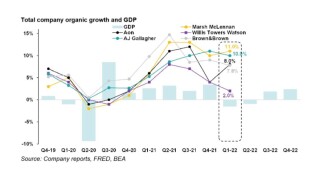

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

As of 14:00 ET, the broker’s stock stood at $232.24 per share, 11.9% higher than the previous close of $207.74.

-

The broker’s Q3 organic growth was driven by specialty lines, including fac financial solutions, natural resources, surety, construction and aviation.

-

WTW said that new staff were ramping up revenue production, following a period of investment in talent.

-

The exercise is understood to involve mainly junior and non-broking staff.

-

Kenneth Gould and Frank Scardino resigned “effective immediately” in early October to join WTW, allegedly forgoing a required 30-day notice period.

-

Despite an upswing in deal activity, large deals have continued to see a steady decline in volume that began in 2021.

-

The two executives, based in Dallas, Texas, have close to 60 years of combined insurance experience.

-

The start-up MGU will initially focus on real estate, hospitality and leisure, financial institutions and professional services industries.

-

The executive was most recently global engagement partner at Marsh.

-

Survey participants said "much work remains post-implementation".

-

Besides reinsurance broking, MGAs and MGUs, affinity is another segment where WTW can scale its operations, the executive noted.

-

The investor’s stake in WTW is now valued at roughly $120mn, while its position the prior quarter was worth around $423mn, according to its Q1 13-F filed with the SEC.

-

Prior to joining WTW, Bryce was a partner and private client practice leader at Canadian broker The Magnes Group.

-

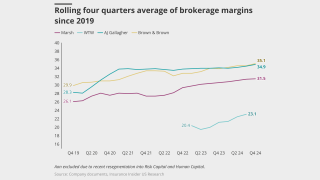

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

WTW is quietly sounding out market executives for a potential relaunch into reinsurance once its two-year non-compete agreement with Gallagher Re ends in December, this publication can reveal.

-

The broker said that key hires – including Lucy Clarke – would pay off in improved results.

-

The broker said it experienced headwinds from prior-year book sales, inflation and investment costs.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Pat Donnelly has succeeded Lucy Clarke at Marsh, and Adam Garrard at WTW has moved into a chairman role.

-

Allegretti joins as WTW’s personal lines P&C sales director for the ICT division, while Anderson-Higgins will step into the corresponding role for commercial insurance lines.

-

The executive will be responsible for the growth of the hospitality insurance portfolio and for providing service to current and prospective clients in this segment.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The exercise is no longer focused around crunching wholesale broking relationships down to a small preferred panel.

-

The incoming executive brings over 25 years’ industry experience, having previously held roles at Allianz Trade, Altradius and Zurich.

-

The intermediary’s latest study shows double-digit rate increases in commercial property and auto lines.

-

He was previously North America Cyber Growth leader and before that Midwest Regional Leader - FINEX Cyber/E&O.

-

Douglas spent the last decade of his 23-year tenure as head of WTW’s climate and resilience hub.

-

A report from WTW and the Institute of International Finance has found little correlation between companies’ operation emissions intensity and their climate transition value-at-risk.

-

Three months ago, Starboard trimmed its stake by almost 14% to 1,925,491 shares valued at over $470mn from 2,232,209 shares at the end of Q3.

-

Though strong growth continues, the future is less clear as driving forces potentially run out of steam.

-

Shares were trading down 6% following the publication of the broker’s Q1 results.

-

The broker reported new business and increased retention in aerospace, financial solutions and natural resources.

-

He was previously vice president – North America construction manager at Scor, and held past roles at Liberty, Swiss Re and CNA.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

She joins from Aviva Canada and has over 20 years of experience in the insurance industry in North America and the UK.

-

Based in London, Artunduaga has served as Aon’s LatAm network leader. In addition, Chile-based Jose Necochea, Victor Padilla and Andres Claro will move to WTW.

-

WTW’s survey cites regulatory risk, health and safety precautions and bribery and corruption on the list of top D&O risks.

-

WTW said driver shortages continue to force contractors to use younger, often less experienced drivers, potentially putting upward pressure on losses.

-

Bolig has been executive managing director at Aon since 2014.

-

Inside P&C takes a deep dive into public brokers’ M&A activity in 2022 as Q4 earnings season comes to an end.

-

The rise marked a deceleration from the increase in Q3, when carriers reported a 5.2% climb, according to WTW figures.

-

Based in Chicago, the executive will lead digital underwriting transformation projects for global commercial lines insurance clients.

-

The executive said the broker stopped receiving client proposals whilst it was set to be taken over.

-

The broker has experienced a resurgence in growth under new leadership and strategy.

-

WTW has appointed Pieter Van Ede as global head of trade credit, in a move the broker said demonstrated its commitment to growth in the class of business.

-

According to WTW’s report, countries are “de-aligning” from the West due to the declining influence of the US and its allies.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The firm’s strategy to consolidate trading relationships faces fundamental, cyclical and company-specific challenges.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In each case, the broker asked the judge to dismiss with prejudice, barring the parties from bringing the disputes to another US court.

-

The broker argued that WTW conspired with former employees Terry Rolfe and Daryl Abbey to use its confidential information and divert customers to WTW.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

The move aligns WTW resources with specialist industries to operate as standalone businesses within North America.

-

Based in Toronto, the executive will focus on supporting clients to redesign their businesses with structures aimed at delivering better results.

-

Only D&O and workers’ compensation clients experienced price decreases during Q3, according to WTW.

-

Based in New York, Sallada will focus on developing and executing an industry vertical growth strategy for the broker’s casualty business.

-

Evan Freely will head up a team of 130 staff specializing in credit and political risk.

-

The members were unanimously selected by the board as part of its multi-year succession planning process.

-

Mahoney joins from Aon, where he was team leader for US general casualty and energy in London.

-

The business line’s premium increases this year were less pronounced than in 2021, when quarterly renewals were in the 50%-200% range.

-

The product will provide $100mn in cover across eight countries at high risk of tropical cyclones.

-

The project, funded by Agence Française de Développement, was revealed during the G20 Leaders’ Summit in Bali.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

The brokers asked the judge in the case for a 30-day extension to finalize settlement terms in Aon’s suit against WTW.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Growth is accelerating at the broker in the wake of a challenging period following the collapse of the Aon merger.

-

The acceleration defied wider sector trends, which has led to slowing growth at other brokers.

-

As the super-cycle slows and the economic landscape becomes more uncertain, brokers will face pressure, though a cooling labor market may aid margins.

-

Lopez succeeds Hector Martinez, who was appointed as Latin America leader at WTW earlier this year.

-

WTW has hired Michelle Cui from Zurich North America as director of actuarial property and casualty in its insurance consulting and technology business.

-

The brokers are working on finalizing the terms in a written settlement agreement, which could be filed within two weeks.

-

In his new role, Ryan will report to WTW North American leader for CRB Mike Liss.

-

The broker said the fallout from the Russia-Ukraine conflict was increasing competition for business.

-

The new deadlines set last week after a hearing suggest that recent settlement negotiations between the brokers to end the case via private mediation did not come to fruition.

-

The managing director is the latest in a series of hires at WTW’s natural resources division.

-

The parties did not disclose whether any money changed hands to end the legal proceedings.

-

In the lawsuit, filed last week in a New York court, WTW is seeking injunctive relief and compensatory damages over a year after Lockton lured the executives.

-

The discovery process will run through August and September, and the court will hold a hearing on Aon’s motion for a preliminary injunction on October 12.

-

The CEO said that WTW was making good progress under its strategy but acknowledged there is more to do.

-

Growth was slower than rival brokers, but CEO Carl Hess said investments would bear fruit in H2.

-

WTW sued the rival broker over the poaching of 25 members of its senior living group in September 2021.

-

The complaint was filed on July 14 in the Superior Court of Suffolk County in Massachusetts.

-

Luis Maurette, current head of Latin America and head of global sales and client management, will retire on December 31, 2022.

-

Peru’s state-owned firm Petroperu has said that the broker designated to run its account was chosen as a result of a “technical evaluation”, following local media and Inside P&C reports that WTW had won with the highest bid in the process.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that the two other bidders in the process were AJ Gallagher with a fee of $885,000 and Lockton with $700,000.

-

Mayers' role will focus on the ICT unit's commercial lines pricing and underwriting propositions.

-

Before his appointment, the executive served multiple senior leadership roles within the division across Germany and Northern and Central Europe.

-

The brokers expect to reach an out-of-court agreement to end the poaching case in south Florida within two weeks.

-

Brokers may face pressure as the pricing cycle turns and estimates fail to keep up.

-

The complaint names surety executives John Thomas, Andrew Bennett and Jennifer Boyers Gullett as defendants.

-

Insurers have expressed concerns about hitting the 2023 deadline for the regime.

-

The executive will report to Tom Coughlin, WTW’s head of industry and specialty for CRB North America.

-

Q1 marked a deceleration from the last quarter of 2021, when commercial lines rates increased around 7% from the same period of 2020.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that the account includes oil platforms, crude barrels and 12 vessels, and is one of the largest accounts in the South American country.

-

The buybacks will be in addition to the $1.3bn remaining on the broker’s current open-ended repurchase program.

-

Inside P&C’s news team canters through the week’s key developments.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The loss of the carrier’s Russian operations is set to create “modest margin headwinds” for the business.

-

The company posted adjusted diluted earnings per share of $2.66, ahead of analyst consensus of $2.50.

-

Michael Chang will join WTW later this year with current head of corporate risk and broking for North America, Mike Liss, set to retire in 2023.

-

WTW Peru recently appointed head Gerbo Pacchioni will report to Tagle as part of the cluster.

-

Cyberattacks and data losses were the top risks with 65% and 63%, respectively, followed by cyber extortion and regulatory threats with 59% and 49%.

-

The appointments come as the broker revamps its corporate development operations.

-

The brokers asked the judge to delay some pre-trial conferences by two weeks as they could obstruct the settlement negotiations.

-

The broker said there was still a “big unknown” around the potential global economic impact of the conflict.

-

WTW forecasts that cyber rates could increase by 100% to 200% for heavily exposed industries.

-

The intermediary said capacity for downstream energy has now returned to 2017 levels.

-

The potential for major deterioration on a 2019 loss could yet prove “devastating” for the market.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Defendants claim that WTW’s complaint “improperly seeks to transform a simple contract dispute with certain former employees into a series of tort claims”.

-

The embattled broker could stand to lose around $50mn in Ebitda as major economies shun Russian trade.

-

Before his promotion, the executive served as WTW’s head of strategy based in London since April 2019.

-

The move follows similar actions taken by Aon and Marsh McLennan.

-

Singh had managed Lloyd’s catastrophe risk appetite prior to joining MS Amlin.

-

The company said it introduced cyber into the survey for the first time and that the line showed a significant rate increase.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The CEO outlined areas of the business which needed additional care and attention, while highlighting the need to build a culture of trust between management and staff.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Financial results in the fourth quarter were impacted by senior staff departures and lost business.

-

CEO Carl Hess said the results did not fully reflect the near and long-term potential of the firm.

-

The broker joins after a brief spell at Aon, where he was head of EMEA business development.

-

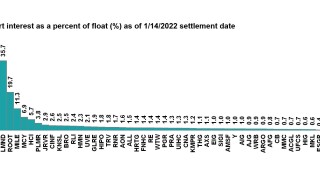

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

Higher returns are available, but at the cost of increased revenue risk, slower results and potential cultural challenges.

-

The brokers will have until early 2023 to settle the case via private mediation or the case will move forward to a jury trial that could last between seven and 10 days.

-

The broker said the last three years of hardening had led to a “substantial technical correction”.

-

The change comes as the broker seeks to draw a line under a tumultuous chapter in which the planned takeover of Willis by rival Aon collapsed.

-

The executive will be based in Toronto reporting directly to Mike Liss, Willis’ North America risk & broking leader.

-

This year deals will continue to increase but ESG, inflation and supply chain issues bring complexity.

-

Heinicke brings over 25 years of experience in the insurance industry, most recently spending over 11 years at Aon Bermuda.

-

The three new directors that will not seek reappointment take the total board members standing down to five.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

A judge for the Miami-Dade County Court has ordered Aon and individual defendants in the Miami facultative team poaching case to avoid doing reinsurance brokerage business with the defendants’ former Willis Towers Watson clients.

-

The new coverage marks the first time that sovereign debt repayments have been protected by a parametric catastrophe clause.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

The Week in Brief: FM Global’s vaccine mandate, Hippo on going public, Hagerty SPAC deal redemptionsInside P&C’s news team runs you quickly through the key developments from the last week.

-

Rate increases were down from just below 8% in the second quarter, with professional lines registering the biggest increases from the prior year.

-

The promotion comes shortly after Willis hired Marsh’s Scott Pizzi to lead property broking in North America.

-

The CEO-designate's comments at the Morgan Stanley conference on Friday were a marked – and welcome – change of tone.

-

Willis president Carl Hess said that hiring rates have dramatically increased in his firm's corporate risk and broking business.

-

Inside P&C’S news team runs you quickly through the key developments from the last week.

-

In an interview, the new Gallagher Re CEO noted that his former company had been weighed down by nearly two years of uncertainty, telling this publication: “That stops today.”

-

The group CEO also observed that the Big Three reinsurance brokers do have a competitive moat based on their scale.

-

The deal was struck in the wake of the collapse of Aon and Willis Towers Watson’s merger.

-

Pizzi will take over the position that has remained open since Nancy Woode left Willis to join McGill and Partners last April.

-

Willis is accusing its blue-chip rival of conspiring with its former employees to pilfer some of its reinsurance brokerage clients in Florida, causing “irreparable harm".

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.

-

Increasing cat costs will drive the focus on modelling and price adequacy, the intermediary said.

-

Willis Towers Watson has selected Inga Beale, Fumbi Chima, Michael Hammond and Michelle Swanback to join its board of directors.

-

While Willis predicted market moderation as capacity expands, the report concluded that the cost of insurance in the near term is still going up.

-

The executive has spent the majority of his 35-year career with Aon.

-

The executive will also remain his current role as head of Colombia, it is understood.

-

Positive earnings results point to the firm meeting full-year guidance, but will it hit the 500 points improvement in margin by 2024?

-

The transaction was cleared in five out of six jurisdictions – including by US antitrust authorities – and is only pending UK regulatory approval.

-

On an earnings call to discuss Q3 results, Willis CEO John Haley said staff attrition has peaked following the aborted Aon takeover.

-

The profitability metrics were impacted by the $1bn income received following the Aon deal termination.

-

Willis’ latest InsurTech briefing shows how a small group of InsurTechs are securing the lion’s share of investment via $100mn-plus mega-rounds.

-

Margin expansion and higher returns to shareholders would come at a cost with a cut in investment and staff over the coming years.

-

Starboard estimates Willis's share price could double in three years and said there is room for margin improvement.

-

In an internal memo, the company named a raft of leaders by country and business unit, though many roles also remain unfilled.