Personal auto

-

Sources said Jefferies and RBC have been retained to advise on the sale process.

-

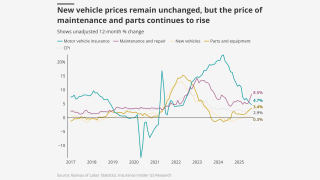

Casualty and auto loss costs continue to rise due to inflation as we head into 2026.

-

Insurance has been an increasingly salient issue among politicians in the state.

-

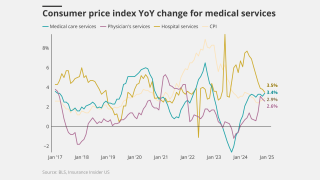

The medical care index increased 3.5% over the past 12 months.

-

The company announced several moves Monday, including the promotion of Nancy Pierce to Geico CEO.

-

The ratings agency said that it continues to assess State Farm’s balance sheet among the strongest.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The reserve strengthening stemmed from bodily injury and defense costs for accident years 2023 and prior.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

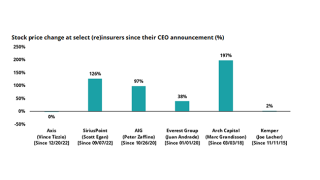

The executive’s exit follows CEO Joseph Lacher’s resignation last week.

-

September’s medical care index increase follows a 0.2% drop in August.

-

By line of business, $35mn of the charge relates to commercial auto and $5mn to personal auto.

-

The insurer booked a $950mn policyholder credit expense in September.

-

Joseph Lacher will step down as president and CEO and resign from the board.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The charges allege “egregious delays” and “unreasonable denials” in claims.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

A report by the ratings agency challenges current industry wisdom.

-

The bipartisan legislation would make Fema a cabinet-level agency.

-

The data modeling firm said losses previously averaged $132bn annually.

-

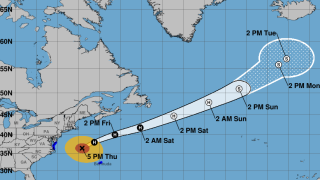

Storm surge of two to four feet could affect the North Carolina coast.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

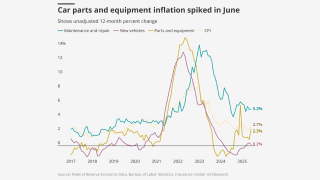

Despite mild headline CPI, some insurance-related items are heading in a worrying direction.

-

July’s medical care increase was up from June’s o.6%.

-

The gross loss ratio for the homeowners InsurTech fell by 12 points last quarter.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The company also purchased $15mn of SCS parametric coverage.

-

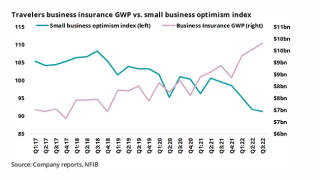

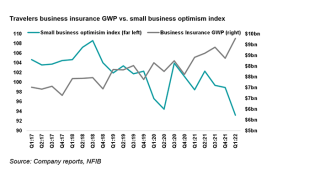

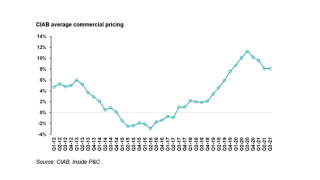

On Q2 calls, carrier executives called out fierce competition in various lines of business, and a misalignment of interest.

-

CEO Roche said that “significant price increases” are still to come, however.

-

The broker posted a 6.5% drop in organic growth YoY.

-

Mercury’s recovery from the guaranteed percentage of losses is $47mn.

-

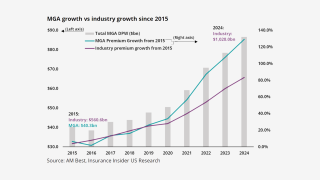

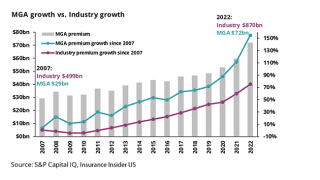

Smaller accounts remain less affected by an influx of MGAs.

-

The automaker’s insurance arm wrote over $300mn in premium last year.

-

Hagerty Re will now assume 100% of the premium and 100% of the risk.

-

The executive said the claims industry is going to “be transformed”.

-

Litigation seeks to block insurers from passing assessment costs to consumers.

-

Rising inflation could raise claims severity but also increase investment income.

-

June’s increase was up from May’s 0.2%.

-

The late March storm caused extensive damage in southern Quebec and Ontario.

-

Early adopters of AI will see efficiencies – and likely increased market share, Kantar said.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The Pennsylvania-based insurer experienced a 10-day network outage this month.

-

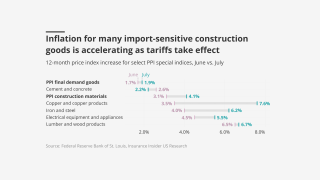

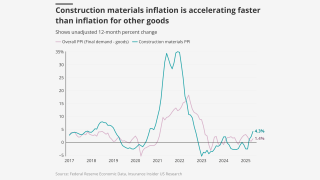

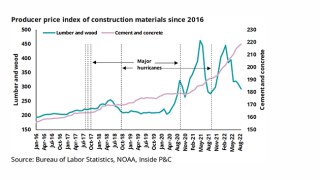

Tariffs could drive up property loss costs, but the impact on other items has been muted.

-

The medical care index numbers were below April’s 0.5% rise.

-

The regulator said further measures could still be passed in this session.

-

Insurers have termed the Democrat-backed legislation “flawed”.

-

One measure could give regulators greater leeway to deny rate requests.

-

The company seeks the full 30% homeowners’ rate request it made last June.

-

Two wind and hail events were responsible for 60% of the total.

-

The medical CPI is up 3.1% for the last 12 months.

-

Hits to personal auto, workers’ compensation led to a drop in NWP.

-

At his last annual meeting as CEO, Buffett highlighted the importance of Berkshire’s insurance operations.

-

The primary and reinsurance unit CoRs were 103.1% and 98.7%, respectively.

-

But automotive repair costs are likely to increase faster than home repair.

-

The Lone Star State has seen rapidly increasing rates in recent years.

-

CEO Marchioni said the overall hit would likely be “in the low single digits”.

-

The sale price represents Elephant’s approximate net asset value.

-

In operation since 1991, Pearl represents Ocean Harbor and Equity insurance companies.

-

Auto and homeowners’ insurance will see effects from the tariffs.

-

Customers will keep their agent relationship and policies will not be impacted.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

The state has seen 11 new entrants into the insurance market, reflecting renewed confidence.

-

The company received over 10,100 home and auto claims as of January 27.

-

Loss-cost indicators are high for liability, low for property.

-

The all-items index posted a 2.9% rise for the last 12 months.

-

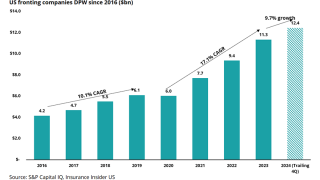

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

Rate inadequacy and inflationary pressures represent significant headwinds, however.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

Net property losses from Hurricane Milton in October reached $153.6mn.

-

The renewal book has auto, home, renters and condo policies, among others.

-

Initial expectations for the later storm prove overblown, while inland auto losses mount for the earlier event.

-

The catastrophe loss estimate for September totalled $889mn, pre-tax.

-

A bill in Congress would expand a similar pilot tried earlier in New York City.

-

The storm is projected to make landfall in the next 24 hours in the highly populated Tampa Bay region.

-

The lawsuit alleges the data is being used by insurers to increase premiums.

-

Lawsuit claims GM unlawfully sold data to insurers collected from 1.5m drivers.

-

Reforms would seek to tamp down legal costs that can drive insurance costs up.

-

NatGen allegedly collected $500mn associated with the fraud.

-

Reserving trends, pricing declines and hurricane forecasts are causes for concern.

-

Longstanding investor Stone Point will continue as a partner and board member.

-

US SCS insured losses YTD already stood at around $12bn prior to these events.

-

Flash floods moved into Texas overnight and into the lower Mississippi Valley Monday.

-

The carrier is also targeting E&S growth in property brokerage and global specialty.

-

Concern about vague cat modeling language was a theme at a Tuesday workshop.

-

Commercial lines will remain bifurcated, with strong growth in property and weak growth in liability.

-

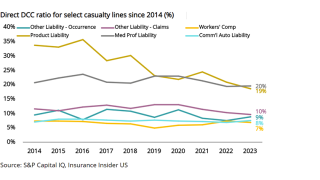

Downward trends of DCC ratios are beginning to reverse, which could cause issues for long-tailed lines.

-

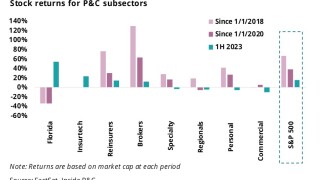

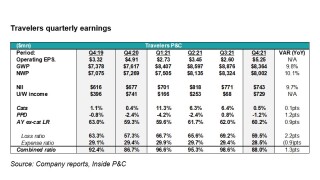

Light cat losses, reserve development, and pricing trends are key topics in Q1.

-

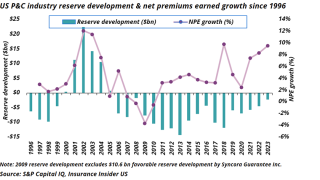

Workers’ comp releases continue to mask deteriorating reserves in 2023.

-

This compared to a 20.6% YoY increase for February and January.

-

He will manage the region’s sales and service teams.

-

The company has retained Tony Ursano’s IAP for the raise.

-

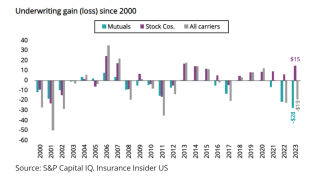

Mutuals struggle to react and adapt to a worsening loss environment.

-

The downgrade reflects the company’s balance sheet strength, which AM Best assessed as weak.

-

Headwinds weigh on carrier results, but premiums and surplus remain mostly stable.

-

The homeowners' CoR fell over 32 points sequentially to 75.8%.

-

It follows Las Vegas intermediary Insurvia, which launched an auction last year.

-

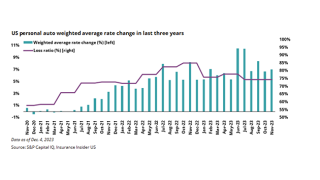

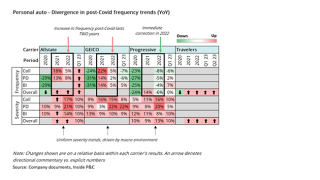

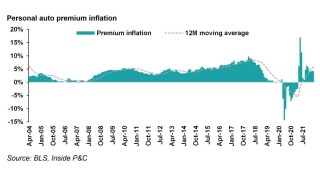

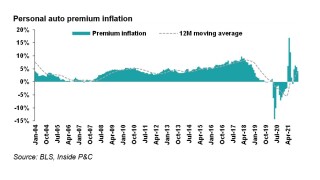

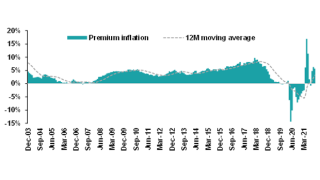

Premium inflation holds, as loss-cost inflation trends continue to moderate.

-

A January freeze saw temps drop to close to -50°F.

-

The CPI all items index was at 3.2%, from 3.1% in January.

-

Commercial lines difficulties continue to weigh down industry results.

-

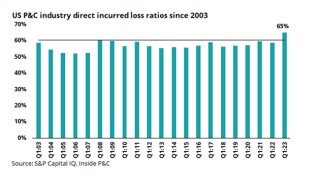

Sizeable investment returns masked 10-year high underwriting losses.

-

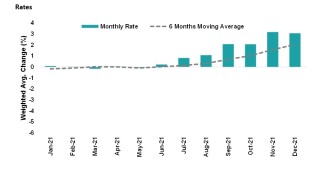

Personal lines rate filings are rising, even as some inflation drivers slow.

-

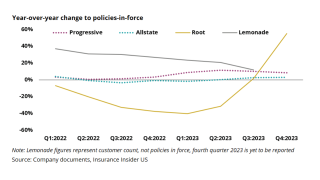

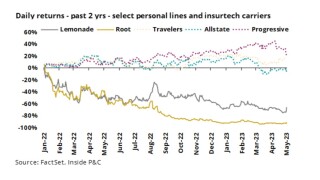

Root’s improved results make it an attractive acquisition, not a comeback story.

-

Personal auto rates increased 19% during the year.

-

The InsurTech’s shares gained over 50% in value on Thursday.

-

The company posted favorable development in the last quarter of 2023.

-

CSAA writes over 70% of its business in the Golden State.

-

Auto-related CPI values continue to drop, while premium inflation hits new highs

-

The CPI all-items index moderated to 3.1%, vs a 3.4% YoY rise for December.

-

The changes will be up for discussion at a March 26 public hearing.

-

The Manheim Used Vehicle Value Index dropped 9.2% year-on-year, to 204.0.

-

A Branch spokesperson cited persistent inflation as a “significant challenge for home and auto insurance companies” and the reason for the staff reductions.

-

December’s increase was an acceleration from 19.2% in November and October, with the CPI all-items index up 3.4% vs a 3.1% YoY rise for November.

-

“The spring bounce was much more pronounced than expected in 2023, and prices slid just as rapidly after that bounce, finishing more calmly in December as expected,” said Cox Automotive’s Jeremy Robb.

-

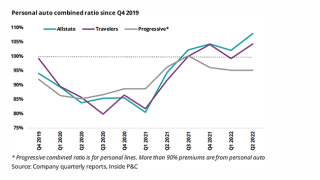

Cooling CPI metrics and improving loss ratios indicate a positive shift for the personal auto industry, but results are not yet back to where they need to be.

-

It is understood that the cuts are based on a review of five-year loss ratios, and that agents above 70% will be impacted.

-

Medical care prices – an indicator of medical inflation, a key input to long-tail loss costs – were up 0.2% YoY, after an 0.8% drop for October and a 1.4% drop for September.

-

The ratings agency also downgraded carrier’s Long-Term Issuer Credit Ratings (Long-Term ICR).

-

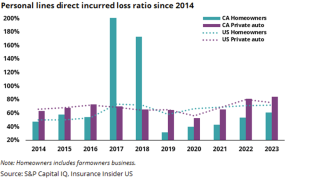

Personal auto carriers risk falling behind in the battle between loss costs and approved rate declines, while homeowners carriers’ double-digit filings might not be enough to keep up.

-

While November’s decline was only slightly less than October’s, the move lower was on Manheim's radar, given the typical seasonal downward trend that paused in August and September.

-

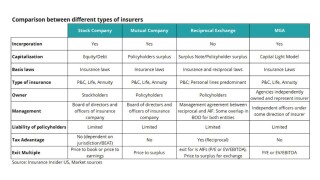

Reciprocals have been cropping up more recently, with a shift toward cat-exposed lines, giving investors a quick way to tap into the hard market with an expectation of a rich multiple at exit.

-

The ratings agency cites ongoing deterioration in results for personal auto and homeowners’ lines, along with rising loss costs, driven by inflationary pressures.

-

The Insurance Insider US Research team walks buyers through valuation considerations for InsurTech MGAs, as capital constraints point to further consolidation.

-

Slowing loss cost trends may signal relief ahead, but only if carriers remain vigilant on rate action until we are past the peak.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This month marks a reversal in the pace of inflation for the segment, after auto insurance prices moderated to 18.9% in September from 19.1% in August.

-

Kemper’s current results and historical trends suggest continued difficulty and remains a TBD story.

-

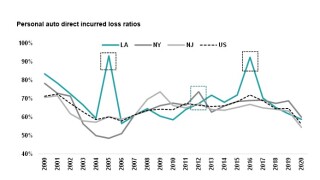

Three states — California, New Jersey, New York — were responsible for adding five points to YTD combined ratio for 2023.

-

The company also plans to ramp up its media spend in 2024 after having significantly slashed advertising budgets earlier this year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Loss costs trends continue to increase in both physical damage and bodily injury coverages for nearly all of Progressive’s commercial auto products, CEO Tricia Griffith wrote in a quarterly update.

-

The cuts amount to roughly 2% of the insurer’s US workforce.

-

Ahead of third quarter earnings, many personal lines insurers are pulling several levers to right-size their operations, including conducting layoffs and reducing exposure.

-

The company expects a net loss of between $140mn-$150mn for the quarter and a net operating loss in the range of $25mn-$35mn.

-

Data shows Texas developments parallel some of the trends in other troubled states, but it is heading in from a stronger position.

-

From 2020 to 2023, P&C replacement costs increased by 45% on average, whereas inflation for the overall US economy increased 15% within that same period, though the forecast expects that to change.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Pricing, reserves and uneven catastrophe losses will be the theme this quarter.

-

On a year-on-year basis, the all-items index for September increased 3.7% before seasonal adjustment.

-

This is the second downgrade faced by State Farm and its subsidiaries from AM Best in the last month.

-

US commercial and personal auto insurer claim payouts combined were up between $96bn and $105bn for the period from 2013 to 2022.

-

Rating agency cites elevated underwriting results from convective storms, cat events in core states of operation.

-

This is the second month motor vehicle insurance prices have risen, following a 17.8% hike in July and a 16.9% increase in June.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The overall CPI rise in July was up by 0.2 points month-on-month from June, marking a reversal of the downward trend that started in June 2022.

-

All policies will be non-renewed or canceled in accordance with state regulations, according to an announcement released ahead of the company’s Q2 earnings call on Monday.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier is set to achieve 20% rate increases in auto this year, with the same rate increase likely to be needed in 2024 to achieve its 2025 targets.

-

Progressive has now reported three consecutive months of adverse development. The Inside P&C Research team takes a closer look.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Pricing, catastrophes and rising costs are headwinds for this quarter’s insurer results, but brokers should be buoyed by continued inflation.

-

Following media reports last week that AAA had plans to pull out of the Florida insurance market entirely, the home and auto carrier "set the record straight” on Monday.

-

It was the largest daily drop Progressive stock has experienced since August 2008.

-

Sources said the Japanese insurer will pull back from the California personal auto market in June 2025 as it is set to exit the state’s admitted personal lines market on June 1, 2026.

-

Motor vehicle insurance price increases moderated to 16.9% from 17.1% in May, while the all-items CPI slowed to 3.0% from 4.0%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The decision applies only to policies issued through the company’s exclusive agency distribution channel.

-

The capital injection comes over a year after Sigo Seguros raised $5.4mn in its seed funding round, co-led by Listen Ventures and Chingona Ventures.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The drop was among the largest declines in the index’s history and the largest since the onset of the pandemic in April 2020.

-

Personal lines underperform predictions, while brokers and InsurTechs are a positive surprise (for now).

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The fundraising includes $80mn of convertible preferred equity, which closed on June 23rd, as well as $25mn of long-term debt financing for Hagerty Re.

-

Used car and truck prices declined 4.2% year on year in May, while new vehicle prices rose 4.7% in the period.

-

This marked the third month-on-month drop in 2023.

-

Recently released statutory data shows the US P&C industry loss ratio touching the 65% mark, the highest level in two decades.

-

The loss for the month was 60% comprising losses from two wind and hail events.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

April auto insurance premium data showed the second highest YoY change in more than 20 years.

-

InsurTech carriers pivot to profitability vs growth.

-

All eight major market segments had seasonally adjusted prices that were lower year over year in April.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Industry reserve releases mask adverse development trends, particularly in personal lines.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Although year-over-year headline CPI has decreased a bit, CPI levels pertaining to insurance are on the rise.

-

This comes as the all-items consumer price index showed only a 5% gain.

-

The private broker said replacement cost values in the homeowners' sector will also go up this year to offset increased construction costs and inflation.

-

Root’s challenges generate lessons for other InsurTechs, as its stock value crash leads to a management exodus, and the banking collapse dries up funding needed to balance cash burn.

-

The new 2022 stat data shows personal lines premium has grown year-over-year, but the loss ratios have been hit hard by catastrophes and loss cost inflation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

2022 statutory data is now available, and results show winners and losers

-

Sentiment scores across US P&C segments dropped sequentially in Q4, though InsurTechs bucked the trend.

-

Rate action for personal auto insurers has been increasing in 2023 to balance rising loss cost trends

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Tesla understands the data-driven nature of insurance and is looking to grow its auto insurance exposure, but the focus is on cars first

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Lemonade and Root both reported strong Q4 results, but will need to execute plans to near-perfection to turn things around.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In tandem, the ratings agency affirmed its "A" issuer credit and financial strength ratings on Farmers and its core operating subsidiaries.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This compares to a 14.2% annual increase in auto insurance prices in December, while the overall index slightly moderated to a 6.4% gain from 6.5% in December.

-

If January’s trends are any indication, the next step for Florida’s plaintiff attorneys will be to redirect their efforts to another piece of the market.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Manheim Vehicle Value Index increased 0.8% in December.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

For the same period in 2021, the company reported a combined ratio of 98.9%.

-

Poor macroeconomic conditions loom, but reinsurers, brokers and personal lines carriers are expected to share positive results.

-

The uptick compared with decreases of 0.3% in November, 2.2% in October and 3% in September.

-

InsurTechs use of “me-too” filings and competitor rates have us wondering, where is the innovation?

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C walks you through the highlights of 2022.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The annual increase represents the smallest 12-month increase since the period ending December 2021.

-

Though Carvana’s financial situation might cause InsurTechs to think twice about an embedded partnership, the auto dealer’s woes could lead to an easing of loss cost pressures for personal auto insurers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Manheim Vehicle Value Index declined 14.2% year-over-year to 199.4, dropping below 200 for the first time since August 2021.

-

InsurTechs’ mounting losses and continuing cash burn combined with reinsurance market hardening could spell trouble for the sector.

-

While Allstate may be beyond the worst of the reserve charges, execution of initiatives needs to go smoothly for it to get back on track.

-

The company paid out $1.63bn for physical damage claims in the first nine months of the year, which exceeded earlier projections of $1.33bn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Third-quarter statutory data reveals premium growth, worsening loss ratio because of increased loss cost trends and Hurricane Ian.

-

Our Trump/Biden note from yesterday discussed the rotation from growth stocks to value stocks playing out over 2022. Unfortunately, insurance technology stocks have had it the worst, with Lemonade stock down 49%, but still doing relatively better than Root (down 86%) and Hippo (down 80%).

-

Though still significantly elevated, the CPI appears to have peaked in the short term, which may give carriers a chance to catch up on rate.

-

The company retained $10mn of $27mn in gross losses from Ian, which accounted for 3.4 points on the loss ratio.

-

Medical inflation – a key input to long-tail loss costs – increased 5.4% year on year but declined 0.5% from September to October.

-

Management said there are early signs that inflationary pressures – which have pushed severity in personal auto in recent months – are easing.

-

The decline was smaller than previous months, with September clocking in at 3% and August's decline at 4%.

-

Progressive’s superior digital distribution and widening auto margins put it far ahead of the competition.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm reported better than anticipated earnings factoring in Ian, but a slowing economy could cloud the outlook.

-

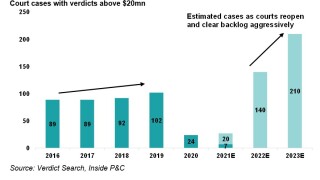

A challenging legal atmosphere and drift in loss cost components add difficulty to the task of tallying ultimate losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In August, the CPI moderated to 8.3% compared with a record high of 9.1% in June.

-

Hurricane Ian, interest rate impact and the cooling economy will be the main themes this earnings season.

-

The Manheim Vehicle Value Index declined to 204.5, showing signs of returning to prices from a year ago, down 0.1%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Auto insurers look set to generate a larger share of losses than with most US wind events.

-

KCC has added a loading for litigation costs to the storm loss estimate for the first time.

-

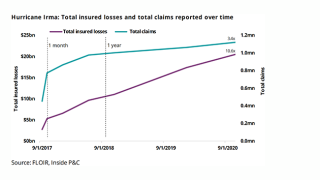

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Claims analysis shows slow reactions to negative trends can affect several quarters, but carriers who emerge strong will be able to pursue growth faster than the competitors who are always playing catchup on loss cost trends.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

August’s overall consumer price index edged up 0.1 points, after no change in the prior month.

-

The ratings agency said the downward revisions reflect inflation, rising loss cost severity, higher reinsurance costs and other challenges.

-

Used car prices in August fell further, down 4% from July, according to auction house Manheim’s monthly market report.

-

This compared with a $11.4bn loss in the first half of 2021, the report said.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Turcotte, CFO since 2008, was part of the leadership that took the company public in December.

-

The Manheim Used Vehicle Value Index declined to 211.6, up 8.8% from a year ago but showing a gradual decline after reaching a January peak of 236.3, except for an increase in May.

-

The company delayed once again the launch of its partnership with State Farm to the first half of next year from Q4.

-

The motor vehicle insurance index rose 7.4% year on year that month, from 6.0% in June, while the annual gain in all-items CPI dropped to 8.5% from 9.1%.

-

The personal lines insurer’s results were also impacted by the states’ regulatory climates and inflationary trends.

-

This is the second monthly decline after May and a sign of continued moderation after the index reached a peak in January.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Rate actions during the quarter was better than expected, said CEO Joseph Lacher.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

For domestic automobile, renewal premium change was 6.3%, up a full three points from the first quarter of 2022 and the carrier expects the increases to continue.

-

The company also said it expects a $408mn reserve charge, including $275mn related to personal auto and $91mn recorded for commercial auto.

-

The cost of a new car gained 6% last month.

-

Tesla Insurance debuted against a backdrop of regulatory hurdles and EV market competitors.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Used car prices are on a general decline this year but the impact on personal auto insurers is yet to be seen.

-

Aon said supply chain disruptions are easing, shipping costs are receding and building materials and vehicle pricing are decelerating.

-

Tesla’s entry into the insurance market presents the firm with both opportunities and risks.

-

The companies have received approval from the Department of Justice under the Hart-Scott-Rodino Act and are awaiting other required regulatory approvals.

-

Although P&C insurers had 9% premium growth, the underwriting loss in 2021 follows a $4.4bn underwriting gain in 2020.

-

The medical care index increased 0.4% month over month (in line with April's increase) and 4% versus May 2021.

-

The firm’s emphasis on charitable giving has enabled a differentiated narrative, but the $4mn given is dwarfed by $345mn of insider selling.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The trend of inflated severity has been evident in the Q1 results of personal lines carriers including Kemper, Progressive, Berkshire’s Geico, The Hanover Group and Allstate.

-

For the month, motor vehicle insurance costs rose 0.8%, compared to 0.7% in March.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In an earnings call with analysts, the CEO said Hagerty was still on track to “get the relationship up and running” this year.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive noted in her shareholder letter yesterday that loss costs on average were up almost 18% from the same quarter last year.

-

The meeting highlighted economic challenges and left questions about future acquisitions after an eventual management transition.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In response, the carrier has completed over 50 auto filings with an average rate increase of 6.2% in recent months.

-

The commercial lines bellwether reported positive quarterly earnings, but challenges may still be ahead.

-

March’s CPI report shows elevated inflation levels, including vehicle CPI of 10.5% and average used car price increase of 24.7%.

-

This brought the Manheim used vehicle value index to 223.5, an increase of 24.8% from a year ago.

-

InsurTech Sigo Seguros has raised $5.4mn in its seed funding round, co-led by Listen Ventures and Chingona Ventures.

-

Paid-to-incurred trends have remained flat compared to past cycle turns, and firms have reacted quickly.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The insurer plans to take more rate throughout the year.

-

The more important driver of past downswings in loss costs has been unemployment.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.)

-

The firm reported quarterly earnings featuring disappointing personal auto loss cost trends.

-

The firm is an outlier on the negative side both in its state mix and the speed of its rating actions.

-

The change in outlook comes after Kemper reported a $257mn UW loss for Q4, its third straight significant negative underwriting result.

-

The merger proposal was supported by at least 95.9% of the votes cast at during a special meeting of stockholders on Tuesday.

-

The carrier is seeking to combat a return to pre-pandemic claims frequency and surging claims severity.

-

The offering includes auto repair shops, auto body shops, car washes, oil change stations, tire shops and auto parts stores.

-

The educator-focused carrier’s underwriting income plunged to $0.3mn from $16mn last year.

-

The firm reported encouraging quarterly earnings, but social inflation and other challenges still loom.

-

The president of the newly listed car company outlined the MGA’s scope for growth, appetite for M&A, and addressed the question of whether it could go full-stack.

-

The latest report shows even higher inflation pushing up severity, forcing carriers to take rate.

-

Although auto insurance rates dipped briefly, the average rate whipsawed 3% since 2020 and up 26% since 2011.

-

Data from Apple and Google show that Omicron has slowed the return to driving in some of the largest states by premiums.

-

The business unit will offer new products, including Hagerty Valuation Tools and DriveShare, designed for buying and selling collector cars.

-

Commercial lines loss ratios may move slightly higher, while personal auto carriers see the light at the end of the loss-cost tunnel.

-

The monthly CPI report shows that inflation continues to push severity higher as carriers take rate in response.

-

Just over a quarter of shareholders voted to redeem shares as Aldel Financial took classic car underwriter public.

-

The classic car underwriter will use the proceeds from its most recent fundraise to spur organic growth, and invest in data, technology, and geographic expansion.

-

The Traverse City, Michigan-headquartered MGA began training Friday after a merger deal with SPAC Aldel Financial, valuing the business at around $3.1bn.

-

The classic car MGA had previously agreed on a SPAC merger deal with Aldel Financial.

-

the executive will oversee the MGA’s growth strategies, business planning, partnerships and execution, reporting to president of insurance Jack Butcher.

-

The Ohio-based InsurTech is also adjusting its prices models to expand modeled coverages and improve segmentation.

-

Inflation remains elevated as auto carriers take rate to mitigate the ongoing uptick in severity.

-

The auto InsurTech blamed the higher loss ratio on an industry-wide spike in frequency and severity trends, larger inflationary pressures and an increase in miles driven.

-

Lemonade expects that Metromile will be a key to run faster through a competitive auto insurance market while assuming fewer risks on the road.

-

InsurTech shares trade mixed in response to Lemonade-Metromile combination.

-

Lemonade CEO Daniel Schreiber told analysts that the Metromile acquisition will put the InsurTech “at the vanguard of car insurance”.

-

Lemonade will acquire Metromile in an all-stock transaction that implies a fully diluted equity value of approximately $500mn.

-

Fronting carrier Obsidian Insurance has signed a deal with InsurTech MGA Loop to launch a new personal auto insurance product powered by artificial intelligence, Inside P&C has learned.

-

Personal lines giant Allstate is increasing rates for its auto insurance business in response to rising loss severity that has hit the segment, the firm’s CEO Tom Wilson said.

-

The personal auto product enables customers to bundle car insurance with home, pet and life policies.

-

The executive said Progressive was taking steps to address “persistent underperformance” in its property segment and emphasized the need to avoid concentrations of risk in areas with significant catastrophe exposure.

-

Excessive speed and distracted driving are among some of the monsters scaring drivers and passengers this spooky season.

-

Capping the firm’s positive quarterly results, Travelers noted a strong but moderating rate in the business insurance segment in a positive read-through for commercial lines carriers.

-

PIF growth is slowing as the firm sees worsening loss-cost trends, and this quick response will likely allow it to outperform peers again.

-

Premium inflation is up but remains flat compared to 2019 despite loss-cost trends, suggesting further rate action from carriers.

-

The Aon claims platform incorporates tech that can predict attorney involvement and subrogation risk for auto claims.

-

Auto insurance claims costs are sharply rising in 2021, as Americans embrace risky driving behavior following a brief decline in miles driven in the early days of the COVID-19 pandemic, APCIA said in its latest report.

-

The automotive company’s total costs for the recall are expected to eventually tally up to around $1.8bn.

-

Ida soaks the tri-state – and has the potential to affect personal auto carriers more than comparable storms of the past.

-

Texas’s objection to Progressive’s recent rate filings garnered attention, calling rates “excessive” and suggesting rebates instead.

-

The InsurTech intends to use the new paper to accelerate the growth of its “next-generation” insurance offerings in the automotive fields.

-

The classic car insurer is expected to trade under the ticker HGTY.

-

What's next for the firm after posting poor results and cutting guidance?

-

Inflation drags on another month, frustrating the recovery and challenging the P&C industry.

-

The InsurTech has revised its guidance and plans to shrink its book in Q4.

-

July CPI data show first decline in auto premiums since December, but prices overall continue to rise.

-

The company’s combined ratio rose by 5.9 points to 95.7%, as lower second quarter catastrophes and a better expense ratio helped mitigate the impact of the higher attritional loss activity.

-

Homes and vehicles were damaged as flash floods washed across Utah in a weekend deluge.

-

NTUM is to complement Amwins’ transportation underwriters and help spur regional growth.

-

Social Inflation could rebound faster than expected and disrupt the industry's narrative on margin expansion.

-

McKee sided with the ACPIA, who have opposed the legislation due to the potential for raised costs.

-

Progressive’s June results point to worsening underlying trends for personal auto carriers.

-

The Florida Office of Insurance Regulation asked insurers to report virtually every type of policy in effect at the 12-story Champlain Towers South.

-

It may take a few more months for personal auto carriers to see the full extent of the impact.

-

The price rise, which pushed the CPI motor vehicle insurance index up 1.2%, was below the 16.9% rise the Bureau of Labor Statistics reported in May.

-

Logan McFaddin, a lobbyist for the APCIA, applauded the governor's use of his veto over legislation.

-

The personal lines giant's best approach to growth may be sticking to its proven strengths.

-

The deal combines the two major mobile telematics companies, which will now cover 21 of the 25 top US auto insurers.

-

The personal lines giant's results are showing a reversion to pre-pandemic trends.

-

The start-up recently announced its move into the $300bn auto insurance market, adding to its life, health, renters, homeowners and pet health offerings.

-

Personal auto carriers lowered rates in response to 2020’s loss cost trends, but chasing market share now could be a mistake.

-

Consumer Price Index data points to short-term and long-term risks to the P&C industry.

-

Root has been mentioned seven times on Reddit message board WallStreetBets in the last two days, with many comments noting the significant short seller interest in the stock.

-

Discovery has spent a decade pioneering telematics in the South African auto market, devising a system based on incentivizing good driving using “gamification”.

-

SafeAuto provides auto insurance in 28 states and wrote around $335mn in direct written premiums in 2020.

-

CPI surged to 4.2% in April, levels not seen since before the Global Financial Crisis.

-

Activist investor Carl Icahn now owns $400mn of Allstate shares.