-

The Japanese P&C carrier agreed a deal to buy 15% of WR Berkley shares in March.

-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The investor offloaded nearly 100,000 Allstate shares in Q3, according to its latest 13-F.

-

The $21/share pricing falls in the middle of the expected range.

-

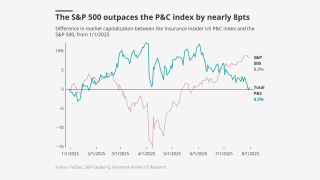

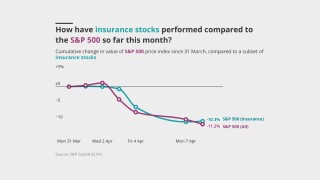

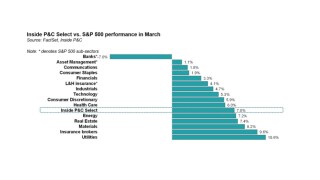

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

The selloff may hint at headwinds for equity investors.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

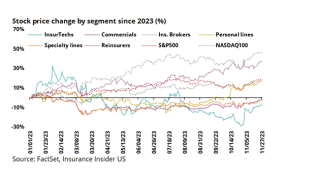

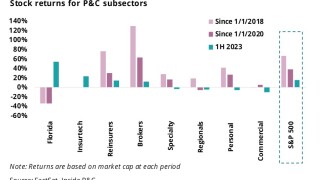

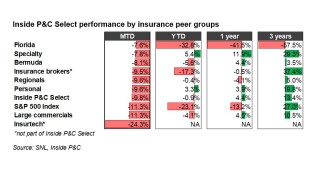

Industry stocks were firmly behind the S&P 500 in Q3.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The S&P 500 outperforms as P&C tumbles on mixed earnings.

-

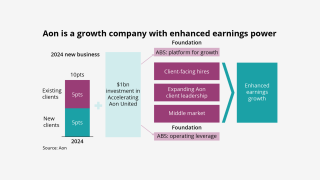

The president expects to see benefits from the deal in H2 2026.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

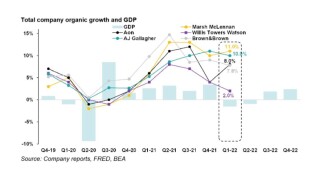

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

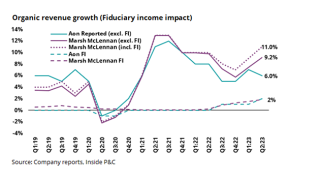

The broker posted a 6.5% drop in organic growth YoY.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

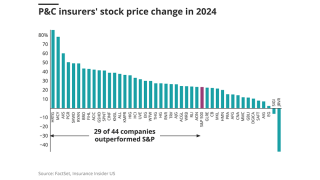

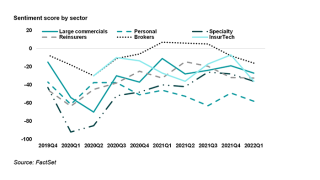

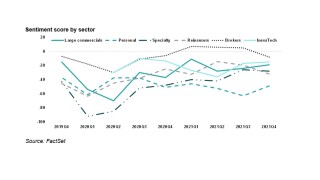

P&C’s outperformance lead dwindles, while specialty rises above other segments.

-

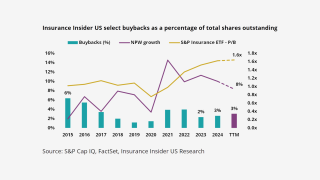

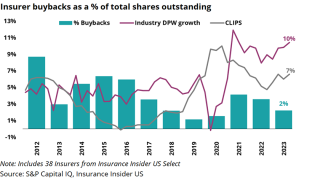

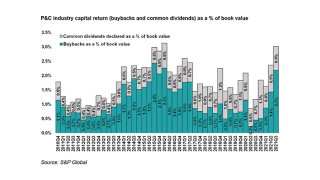

Additional buybacks are more feasible if P&C stocks slip and pricing moderates.

-

Above-market organic growth, mid-market M&A and talent infusions were all heralded.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

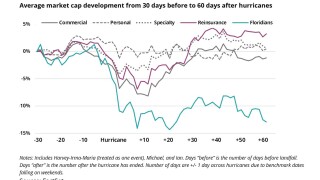

The latest update brings the agency’s combined estimate for Milton and Helene to $32.4bn.

-

Insurance outperformance slows as markets recover from tariff shock.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

The bond will provide named storm and quake coverage in the US.

-

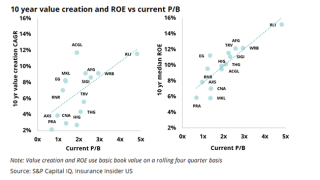

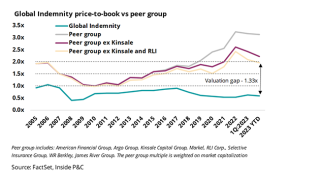

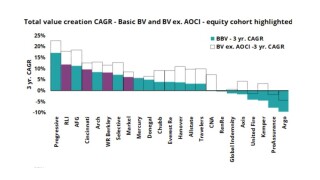

Unpacking how much excess capital there really is and dissecting the source of its returns.

-

The program will succeed the previous buyback launched in 2023.

-

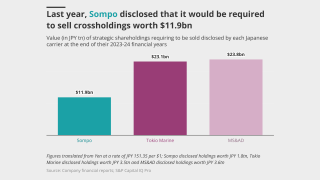

The conglomerate’s insurance subsidiaries will have to make do without some of their prior strategic advantages.

-

P&C held up better than the S&P 500, but there are causes for longer term concern.

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The state insurer of last resort is set to purchase $2.89bn of reinsurance this year.

-

Inflection sets in for insurance stocks as macro albatross gets heavier.

-

Macroeconomic volatility could also create top-line headwinds.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

The program will provide excess casualty coverage across a broad range of industries.

-

The business will still look at large non-life deals in particular in-the-money ADCs.

-

The investment recovery will be welcome but Chinese tariffs will contribute to loss-cost inflation.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

The announcement spurred a quick spike in stock market valuations.

-

Trade credit and marine are among the lines facing direct impacts amid a broader inflationary challenge.

-

Markets have taken a battering across the globe following the “Liberation Day” announcement.

-

Insurance’s demand inelasticity will be its greatest strength in 2025.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Insurance share prices were resilient amid today’s market meltdown.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.

-

Total reinsurer capital grew by $45bn in 2024 to $715bn.

-

The company’s stock jumped 14% within 30 minutes of the market’s open.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

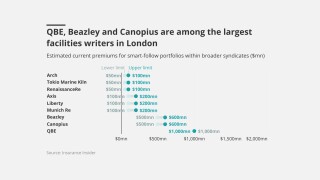

Industry sources estimate the market to be around $3bn.

-

The insurance market remains generally immune to tariff uncertainty, but not all is well.

-

The big brokers are lining up London capacity to write follow lines on US risks.

-

On Monday, the firm reported a Q4 CoR of 155.1%, versus 98.1% a year ago.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

Jana holds around 109,000 shares and 69,000 call options, at a $307mn total value.

-

The loss aggregator has classified the fires as two separate events for reinsurance purposes.

-

Insurance stocks are lukewarm amid earnings season, cats and political changes.

-

The board will lead the review following feedback from shareholders including activist investor Jana.

-

The PE firm held over 6.7 million Axis shares, around 8.2% of shares outstanding.

-

The carrier’s Q4 operating EPS declined to $0.41 from $0.77 in Q4 2023.

-

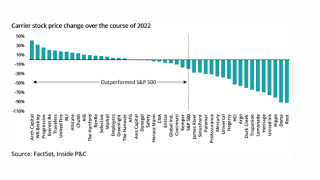

Most insurers outperformed the S&P 500 last year, but the trend is unlikely to continue.

-

The company’s stock price has plummeted in the wake of the LA wildfires.

-

In June 2023, Hale Partnership got its license from the Cayman Islands Monetary Authority for HP Re.

-

The state insurer is budgeting for an extra 43% of overall coverage in 2025-26.

-

The 2025 target would be ~25% larger than the $3.56bn it placed for 2024.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

The firm had owned 3.45 million shares in Q2, then valued at over $256mn.

-

Multiple reinsurance brokers have pitched the firm for sidecars.

-

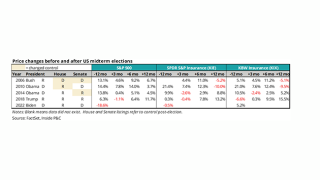

Republican tariffs and higher Democratic corporate taxes would hurt the sector.

-

The stock was hovering around $40 per share just before closing.

-

The loss tally is considerably lower than estimates issued by model vendors.

-

The Floridian insurer anticipates that it will remain profitable in Q3 and Q4 despite hurricane activity.

-

Grandisson's sudden retirement could mean a complicated future for Arch.

-

Milton’s significant but less-than-expected hit shifts our expectations for industry recovery.

-

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

The raise includes minority investments from Nationwide, Enstar and others.

-

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

The move comes less than a year after AssuredPartners’ sale process reached a stalemate.

-

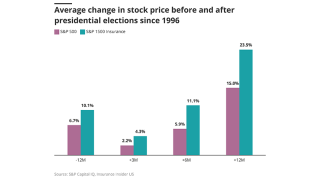

While Republicans are typically perceived as best for business, there are several factors at play.

-

The move comes just days after the Warren Buffett-controlled conglomerate reached the $1tn market cap mark for the first time.

-

Westaim reported roughly $79mn in net proceeds from the sale.

-

Reagan Consulting has been retained to advise the ~$125mn Utah-based brokerage.

-

The conglomerate now owns around 27 million Chubb shares valued at roughly $6.9bn, compared to nearly 26 million in Q1.

-

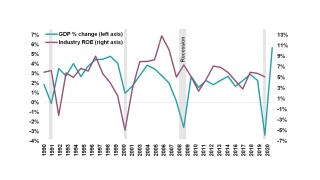

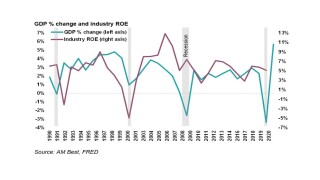

The industry could weather a recession, unless loss costs and reserving pressures worsen.

-

S&P’s Insurance Select industry index had fallen by 2.7% at market close.

-

The funds were contributed to support the specialty carrier’s growth.

-

BHMS joins a group of Boost backers that includes Markel, Canopius US and management.

-

With the deal, 1970 secured capital to boost its liquidity management services for insured companies.

-

The Hartford and Aon also posted notable, though more muted, stock bumps.

-

Travelers and Selective’s releases point to ongoing reserving challenges this earnings season.

-

The news follows a string of deals that the stop-loss segment has seen in recent months.

-

The carrier’s CoR increased 15.9 points YoY to 116.1% on unfavorable GL development.

-

Longstanding investor Stone Point will continue as a partner and board member.

-

It is understood that the company expects to launch its Florida reciprocal in Q4.

-

Stable first half insufficient to counterbalance concerns on reserving trends.

-

Sources said the deal between the PE firms valued the broker at in excess of 16x Ebitda, or $4bn+.

-

It is understood that the goal is to use a capital injection to form a reciprocal.

-

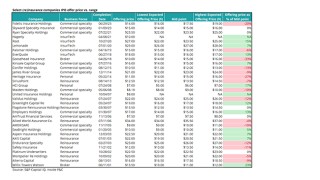

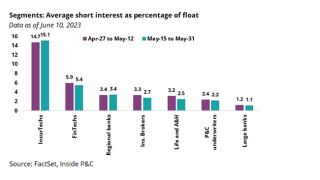

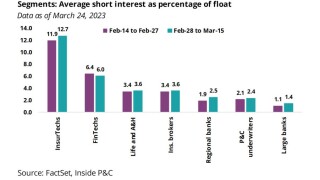

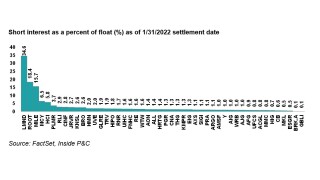

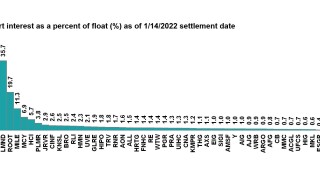

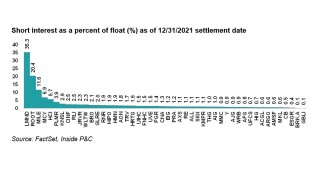

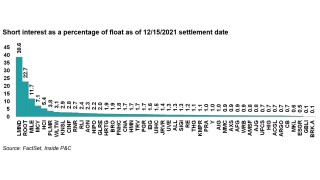

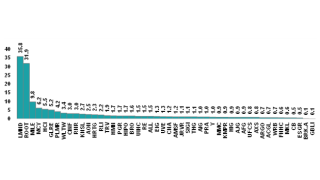

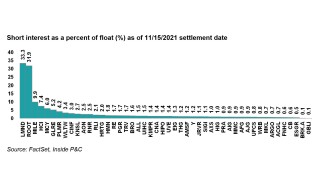

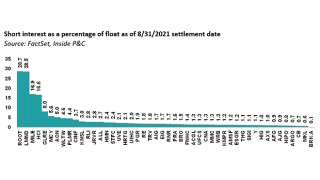

Investor skepticism visible in stock prices and short interest data over first half of 2024.

-

Insurance Insider US recently revealed the parties were in advanced sale talks.

-

The executive gave his view on the (re)insurance landscape and the impact of PE on the sector.

-

In January, this publication revealed that the Southern retailer retained Piper Sandler to run an auction to bring in a new PE investor.

-

Onex has proposed an alternative sale structure, which includes R&Q’s potential liquidation.

-

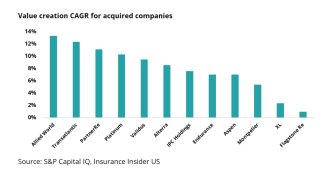

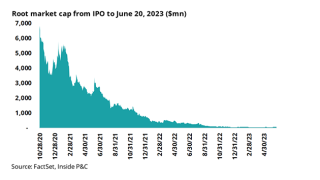

Analysis of company performance post-IPO shows varying trajectories over time

-

The company increased its full year 2024 adjusted net income guidance.

-

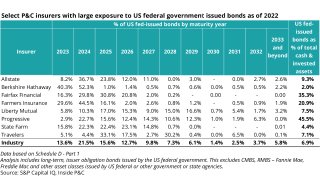

Changes in investment strategy and strong results show carriers can weather financial storms.

-

The proposals include increasing either statutory or CRTF funds.

-

The start-up's founder set out the new broker’s strategy, M&A goals and structure.

-

PE house Vistria will back the buy-and-build strategy in the independent agency space.

-

The $6.7bn Chubb investment is an outlier in the Berkshire portfolio.

-

Citizens also secured $1.1bn of limit for its Everglades Re cat bond.

-

The conglomerate exited its $620mn position in Markel, which it has held since 2022.

-

An overview of Q1 earnings shows upsides, but also plenty of concerns going into the rest of 2024.

-

New leaders of these reinsurers have started strong, but Axis still has work to do.

-

The broker’s opening price on Friday was $272.10 per share, versus Thursday’s closing price of $306.

-

Earlier today, the carrier reported that its Q1 combined ratio came in at 88.8%, down from last Q1’s 90.6%.

-

Sources said Piper Sandler will run the auction for the CIVC-backed firm.

-

P&C buybacks have continued to decline, but large authorizations keep companies flexible.

-

It is understood that the company aims to launch in Q3 or Q4 of this year.

-

Sources said the process will target buyout firms and will not be open to trade bidders.

-

Hiscox, Intact Ventures, Weatherford and RPM Ventures participated in the fundraise.

-

Shares had fallen over 20% since Monday.

-

James River is suing Flemming Intermediate while a potential sale of the company is ongoing.

-

This publication revealed that the company was raising capital earlier this year.

-

The InsurTech’s shares gained over 50% in value on Thursday.

-

SEC filings show that Travelers’ equity ownership was valued at over $107mn in Q4.

-

The company would ideally like to target a minority investment.

-

Enstar acquired 637,640 shares of James River in Q4 last year valued at nearly $6mn.

-

The company provides a platform for brokers to value, buy and sell books of business.

-

The company will hold its Q4 earnings call on Friday February 16.

-

The company's reinsurance panel has expanded to over a dozen risk capital providers.

-

Intact Ventures, Era Ventures, Greenlight Re and Spark Capital also participated.

-

Commercial carrier earnings continue to show mixed prior-year development.

-

Last year, this publication revealed that TPA SCM and Rimkus launched sales processes.

-

Markel, Axis and Selective booked sizeable reserve charges in their liability segments.

-

It is understood that the InsurTech began fundraising late last year.

-

Axis’s reserve cleanup removes longstanding overhang and narrows the credibility gap.

-

On Wednesday, the insurer reported 12% growth in net written premiums.

-

Sources said that the retailer will be marketed off an Ebitda of $40mn-$45mn, pointing to a potential valuation in the $650mn-$750mn range.

-

Participating in the funding round were Caffeinated Capital, Altai Ventures, Zigg Capital, 8VC, Buckley Ventures, Habitat Partners and Arch Capital.

-

The Aspen IPO provides an opportunity to benefit from the specialty market without commensurate prior-year reserve risks due to an LPT cover.

-

The agency said TRUE’s ratings will remain under review until there is additional clarity surrounding a new business plan.

-

TRUE will use the capital injection to provide underwriting capacity in Florida “at a crucial time” and to expand its footprint nationally, according to a statement.

-

A more consistent trading rhythm returned to the property market, with capacity deployment outside of frequency-exposed layers and more heavily loss-impacted segments bouncing back.

-

Insurance Insider US dissects the largest and hottest deals of the year across broking, reinsurance and other segments of the industry.

-

The deal’s consideration consisted of a cash payment of $119mn and the 13.5% equity interest that Enstar held in Northshore, the parent of Lloyd’s underwriter Atrium.

-

Leading the decline was AJ Gallagher, with a 7.5% drop as of mid-afternoon, after having traded down over 8% earlier in the day.

-

Earlier this morning, SiriusPoint announced it had been informed that major shareholder CMIH had been taken into private receivership by lenders in Singapore.

-

The suspension of Global Indemnity’s effort to sell its E&S arm is likely specific to the franchise rather than an indicator of a dealmaking slowdown.

-

Sources said the Gemspring Capital-backed group retained investment bank Baird earlier this year as adviser in the sale process.

-

The lawsuit, filed Thursday on behalf of Clear Blue and its subsidiaries, alleges that Aon conducted insufficient due diligence on the ILS InsurTech.

-

A quick roundup of this week’s biggest stories.

-

The latest short interest data shows continued pessimism on InsurTechs and Florida insurers.

-

The fundraise was led by Golub Capital and jointly arranged by Antares Capital, both existing lenders to Patriot Growth.

-

This latest funding round brings total committed capital for the collateralized reinsurer to $75mn.

-

In addition to Lightyear’s capital injection, current backer BHMS agreed to roll a material portion of its existing equity and made an additional investment alongside Lightyear.

-

The offering sold 3.6mn shares priced at $30.50 apiece and brought in approximately $104.9mn.

-

Amynta Ease-of-Business president Arthur Seifert said he expects MGAs to move away from the popular Dutch auction process and instead find one party that’s a good fit.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

SEC filings show that, in Q3, the activist shareholder liquidated its remaining 508,880 shares in WTW — worth around $120mn at the end of Q2.

-

With the fundraising, Skyward will capitalize on market opportunities within existing lines of business, but also continue to expand into new products.

-

Last month this publication reported that the 777 Partners-backed company was close to signing a deal with Charlesbank.

-

James River’s stock price plummeted more than 30% on Thursday, after the firm sustained downgrades from equity analysts over concerns around the insurer’s E&S casualty reserves.

-

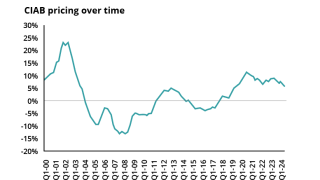

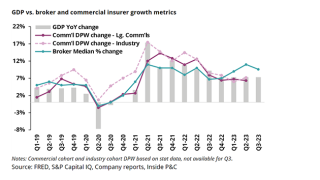

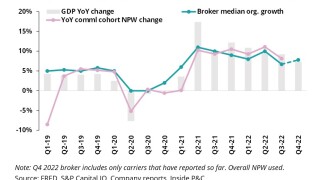

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

The challenging funding environment has left InsurTechs with limited options for capital raising and liquidity.

-

The pendulum that swung towards a focus on growth for the past few years is now swinging towards profitability and increased partnership.

-

The Bermudian firm said it expects the acquisition could drive more growth than the prior forecast of $2.7bn incremental premium.

-

In 2021, SiriusPoint acquired a “significant ownership stake” in the firm, which meant the specialty insurer and reinsurer providing multi-year capacity and paper to the ILS house.

-

Will this year be a repeat of a shift from “growth at all costs” to “flight to quality”, or will we see the InsurTech space bounce back in the direction of 2021 optimism?

-

As of 14:00 ET, the broker’s stock stood at $232.24 per share, 11.9% higher than the previous close of $207.74.

-

The new business unit will target firms with between $10mn and $50mn of Ebitda and will deploy up to $500mn of equity capital over time.

-

Sources said the PE heavyweight shelved the stake sale plans earlier this year as multiples in the adjusting segment remain under pressure.

-

White Mountains’ final stake could range between 62%-81% of Bamboo, and the Bermudian’s investment in connection with the deal could be around $246mn-$323mn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

First-round bids for the company were due in late September.

-

The fronting carrier space is seeing increased M&A activity due to a rise in private equity interest over the past two years.

-

Backed by private equity firm 777 Partners since 2019, Sutton National booked $230mn DPW last year — up from $71mn in 2021 according to AM Best — ranking 13th among US fronting firms.

-

The carrier has suffered five quarters of losses, largely spurred on by hefty natural catastrophe losses.

-

Sources said the specialty underwriter retained boutique firm Insurance Advisory Partners earlier this year as an adviser.

-

Inside P&C’s news team brings you all the top news from the week.

-

Canopius’s investment was made as part of a broader round of financing with participation from a number of new and existing investors including RRE Ventures, Fin Capital, and IA Capital Group.

-

Now that the tides have turned from a “growth-only” to a “profitability first” mindset, companies are letting go of the additional hires and focusing on insurance fundamentals and insurance expertise.

-

Inside P&C’s news team brings you all the top news from the week.

-

A summary of commentary from the second day of Inside P&C New York, with insights on InsurTechs, MGAs and Vesttoo.

-

A summary of commentary from the first day of Inside P&C New York, with insights on capital raising, E&S and reinsurance expectations.

-

As part of the deal, PE house Corsair Capital sold its stake in the company while Oakbridge leadership and employees retained a position in the broking firm.

-

Performance overall has been good, but there have been insurance M&A missteps and its share price has lagged.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This publication revealed last month that Doxa Insurance was preparing to launch a sale process after earlier attempts to reach a bilateral deal for the Century-backed MGA platform fell apart.

-

Yesterday, Inside P&C revealed that the secondary deal takes the total equity raised to $4.1bn, with ~30% of the equity set to change hands.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Investors include IA Capital Group, Blue Bear Capital, Gallatin Point Capital, and Avanta Ventures, among others

-

After dropping out of the strategic process in the spring, Blackstone has now come in as an investor.

-

With the deal, KKR purchased over half of USI shares held by Canadian investment firm CDPQ in addition to stock from other investors.

-

The reciprocal exchange received a consent order on Friday and is expected to begin underwriting in December

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Shifting economic winds make growth plays more attractive, causing insurer stock performance to lag though short interest remains flat.

-

-

Inside P&C’s news team runs you through the key highlights of the week.

-

In a recent report titled “TFC: Primed for activist”, Wells Fargo notes investor discontent and lists pressing issues to be addressed at Truist.

-

With the deal, Goldman Sachs will join Charlesbank Capital as co-lead equity investor in the Iselin, New Jersey-based retailer.

-

The Omaha conglomerate held its ~2.1% stake in Aon valued at nearly $1.5bn and its interest of over 3% in Markel, worth over $652mn at the end of Q2.

-

The investor’s stake in WTW is now valued at roughly $120mn, while its position the prior quarter was worth around $423mn, according to its Q1 13-F filed with the SEC.

-

The Americas saw the largest fall in M&A activity over the first half of 2023.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Financial adviser Waller Helms has started contacting potential acquirers as Century Capital seeks to exit.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Sources said the private equity house is working with Bank of America and has approached institutional capital including PE firms and sovereign wealth funds.

-

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

The Bermuda-based specialist said the capital injection will boost its talent acquisition and product development plans.

-

CinFin lead the outperformers, while Aon and The Hartford's shares dropped sharply.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The company’s targeted Vescor cat bond would have provided collateral to meet auto and other obligations, but there were multiple structural points of risk for investors.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm’s statement followed allegations in Israeli tech media of missing collateral linked to deals it was concerned in.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

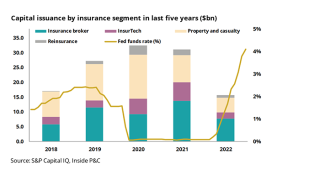

With the macro environment drying up capital streams M&A has slowed, but IPOs are reflective of pricing opportunities.

-

Personal lines underperform predictions, while brokers and InsurTechs are a positive surprise (for now).

-

After pricing below the expected range at its IPO, the Fidelis stock price slipped on the first day of trading - here's how other (re)insurance IPOs have gone since 2000.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Fidelis shares closed down from the $14 per share price set for the IPO, or a 0.8x multiple of its $17.19 book value per share at end of Q1 2023.

-

Bruce Lucas added that the company is no longer pursuing a Series B round.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The fundraising includes $80mn of convertible preferred equity, which closed on June 23rd, as well as $25mn of long-term debt financing for Hagerty Re.

-

The reciprocal’s purpose is to deliver additional US property catastrophe capacity to existing and new policyholders of Victor's subsidiary, International Catastrophe Insurance Managers LLC.

-

“Tomorrow will be a better day.” “Next year will be a better year.” “The coming decade will be when this industry realizes its true potential.” We hear the same for most public enterprises.

-

The credit facility builds on the funding Slide secured in its $105mn venture-backed Series A round, which closed in November 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This would be a premium to Root’s closing price on Tuesday of $6.02 per share, which gives the company a market value just north of $80mn, significantly below its peak of roughly $7.5bn.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

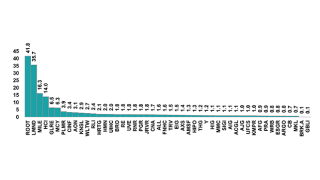

InsurTechs are still the most heavily shorted among P&C names, though they likely have been beneficiaries of a short squeeze for most of 2023.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Recent top line growth and improved performance will need to be weighed against historical underperformance at group level, but the opportunity could attract a non-traditional buyer.

-

The carrier is offering 65 million shares of common stock, out of approximately 648 million total shares outstanding.

-

Forecasts for “near-normal” activity may mean the chance at a reprieve for the Florida market, but a history of underestimates warrants caution.

-

Onex reduced its position in the wholesaler by almost two-thirds to nearly 3.7% from around 11.3%, while president Tim Turner sold ~700,000 of his nearly 4.9 million shares.

-

The current status of debt ceiling discussions, or lack thereof, are rattling markets, but select P&C insurers look strong in a relative sense.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Details of the placement are being closely guarded, but one source suggested the raise could be in the region of $1bn.

-

The intermediary employs over 150 staff members and has annual revenues of $15mn-$20mn.

-

The Dan Loeb-controlled investment firm reduced its position in AIG to 2.95 million shares, or ~0.4%, in Q1, from or 5.1 million shares, or around 0.7%, at the end of Q4.

-

Three months ago, Starboard trimmed its stake by almost 14% to 1,925,491 shares valued at over $470mn from 2,232,209 shares at the end of Q3.

-

Securities filings show the conglomerate’s ownership of Markel holdings was valued at over $600mn at the end of March.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Bermudian carrier SiriusPoint’s equity stake in D&O MGA Banyan Risk has been reduced to 49% from 100%, filings show.

-

Mega-round funding accounted for the smallest percentage of total funding since Q1 2020, according to Gallagher Re’s latest Global InsurTech Report.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

When a Grade A franchise like Hub refis at this kind of valuation, the read across to other assets is highly negative.

-

Inside P&C revealed in late March that Leonard Green was one of the two remaining parties in the process, with an enterprise value of under $25bn, based on bids of ~16x just under $1.5bn of Ebitda.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the executive had a minority ownership interest believed to be around 20%-30% of the operation.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the company has assessed different options to bring in additional capital this year as it ramps up its growth strategy.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The company is considering separating its program management business Accredited from its legacy division.

-

The news confirms this publication’s report from last month that Doxa was in the market to raise preference shares.

-

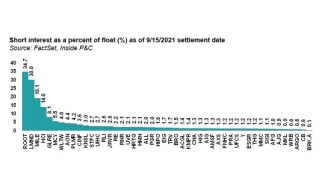

Recent data shows an increase in InsurTech short interest and a slight uptick for brokers and P&C insurers as a result of economic uncertainty following the banking crisis.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The move follows the carrier’s 30-point improvement in its combined ratio to 101.4% after markets yesterday.

-

Sources said the Chicago-based retail broker is in the preliminary stages of work with the intention of securing an investment later in the year.

-

At the end of October, the investor decreased its stake in the specialty insurer to around 3.05% from over 6.3% at the end of Q3, filings show.

-

JP Morgan served as sole placement agent for the transaction.

-

The move follows the company’s loss estimate increase to $1.54bn from a preliminary estimate of $1bn.

-

The move follows commentary on loss cost inflation exceeding rate rises in Q4 across Markel’s portfolio, driven by lines including public D&O and financial institutions.

-

The moves follow RenRe’s positive feedback on January 1 renewals, and UPC selling most of its outstanding policies in Florida to InsurTech Slide.

-

A deal would give the broker the funds needed to finance its growth strategy, extending its IPO timeline at least into next year.

-

Broker and commercial carrier trends align on economic indicators but diverge on stock performance and 2023 consensus estimates.

-

Established players are walking away from writing IPO, SPAC and de-SPAC accounts as increased capacity and falling demand in the sub-class causes rates to crater.

-

After market close on Wednesday, the carrier disclosed an estimated combined ratio of 109.1% for the quarter, adding 10 points year on year.

-

This publication revealed this morning that Bain-backed retail broker raised ~$100mn of preference shares in a deal with the private equity.

-

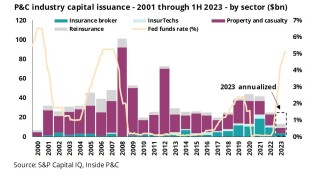

Increased interest rates and unfavorable market conditions led to reduction in capital issuance activity in the P&C insurance industry in 2022.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

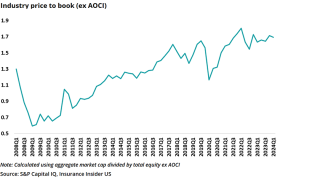

Price-to-book multiples for insurers have increased materially over the last two years, but drops in equity partially drove the increase due to unrealized losses.

-

Media reports said a group of Carvana’s 10 biggest lenders holding around $4bn of the company's unsecured debt have made a three-month pact to act together in the case of restructuring.

-

Executive chairman Bill Berkley expects the company’s returns to reach or exceed its targeted 15% rate, driven by its investment income results.

-

The Canadian investment fund now owns almost 3.8 million shares of the personal lines insurer, compared to 281,773 in Q2.

-

In the uncertain economic landscape, investors have shifted toward value stocks like insurance, with increasing movement around this earnings season and the election.

-

The broker also lowered its organic growth guidance for the full year 2022 to 14.5%-16%, compared with the prior guidance range of 16.5%-18%.

-

The likely windows for a secondary offering of Corebridge's common stock will be mid- to late March as well as mid-May to late June.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The delisting comes after the insurer’s stock price fell below $1 for 30 consecutive days.

-

Normalized cat returns of 25%-30% do not seem to be persuading reinsurers to dial up risk.

-

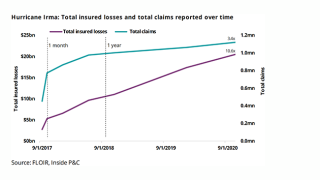

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

If the company does not cure the event within 10 days of the missed payment or September 25, an event of default will occur.

-

The shares expected to be bought back in the tender offer represent around 11.5% of White Mountains' shares outstanding as of August 19.

-

The InsurTech’s stock price was down as much as 9% in after-hours trading following the announcement.

-

US investments in the ILS and cat bond market are highly concentrated with five companies accounting for 70% of industry investments.

-

Reinsurers are more bullish about their prospects than they have been in years, but start-up and ILS fundraising is a desert.

-

The funds are expected to drive additional growth through market expansion and accelerate the deployment of Patra's technologies.

-

Sources noted that competition has expanded from excess layers into the primary market – and that has been a major development since the beginning of the year.

-

The new funding brings the total Ategrity has received from Zimmer since 2018 to $300mn.

-

A differentiated investment strategy has led to increased value creation and price-to-book multiples for a small group of specialty carriers.

-

Berkley also increased its position in Global Indemnity and now owns around 8.5% of the firm.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The stock was down $5.91 early trading hours from its close of $32.22 on Monday.

-

Pressure on the Californian insurer’s stock mounted this morning after it reported a Q2 11.7-point deterioration in its combined ratio to 106.6% yesterday.

-

The shares are trading today at $98.56 per share, down 13.13% from yesterday's close.

-

The downward trend of securities class actions against public companies is expected to continue in 2022, with the annual filings projected to drop by 7% this year, Woodruff Sawyer said.

-

The executive discussed InsurTech challenges, his priorities for Branch, fundraising, and his concerns about the capital markets.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Brokers may face pressure as the pricing cycle turns and estimates fail to keep up.

-

Inside P&C’s news team runs you through the key developments from the past week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The past few weeks bring back bad memories of 2008, but many factors that triggered that crisis seem not to be in play this time around

-

Following the announcement of the delay, Metromile shares rose over 9% earlier this morning to just under $0.90 per stock.

-

GDP drops haven’t guaranteed RoE declines, and the yield curve is inversely correlated with industry P/B.

-

Following his promotion, Hippo’s new CEO discussed InsurTech public market conditions, the funding environment for private companies, inflationary pressures and loss ratios.

-

Sentiment scores are down across the industry, indicating pessimism regarding inflation and the economy.

-

The Warren Buffett-led conglomerate also remained firm in its position in rival broker Aon.

-

The homeowners-focused InsurTech slashed expenses, posted an improved gross loss ratio and reiterated guidance.

-

The broker put ILS capital at $96bn by year end, $1bn lower than mid-2021 but ahead of its $94bn year-end 2020 estimate.

-

Inside P&C’s news team canters through the week’s key developments.

-

The call came after Markel reported Q1 results that included 21% growth and a 5 point reduction in the combined ratio.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The executive – whose new venture wrote $230mn last year – is skeptical about the long-term future of MGAs in the D&O and casualty spaces.

-

Yield curve inversion, thoughts on a potential recession and impact on the property-casualty industry.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Two more vehicle tech companies face SPAC-related securities suits.

-

The insurance sector was up through the first quarter of 2022 as broader economic and international factors drove down markets.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The proposed regulations would require additional disclosures about SPAC sponsors, conflicts of interest and sources of dilution.

-

The activist investor cited progress on governance issues in pulling back two proposed directors but pushed Safety Insurance for further strengthening.

-

The board also declared a quarterly dividend of $0.535 per share on common stock, payable on May 13.

-

Courts in Bermuda and the US approved the move, which had earlier been subject to investor litigation.

-

Sources fear that the issue will be buried after the coming legislative elections in November.

-

Experts at the PLUS D&O symposium took a deep dive into the issues and uncertainties affecting SPAC deals.

-

Insurance carriers tailor their comments to leave investors walking away with an optimistic view.

-

The start-up said its survey shows that SPAC and de-SPAC claims would drive increasing litigation throughout 2022.

-

The stock hit new lows after James River booked a $115mn reserve charge and posted a Q4 combined ratio of 140.6%.

-

Combined, Warren Buffet’s investment conglomerate has shed over 4.88 million shares of Marsh since the end of June, or more than 92% of its holdings.

-

Stock volumes were up, and InsurTech short interest intensified despite significant existing short positions in the stocks.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Investors are taking a second look at private valuations, as they realize that an IPO or a SPAC exit is no longer an attractive option in the short term.

-

Insurance stocks mixed following swath of earnings results; Aon gains nearly 7% in Friday trading.

-

Harper’s comments follow Kin and Omnichannel mutually agreeing to terminate their previously announced SPAC merger deal due to 'unfavorable market conditions'.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The next generation must stay private longer, employ a partnership approach to capital and take the complexities of insurance more seriously.

-

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

The parties decided to terminate the business combination agreement due to “current unfavorable market conditions”.

-

Woodruff Sawyer noted that the SEC, Finra, and the DoJ are likely to continue focusing on the SPAC market in 2022.

-

Aggregate settlements during 2021 amounted to $1.8bn, falling 18.2% from the $2.2bn aggregate amount in 2020, Nera data showed.

-

The InsurTech’s stock traded at $28.25 by midday Tuesday, down from its $163.93 peak in February 2021.

-

For the SPAC market, sources said that prices should continue to harden, while D&O rates are expected to stabilize amid a capacity flush.

-

InsurTechs continue to get battered as markets enter correction territory, but broader industry holds up amid wide declines.

-

The share price of the auto InsurTech plunged after the company said it was cutting its headcount by 330 staffers, or about 20% of its workforce.

-

HCI’s suspension of TypTap's spin off amid a punishing market for InsurTechs pressured the company's stock.

-

If the vote is successful and all closing requirements are satisfied, the combined company will be named Kin insurance and is expected to be listed on the NYSE under the ticker symbol “KI”.

-

InsurTechs, including Lemonade, Root, Hippo, and Metromile, shed some short interest but remain the target of choice for short-sellers.

-

The legacy carrier said it expected cross-trading on the OTCQX to widen its investor base and support liquidity on the LSE AIM.

-

Negotiations were dragged out by decisions being referred for sign-off at senior levels.

-

Lemonade, Root, and Metromile remain the focus of short sellers, as most firms see little short interest change.

-

Lemonade and Root remain the focal points of short sellers, while Metromile’s stock loan fee rate increases (pending acquisition).

-

The classic car insurer goes public but might have to pay a price for growth later.

-

Just over a quarter of shareholders voted to redeem shares as Aldel Financial took classic car underwriter public.

-

The higher level of repurchases seen in Q3 will likely last longer than expected.

-

The classic car underwriter will use the proceeds from its most recent fundraise to spur organic growth, and invest in data, technology, and geographic expansion.

-

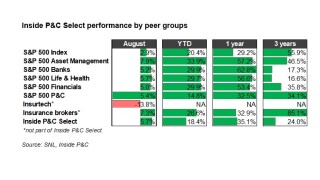

In November, the Inside P&C Select was -6.8%, underperforming the S&P 500 which delivered -0.8%.

-

Short interest fell in InsurTechs, but not enough to ease the pressure on the sector.

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.

-

Root shares leap in Thursday trading after InsurTech posts revenue gain, per-share loss that best Wall Street expectations.

-

InsurTech stock price dips fail to shake short interest from the firms.

-

InsurTech shares trade mixed in response to Lemonade-Metromile combination.

-

Root and Lemonade remain the highest-shorted stocks covered, as short interest in most firms remains flat in anticipation of earnings.

-

James River stock tumbles, Brown & Brown slips, RenRe sees modest gains on Q3 results.

-

Margin expansion and higher returns to shareholders would come at a cost with a cut in investment and staff over the coming years.

-

Short interest attention remains concentrated on InsurTech stocks as the industry awaits the update in earnings next week.

-

RT ProExec report finds increasing legal and regulatory action on SPACs and cybersecurity among top concerns for D&O market.

-

Positive commentary on commercial lines contrasts with declining insider purchasing, pointing to caution from executives about the sector's prospects.

-

The insurance sector was down in September across all sub-sectors as broader economic factors drove markets lower.

-

Investors pile into James River stock after the Bermudian sells off its loss-riddled legacy portfolio of Uber policies.

-

Without any major catalysts, the short interest for the industry was muted, with movement centering around InsurTechs once again.

-

Markel will provide approximately $150mn to facilitate the buyout of the retrocessional segregated accounts of the funds, as well as tail-risk cover to release $100mn of trapped collateral.

-

As federal courts and the SEC take a more critical view of the vehicles, D&O underwriters are approaching coverage with caution.

-

Pressure on Root cools following stock price dips, but persistent short interest in InsurTechs suggests that prices haven’t bottomed out yet.

-

Stock analysts raise price targets on Willis shares after execs outline financial goals following the collapse of the Aon-Willis merger.

-

Shares in the InsurTech are up 38% since further detailing losses from Winter Storm Uri and PCS cat events last Thursday.

-

The surge likely reflects talk in the buy-side community fuelled by tracking the latter's private jet.

-

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.