WTW

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

Newfront’s business units will be combined with Risk & Broking and Health, Wealth & Career.

-

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

-

Former head of construction Bill Creedon will assume the role of chairman.

-

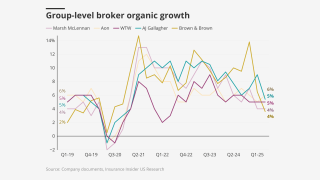

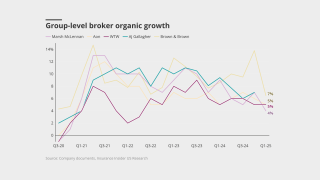

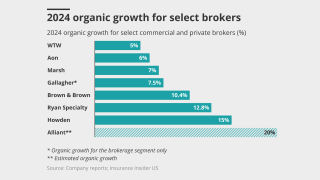

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

Verita leadership and staff will remain intact and “seamlessly functional”.

-

WTW is “particularly interested” in growing markets like wealth management with bolt-on M&A.

-

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

Renewable energy premium written in London and international markets amounts to $2bn.

-

She joins the brokerage after 18 years at Canada’s Intact.

-

Willis’ continued reinsurance build-out has targeted London and Bermuda marine and retro specialists.

-

Brokers across London and Bermuda have handed in their notice to join the start-up reinsurance broker.

-

The Bermuda-based team is led by John Fletcher.

-

Increases dropped to 5.3% from 5.6% for the previous quarter.

-

The broker is launching a reinsurance arm in partnership with Bain Capital.

-

The suit names former Marsh execs Hanrahan and Andrews as defendants.

-

During first quarter earnings calls, insurers argued that they can mitigate volatility.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It will be tough to pull off prior goals despite management assurances.

-

The pair add to the roster of aviation-focused hires at WTW.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

Lucy Clarke said the broking business was resilient in the face of macro challenges.

-

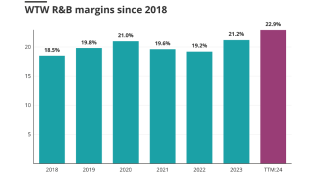

Organic growth was flat on the prior year and in line with Q4 2024 figures.

-

Insurance Insider US explores the economics of the lift-out growth strategy.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Of the 178 passengers and crew on board, no serious injuries have been reported.

-

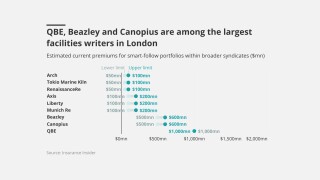

The big brokers are lining up London capacity to write follow lines on US risks.

-

Q2 renewals will likely signal changes in the reinsurance market, the broker said.

-

The arrival of Marsh’s Donnelly will "accelerate" US specialty growth, the CEO said.

-

Company-specific strategies will play a vital role in sustaining growth in the current market.

-

CEO Carl Hess said WTW is entering 2025 with “considerable momentum”.

-

The executive will link up again with former colleague Lucy Clarke in Q2.

-

Starr-leads the WTW-placed all-risks cover for American Airlines.

-

Bradley was construction team leader for US casualty at WTW.

-

The Willis name, which dates back to 1828, will be used with clients and markets.

-

He succeeds Hugo Wegbrans, who becomes head of CRB for Europe.

-

But forecasts of slowing growth in recent years have been too pessimistic – and uncertainty remains.

-

CMP and BOP reached their highest levels in over a decade.

-

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

A quick roundup of our best journalism for the week.

-

The firm’s trajectory could, however, make it harder to meet guidance going forward.

-

Adam Garrard will cover his responsibilities on an interim basis.

-

WTW will hold a significant minority stake in the start-up with an option to acquire complete ownership over time.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The global market is stabilising and softening, and casualty and specialty lines are generally stable, the CEO said.

-

The broker posted a net loss of $1.67bn including pre-tax non-cash losses.

-

He brings over 25 years of experience in PE and transactions solutions.

-

The broker will take a charge of $1.6bn-$2.1bn relating to the sale.

-

Baudouin is transitioning to a chairman position in Mexico.

-

Commercial auto and excess umbrella continue to face upward pressure.

-

The choice to build a reinsurance unit at arm’s length alleviates some financial strain.

-

The two parties are targeting a launch by the end of the year, with scope for WTW to buy the start-up at maturity.

-

It will offer additional capacity to WTW US property clients with a limit up to $25mn.

-

The company yesterday promoted Jenna Ziomek to P&C leader for PE and M&A.

-

Ziomek joined WTW in 2021 and has 17 years of industry experience.

-

The new broking president added that hundreds of Marsh staff would not show up tomorrow at WTW.

-

The broker said achieving profitability “remains challenging” for insurers.

-

CRB NA growth was driven by specialty lines, including natural resources, construction and real estate.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The broker raised the low end of its 2024 target ranges for adjusted operating margin and adjusted EPS.

-

A quick roundup of today’s need-to-know news, including the CrowdStrike outage and a hire at SiriusPoint.

-

Alongside the appointment, Adam Garrard will take on the new role of chairman of risk and broking.

-

-

Jorgen Andersson and Peter Galla will serve as deputy heads of the division.

-

The executive previously led the excess casualty practice at Aon.

-

He brings more than 20 years of industry experience to the role.

-

Quarterly price increases of around 6% have remained steady since the pandemic.

-

deLaricheliere will report to WTW head of FIPS Brad Messinger.

-

The executive said expansion was driven by retention and new business.

-

CEO Carl Hess hailed a “solid” first quarter of results.

-

Prior to her stint at Lockton, the executive worked at Marsh.

-

The firm reportedly parted ways with 120-130 employees as part of the cuts.

-

The executive joins from regional insurer ASSA, where he spent almost 16 years.

-

WTW predicted that ‘meaningful softening’ could creep into energy markets during the year.

-

The US regulator faces litigation from both sides of the climate issue.

-

Increased reinsurance retentions left some insurers with their worst net results in a decade.

-

Graham Knight will become chairman of natural resources.

-

WTW said the rise of the risk from health and safety was “surprising”.

-

WTW said adverse development “is evident” in auto liability lines from 2015 to present.

-

WTW hired Kolos for transactional solutions, Chin for tax insurance and Kesack for contingent solutions.

-

The facility offers a range of $25mn to $50mn in excess capacity.

-

Insurance Insider US runs you through the earnings results for the day.

-

At market close, WTW shares were up almost $18.

-

The CEO said winning back clients had “validated” the broker’s approach.

-

Risk and broking was driven by new business, client retention and rates.

-

The role marks Miranda Rodriguez’s return to WTW from Brookfield Asset Management, where she was vice president of risk and insurance.

-

In October 2023, it was announced that Powell was leaving Marsh to join WTW as the broker’s global chief claims officer.

-

The broker said there was a “record level of dry powder” waiting to be deployed.

-

Joining WTW in 2010, Despina Buganski has served as COO for the Ppersonal lines business since 2015.

-

Tyson Stevenson will be responsible for producing new business and driving growth in WTW’s real estate portfolio for 2024.

-

Commercial Property experienced the greatest rate increase, with a double-digit surge that came in slightly lower than the previous quarter.

-

The appointment comes two weeks after this publication revealed that the executive had resigned from Lockton to join the rival broker.

-

The broker said reinsurance capacity has contracted over the past 18 months, and the once-diamond-hard aviation war market has started to soften.

-

WTW also said private equity will continue to dominate the M&A landscape in 2024, with firms sitting on “over $2tn in dry powder” which is ready to deploy.

-

The broker said it anticipated new entrants in the downstream class following a profitable 2023.

-

A quick roundup of this week’s biggest stories.

-

The executive joined family-owned Lockton in 2020, as director of energy within the South Florida-based Latin America and Caribbean team.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

SEC filings show that, in Q3, the activist shareholder liquidated its remaining 508,880 shares in WTW — worth around $120mn at the end of Q2.

-

A-Star offers up to $80mn in additional capacity for D&O liability insurance.

-

The broker has not been acquisitive since the deal to create the group in 2015, and has divested a number of its units in that time.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

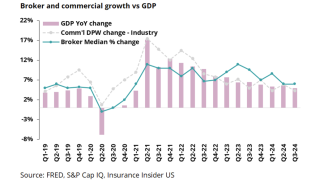

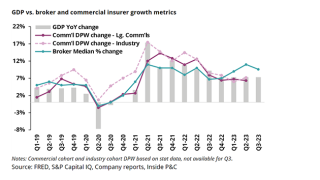

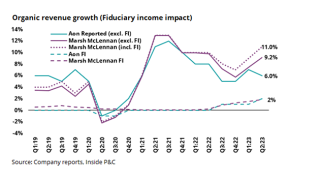

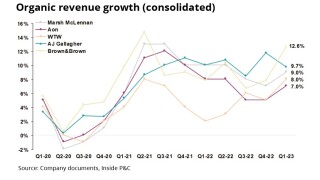

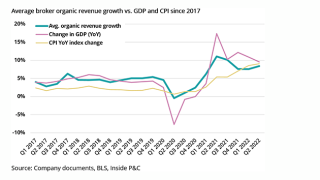

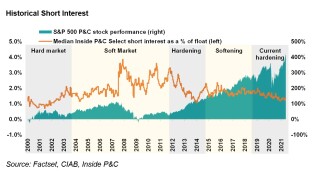

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Work is at an exploratory stage, with efforts focused on London specialty and US P&C mid-market expertise.

-

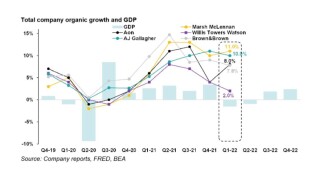

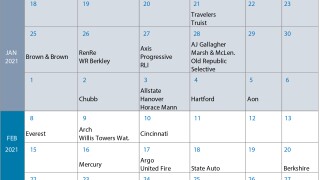

AJ Gallagher posts 10.5% Q3 organic growth, lower sequentially but up year-on-year

-

As of 14:00 ET, the broker’s stock stood at $232.24 per share, 11.9% higher than the previous close of $207.74.

-

The broker’s Q3 organic growth was driven by specialty lines, including fac financial solutions, natural resources, surety, construction and aviation.

-

WTW said that new staff were ramping up revenue production, following a period of investment in talent.

-

The exercise is understood to involve mainly junior and non-broking staff.

-

Kenneth Gould and Frank Scardino resigned “effective immediately” in early October to join WTW, allegedly forgoing a required 30-day notice period.

-

Despite an upswing in deal activity, large deals have continued to see a steady decline in volume that began in 2021.

-

The two executives, based in Dallas, Texas, have close to 60 years of combined insurance experience.

-

The start-up MGU will initially focus on real estate, hospitality and leisure, financial institutions and professional services industries.

-

The executive was most recently global engagement partner at Marsh.

-

Survey participants said "much work remains post-implementation".

-

Besides reinsurance broking, MGAs and MGUs, affinity is another segment where WTW can scale its operations, the executive noted.

-

The investor’s stake in WTW is now valued at roughly $120mn, while its position the prior quarter was worth around $423mn, according to its Q1 13-F filed with the SEC.

-

Prior to joining WTW, Bryce was a partner and private client practice leader at Canadian broker The Magnes Group.

-

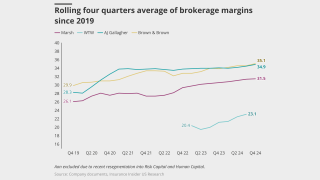

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

WTW is quietly sounding out market executives for a potential relaunch into reinsurance once its two-year non-compete agreement with Gallagher Re ends in December, this publication can reveal.

-

The broker said that key hires – including Lucy Clarke – would pay off in improved results.

-

The broker said it experienced headwinds from prior-year book sales, inflation and investment costs.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Pat Donnelly has succeeded Lucy Clarke at Marsh, and Adam Garrard at WTW has moved into a chairman role.

-

Allegretti joins as WTW’s personal lines P&C sales director for the ICT division, while Anderson-Higgins will step into the corresponding role for commercial insurance lines.

-

The executive will be responsible for the growth of the hospitality insurance portfolio and for providing service to current and prospective clients in this segment.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The exercise is no longer focused around crunching wholesale broking relationships down to a small preferred panel.

-

The incoming executive brings over 25 years’ industry experience, having previously held roles at Allianz Trade, Altradius and Zurich.

-

The intermediary’s latest study shows double-digit rate increases in commercial property and auto lines.

-

He was previously North America Cyber Growth leader and before that Midwest Regional Leader - FINEX Cyber/E&O.

-

Douglas spent the last decade of his 23-year tenure as head of WTW’s climate and resilience hub.

-

A report from WTW and the Institute of International Finance has found little correlation between companies’ operation emissions intensity and their climate transition value-at-risk.

-

Three months ago, Starboard trimmed its stake by almost 14% to 1,925,491 shares valued at over $470mn from 2,232,209 shares at the end of Q3.

-

Though strong growth continues, the future is less clear as driving forces potentially run out of steam.

-

Shares were trading down 6% following the publication of the broker’s Q1 results.

-

The broker reported new business and increased retention in aerospace, financial solutions and natural resources.

-

He was previously vice president – North America construction manager at Scor, and held past roles at Liberty, Swiss Re and CNA.

-

The WTW D&O liability 2023 survey canvassed directors and risk managers in 40 countries around the world.

-

She joins from Aviva Canada and has over 20 years of experience in the insurance industry in North America and the UK.

-

Based in London, Artunduaga has served as Aon’s LatAm network leader. In addition, Chile-based Jose Necochea, Victor Padilla and Andres Claro will move to WTW.

-

WTW’s survey cites regulatory risk, health and safety precautions and bribery and corruption on the list of top D&O risks.

-

WTW said driver shortages continue to force contractors to use younger, often less experienced drivers, potentially putting upward pressure on losses.

-

Bolig has been executive managing director at Aon since 2014.

-

Inside P&C takes a deep dive into public brokers’ M&A activity in 2022 as Q4 earnings season comes to an end.

-

The rise marked a deceleration from the increase in Q3, when carriers reported a 5.2% climb, according to WTW figures.

-

Based in Chicago, the executive will lead digital underwriting transformation projects for global commercial lines insurance clients.

-

The executive said the broker stopped receiving client proposals whilst it was set to be taken over.

-

The broker has experienced a resurgence in growth under new leadership and strategy.

-

WTW has appointed Pieter Van Ede as global head of trade credit, in a move the broker said demonstrated its commitment to growth in the class of business.

-

According to WTW’s report, countries are “de-aligning” from the West due to the declining influence of the US and its allies.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The firm’s strategy to consolidate trading relationships faces fundamental, cyclical and company-specific challenges.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

In each case, the broker asked the judge to dismiss with prejudice, barring the parties from bringing the disputes to another US court.

-

The broker argued that WTW conspired with former employees Terry Rolfe and Daryl Abbey to use its confidential information and divert customers to WTW.

-

Although 2022 was on balance, a good year, macro-economic issues such as a slowing economy, falling employment, and loss cost reversion could create an overhang for 2023.

-

The move aligns WTW resources with specialist industries to operate as standalone businesses within North America.

-

Based in Toronto, the executive will focus on supporting clients to redesign their businesses with structures aimed at delivering better results.

-

Only D&O and workers’ compensation clients experienced price decreases during Q3, according to WTW.

-

Based in New York, Sallada will focus on developing and executing an industry vertical growth strategy for the broker’s casualty business.

-

Evan Freely will head up a team of 130 staff specializing in credit and political risk.

-

The members were unanimously selected by the board as part of its multi-year succession planning process.

-

Mahoney joins from Aon, where he was team leader for US general casualty and energy in London.

-

The business line’s premium increases this year were less pronounced than in 2021, when quarterly renewals were in the 50%-200% range.

-

The product will provide $100mn in cover across eight countries at high risk of tropical cyclones.

-

The project, funded by Agence Française de Développement, was revealed during the G20 Leaders’ Summit in Bali.

-

The broker warned that more insurers will restrict or drop oil and gas business in the coming years.

-

The brokers asked the judge in the case for a 30-day extension to finalize settlement terms in Aon’s suit against WTW.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Growth is accelerating at the broker in the wake of a challenging period following the collapse of the Aon merger.

-

The acceleration defied wider sector trends, which has led to slowing growth at other brokers.

-

As the super-cycle slows and the economic landscape becomes more uncertain, brokers will face pressure, though a cooling labor market may aid margins.

-

Lopez succeeds Hector Martinez, who was appointed as Latin America leader at WTW earlier this year.

-

WTW has hired Michelle Cui from Zurich North America as director of actuarial property and casualty in its insurance consulting and technology business.

-

The brokers are working on finalizing the terms in a written settlement agreement, which could be filed within two weeks.

-

In his new role, Ryan will report to WTW North American leader for CRB Mike Liss.

-

The broker said the fallout from the Russia-Ukraine conflict was increasing competition for business.

-

The new deadlines set last week after a hearing suggest that recent settlement negotiations between the brokers to end the case via private mediation did not come to fruition.

-

The managing director is the latest in a series of hires at WTW’s natural resources division.

-

The parties did not disclose whether any money changed hands to end the legal proceedings.

-

In the lawsuit, filed last week in a New York court, WTW is seeking injunctive relief and compensatory damages over a year after Lockton lured the executives.

-

The discovery process will run through August and September, and the court will hold a hearing on Aon’s motion for a preliminary injunction on October 12.

-

The CEO said that WTW was making good progress under its strategy but acknowledged there is more to do.

-

Growth was slower than rival brokers, but CEO Carl Hess said investments would bear fruit in H2.

-

WTW sued the rival broker over the poaching of 25 members of its senior living group in September 2021.

-

The complaint was filed on July 14 in the Superior Court of Suffolk County in Massachusetts.

-

Luis Maurette, current head of Latin America and head of global sales and client management, will retire on December 31, 2022.

-

Peru’s state-owned firm Petroperu has said that the broker designated to run its account was chosen as a result of a “technical evaluation”, following local media and Inside P&C reports that WTW had won with the highest bid in the process.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that the two other bidders in the process were AJ Gallagher with a fee of $885,000 and Lockton with $700,000.

-

Mayers' role will focus on the ICT unit's commercial lines pricing and underwriting propositions.

-

Before his appointment, the executive served multiple senior leadership roles within the division across Germany and Northern and Central Europe.

-

The brokers expect to reach an out-of-court agreement to end the poaching case in south Florida within two weeks.

-

Brokers may face pressure as the pricing cycle turns and estimates fail to keep up.

-

The complaint names surety executives John Thomas, Andrew Bennett and Jennifer Boyers Gullett as defendants.

-

Insurers have expressed concerns about hitting the 2023 deadline for the regime.

-

The executive will report to Tom Coughlin, WTW’s head of industry and specialty for CRB North America.

-

Q1 marked a deceleration from the last quarter of 2021, when commercial lines rates increased around 7% from the same period of 2020.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

It is understood that the account includes oil platforms, crude barrels and 12 vessels, and is one of the largest accounts in the South American country.

-

The buybacks will be in addition to the $1.3bn remaining on the broker’s current open-ended repurchase program.

-

Inside P&C’s news team canters through the week’s key developments.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The loss of the carrier’s Russian operations is set to create “modest margin headwinds” for the business.

-

The company posted adjusted diluted earnings per share of $2.66, ahead of analyst consensus of $2.50.

-

Michael Chang will join WTW later this year with current head of corporate risk and broking for North America, Mike Liss, set to retire in 2023.

-

WTW Peru recently appointed head Gerbo Pacchioni will report to Tagle as part of the cluster.

-

Cyberattacks and data losses were the top risks with 65% and 63%, respectively, followed by cyber extortion and regulatory threats with 59% and 49%.

-

The appointments come as the broker revamps its corporate development operations.

-

The brokers asked the judge to delay some pre-trial conferences by two weeks as they could obstruct the settlement negotiations.

-

The broker said there was still a “big unknown” around the potential global economic impact of the conflict.

-

WTW forecasts that cyber rates could increase by 100% to 200% for heavily exposed industries.

-

The intermediary said capacity for downstream energy has now returned to 2017 levels.

-

The potential for major deterioration on a 2019 loss could yet prove “devastating” for the market.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Defendants claim that WTW’s complaint “improperly seeks to transform a simple contract dispute with certain former employees into a series of tort claims”.

-

The embattled broker could stand to lose around $50mn in Ebitda as major economies shun Russian trade.

-

Before his promotion, the executive served as WTW’s head of strategy based in London since April 2019.

-

The move follows similar actions taken by Aon and Marsh McLennan.

-

Singh had managed Lloyd’s catastrophe risk appetite prior to joining MS Amlin.

-

The company said it introduced cyber into the survey for the first time and that the line showed a significant rate increase.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The CEO outlined areas of the business which needed additional care and attention, while highlighting the need to build a culture of trust between management and staff.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Financial results in the fourth quarter were impacted by senior staff departures and lost business.

-

CEO Carl Hess said the results did not fully reflect the near and long-term potential of the firm.

-

The broker joins after a brief spell at Aon, where he was head of EMEA business development.

-

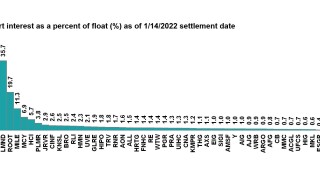

Stock prices fluctuated, and InsurTech short-sellers took some profits.

-

Higher returns are available, but at the cost of increased revenue risk, slower results and potential cultural challenges.

-

The brokers will have until early 2023 to settle the case via private mediation or the case will move forward to a jury trial that could last between seven and 10 days.

-

The broker said the last three years of hardening had led to a “substantial technical correction”.

-

The change comes as the broker seeks to draw a line under a tumultuous chapter in which the planned takeover of Willis by rival Aon collapsed.

-

The executive will be based in Toronto reporting directly to Mike Liss, Willis’ North America risk & broking leader.

-

This year deals will continue to increase but ESG, inflation and supply chain issues bring complexity.

-

Heinicke brings over 25 years of experience in the insurance industry, most recently spending over 11 years at Aon Bermuda.

-

The three new directors that will not seek reappointment take the total board members standing down to five.

-

Inside P&C dissects the biggest deals of the year across broking, commercial lines and InsurTech.

-

A judge for the Miami-Dade County Court has ordered Aon and individual defendants in the Miami facultative team poaching case to avoid doing reinsurance brokerage business with the defendants’ former Willis Towers Watson clients.

-

The new coverage marks the first time that sovereign debt repayments have been protected by a parametric catastrophe clause.

-

Carriers are planning for inflationary threats and have been responding to major catastrophes, while the InsurTech and broking markets have driven M&A drama.

-

The Week in Brief: FM Global’s vaccine mandate, Hippo on going public, Hagerty SPAC deal redemptionsInside P&C’s news team runs you quickly through the key developments from the last week.

-

Rate increases were down from just below 8% in the second quarter, with professional lines registering the biggest increases from the prior year.

-

The promotion comes shortly after Willis hired Marsh’s Scott Pizzi to lead property broking in North America.

-

The CEO-designate's comments at the Morgan Stanley conference on Friday were a marked – and welcome – change of tone.

-

Willis president Carl Hess said that hiring rates have dramatically increased in his firm's corporate risk and broking business.

-

Inside P&C’S news team runs you quickly through the key developments from the last week.

-

In an interview, the new Gallagher Re CEO noted that his former company had been weighed down by nearly two years of uncertainty, telling this publication: “That stops today.”

-

The group CEO also observed that the Big Three reinsurance brokers do have a competitive moat based on their scale.

-

The deal was struck in the wake of the collapse of Aon and Willis Towers Watson’s merger.

-

Pizzi will take over the position that has remained open since Nancy Woode left Willis to join McGill and Partners last April.

-

Willis is accusing its blue-chip rival of conspiring with its former employees to pilfer some of its reinsurance brokerage clients in Florida, causing “irreparable harm".

-

Insurance carriers tend to favor a negative outlook during their earnings calls, even when its unwarranted.

-

Increasing cat costs will drive the focus on modelling and price adequacy, the intermediary said.

-

Willis Towers Watson has selected Inga Beale, Fumbi Chima, Michael Hammond and Michelle Swanback to join its board of directors.

-

While Willis predicted market moderation as capacity expands, the report concluded that the cost of insurance in the near term is still going up.

-

The executive has spent the majority of his 35-year career with Aon.

-

The executive will also remain his current role as head of Colombia, it is understood.

-

Positive earnings results point to the firm meeting full-year guidance, but will it hit the 500 points improvement in margin by 2024?

-

The transaction was cleared in five out of six jurisdictions – including by US antitrust authorities – and is only pending UK regulatory approval.

-

On an earnings call to discuss Q3 results, Willis CEO John Haley said staff attrition has peaked following the aborted Aon takeover.

-

The profitability metrics were impacted by the $1bn income received following the Aon deal termination.

-

Willis’ latest InsurTech briefing shows how a small group of InsurTechs are securing the lion’s share of investment via $100mn-plus mega-rounds.

-

Margin expansion and higher returns to shareholders would come at a cost with a cut in investment and staff over the coming years.

-

Starboard estimates Willis's share price could double in three years and said there is room for margin improvement.

-

In an internal memo, the company named a raft of leaders by country and business unit, though many roles also remain unfilled.

-

Alex Shepherd, who joins from ERS Syndicate 1856, will aim to replicate the broker’s “hub approach” in its facultative business.

-

The agreement ends non-solicitation action against the team of brokers, led by Cameron Roe and chairman Tony Phillips.

-

The arrival of Elliott, Starboard and TCI could play a major role in shaping the broker’s future.

-

Willis signed the new loan after outlining in early September its plans for reinvigorating its business following the termination of its $30bn mega-merger with Aon.

-

The stipulation will end the case, as all the parties requested a dismissal with prejudice.

-

The Competition and Markets Authority will investigate whether the deal lessens competition in the UK.

-

Following the collapse of its merger with Aon, Willis Towers Watson is being targeted by activist investors.

-

More than half of deals completed this year exceeded $1bn in value.

-

The broking giant has spent the past eight weeks executing on the strategy it developed for the combined firm.

-

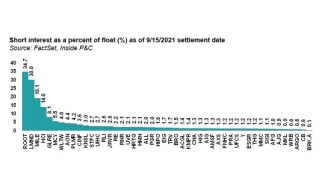

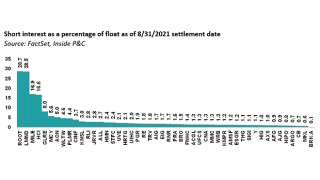

Without any major catalysts, the short interest for the industry was muted, with movement centering around InsurTechs once again.

-

Previously, Hess had earned $650,000 a base salary and was eligible to receive a short-term incentive bonus worth 90% of his annual salary.

-

Next year could see more M&A activity in the P&C space as carriers look for growth amid a moderating pricing environment.

-

The brokerage firm said that $4bn increase comes in addition to the $500mn remaining on its existing share repurchase program.

-

The new recruit has spent 20 years in investment roles.

-

Pressure on Root cools following stock price dips, but persistent short interest in InsurTechs suggests that prices haven’t bottomed out yet.

-

Stock analysts raise price targets on Willis shares after execs outline financial goals following the collapse of the Aon-Willis merger.

-

The firm puts the failed Aon merger behind it and sets expansive targets, but those goals may prove hard to balance.

-

After Willis Towers Watson’s attrition rate rose 22% amid the Aon merger uncertainty, executives are seeking to dial back a talent drain.

-

The broker expects to increase its revenues to $10bn by 2024.

-

The acquisition is still subject to regulatory approval but expected to be completed in the fourth quarter.

-

Following the breakdown of the Aon deal and with a potential activist circling, the firm finds itself at a crossroads.

-

It is not yet clear if the fund – known for its activist campaigns – will look to take on management in this case.

-

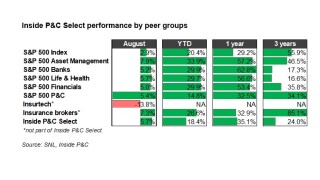

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

The broker also announces that Nicolas Aubert is set to leave the company to “pursue new interests”.

-

A complex web of factors are creating uncertainty around the likely insured loss, but much early discussion centers on a $20bn-$25bn range.

-

Outgoing CFO Michael Burwell is to receive a $1mn bonus.

-

Andrew Krasner returns to Willis from AssuredPartners, where he served as CFO for just over six months.

-

The brokers have signed a heads of terms and will move towards a full acquisition.

-

The executive was previously leader for the Midwest, Northeast US and Canadian environmental business.

-

The move comes after major defections to rivals from the firm’s retail broking and reinsurance operations earlier in the year.

-

The executive will head up a 26-strong team, working across all major lines of business.

-

The broker also filed a lawsuit against Goode, Honeycutt, Forst, Rice, Lee and Keenan as individual defendants.

-

He previously held roles at Tower Hill, Axis and Aon Benfield.

-

Yesterday’s announcement that long-serving Willis Towers Watson CEO John Haley will be replaced by Carl Hess will have come as a surprise to many market watchers.

-

The two brokers have also agreed to non-solicitation clauses in their new deal.

-

Earlier today the firm announced that insider Hess will succeed CEO John Haley at year-end.

-

The current head of the investment, risk and reinsurance segment will take the helm in January.

-

The executive also praised Willis Re's management team for pushing for the best outcome for clients.

-

The broker has explained the rationale for its $3.25bn acquisition of Willis Re on an investor call.

-

After the collapse of the Aon-Willis merger, Gallagher has successfully resurrected the deal that will catapult its reinsurance operation into the big league.

-

London-based Brendan Carberry’s hire is part of a surge in recent moves in the product recall class.

-

The executive was speaking in his first interview since the collapse of his firm's proposed merger with Willis.

-

AJ Gallagher is on the cusp of a deal to acquire Willis Re, and the transaction is likely to be announced imminently, this publication can reveal.

-

The executive is leaving his role as global head of broking at Willis to take on a major role at Aon, in the aftermath of the mega-merger collapse.

-

The departure comes as Willis comes to terms with the aftermath of the failed merger with Aon and the impending retirement of long-term CEO John Haley.

-

The limits of the mega deal for the public players has been tested, but there is scope for some of the bigger private players to merge.

-

Willis Re conducted the Wildfire Resilience Insurance project with Nature Conservancy to offer solutions to a worsening wildfire market outlook.

-

Major increase in incentive pool represents an early step from management to shore up its staff base.

-

The firm looks to leave the nixed merger behind, but the distraction has left it lagging behind peers, although with positive numbers.

-

The share price jumped after CEO Haley said during an analyst call that the board was working on his succession plan, as well as signalling that its reinsurance business remains in play.

-

The CEO also pledged revived investment in growth after the Aon deal collapse.

-

The Willis Towers Watson CEO also confirmed the broker will not pay out bonuses contingent on the Aon merger.

-

The broker reported adjusted diluted EPS of $2.66, up 48% on Q2 2020.

-

The investment bank said a transaction would stabilise employee retention at Willis Re and allow Willis to pursue buybacks.

-

Sources have said a deal could be signed as soon as the middle of the week, with a valuation higher than the last agreement.

-

Ron Whyte, Willis Towers Watson’s COO of corporate risk and broking (CRB) for Asia is to leave the business next month, this publication can reveal.

-

Willis Towers Watson will not pay staff bonuses that were contingent on the completion of the Aon merger.

-

Willis’s Quarterly InsurTech Briefing shows investments raised more in H1 this year than the whole of 2020.

-

The committee will be responsible for seeing through the broker’s four-pronged Aon United Blueprint.

-

A White House press spokesperson said the deal would have led to higher costs for businesses and consumers.

-

The search will need to be rapid and sure-footed to give the firm the best opportunity to address its issues.

-

The firm must now grapple with the related questions of leadership, ownership and the future shape of the group.

-

The Illinois-based broker said it would also redeem $650mn in 10-year notes that it issued in May.

-

Wells Fargo insurance analyst Elyse Greenspan said Willis Towers Watson stock “seems very inexpensive” in a note to investors on Monday.

-

Shares in rival broker AJ Gallagher, whose plans to buy several Willis assets at a knock-down price are now highly uncertain, were down by 2.3% at $139.

-

In a statement, Garland argued that the decision will help preserve competition in the insurance brokerage sector in the US.

-

Greg Case said the regulator had a "fundamental misunderstanding" of the industry, and that timing prevented the brokers from going to trial.

-

The broker has also stated plans to invest in “organic and inorganic growth opportunities” over the next three years.

-

The companies disclosed that Aon will pay Willis the $1bn break fee.

-

Details of potential additional divestitures are closely guarded, but they would likely include P&C broking assets.

-

Advocates of firm action by the Federal Government against competition law violations welcomed Kanter’s appointment.

-

The DoJ was given a deadline to provide Aon’s lawyers with pertinent evidence collected from third parties during its investigation into the $30bn mega-merger.

-

The merged entity must divest its corporate and commercial short-term insurance broking in the country, as well as offload several global businesses.

-

The brokers have offered to divest Willis’ largest corporate risk and broking clients to Gallagher’s Crombie Lockwood.

-

The competition watchdog has approved the acquisition of Willis Towers Watson by Aon if the latter complies with a ‘substantial set of commitments’, including the divestment of central parts of Willis’s business to Gallagher.

-

The keenly anticipated antitrust showdown has now been scheduled for November 18.

-

Aon will have to wait until November at the earliest to argue the case in Federal Court for its $30bn merger with Willis Towers Watson.

-

The Commerce Commission has extended its review of the merger by another six weeks.

-

The Parrish poaching case sits awkwardly alongside Aon’s insistence to regulators that talent and clients are portable.

-

Marsh claimed Aon is trying to ‘flip the narrative’ from its poor management decisions and uncertain future in its response to the suit.

-

Aon’s legal team said it was concerned that the proposed timetable could kill off the deal before the trial begins.

-

The deal was approved by regulators on the proviso of the disposal, as well as other divestitures already agreed.

-

The CCCS has identified competition concerns around executive pay consulting services.

-

“We are not about to let [the] delay…compromise the deal”, says Latham & Watkins lawyer Dan Wall.

-

The Willis veteran becomes the latest fac executive to depart, following the recent exits of Alf Garner and Antonio Tosti.

-

With the DoJ’s suit creating question marks around closing, the junior merger partner’s standalone prospects must be weighed.

-

The parties will likely look to deliver a carve-out of large P&C and health benefits broking in the US to target a DoJ settlement.

-

Citi analyst Suneet Kamath wrote that P&C underwriters have more exposure to inflation pressures, due to higher claim costs compared with brokers and life insurers.

-

Aon and Willis were taken by surprise by the lawsuit, a CTFN report claims.

-

Carriers also reported premium expansion and improved solvency during the quarter.

-

With economic activity bouncing back globally and major events attracting large crowds returning to the calendar, Willis Towers Watson warned that the level of terrorism risk is also likely to rebound.

-

The CEO said that his company was ‘wide open’ to absorbing additional assets to satisfy regulators’ concerns.

-

Shares in AJ Gallagher and Willis Towers Watson held broadly stable after the announcement from the US Department of Justice.

-

The investment bank’s analysts suggested that staff and clients may leave as a result of uncertainty, during a prolonged US lawsuit over the Aon-Willis mega merger.

-

Inside P&C gives a blow-by-blow account of the regulator's antitrust complaint against the mega deal.

-

The broking houses also said they "remain fully committed to the benefits of [their] proposed combination".

-

The move from the US regulator represents the biggest threat to the mega-merger since it was announced in March last year.

-

A recent spate of divestiture offers have reportedly failed to address fears around corporate broking business.

-

The news follows the agreement to sell several assets to AJ Gallagher, including Willis Re.

-

The US retirement disposals announced last week will be followed by two health unit sales as the parties seek regulatory sign-off.

-

The new accounting framework is being brought in to replace current GAAP reporting measures.

-

The broker has offered to sell its group pharma purchasing and claims audit services in a bid to get the green light for its Willis takeover.

-

The deal is designed to assuage the Department of Justice’s concerns over the Aon-Willis merger.

-

The US government reportedly has around 20 attorneys at work in case it decides to sue to block the deal.

-

The executive had previously been the head of third-party capital at Axis.

-

Brokers’ first-quarter performance was highly positive, but the real rewards are still to come.

-

Management should examine the relationship between company strategy, broader market cycles and short interest.

-

The Commerce Commission has delayed its decision for the third time.

-

The merging brokers have also agreed a two-year non-compete agreement on transferring Willis business.

-

The combination still needs sign-off from US, EC and other international authorities.

-

With the planned disposal of a further $240mn of Ebitda, the parties are showing their commitment to closing the overall deal.

-

The transaction accelerates Gallagher’s evolution into a big global broker and risk management consultant.

-

The $3.57bn side deal is contingent on the closing of the bigger merger, which itself needs approval from regulators including the European Commission and Department of Justice.

-

Despite the sizable divestitures at a painful price, the deal maintains its appeal across most strategic and financial aspects.

-

The AJG CEO vowed to invest in Willis Re assets while stressing the quality and security of the team.

-

The deal is designed to address antitrust concerns to smooth the way for the mega merger to close.

-

Aon and Willis have been in talks with Gallagher over a sale of assets the broking houses must make to gain approval of their pending merger from antitrust regulators.

-

The report says a final decision on the structure of the deal has yet to be made.

-

The Capitol Forum says EU competition chief Margrethe Vestager is on board with the remedies.

-

The deal could be signed later this week or at the weekend, sources said.

-

Although this period’s short-interest shift was muted, the next update will likely show greater movement as Q1 is digested.

-

The yardstick will allow insurers and financial institutions to assess companies’ transition plans against the 2015 Paris Agreement.

-

The regulator had previously set a 27 July deadline after the merger partners offered divestments to secure regulatory approval.

-

CEO Greg Case says the broking union offers greater opportunities than when the deal was first announced.

-

After the strong organic growth from Marsh McLennan and Brown & Brown, Willis Towers Watson and AJ Gallagher followed suit with 5% growth in underlying brokerage revenues.

-

With a sale of the remedy assets to AJG not yet agreed, the firms will have to choose their words carefully this week.

-

Net income leapt by 140% whilst margins expanded across all business segments.

-

European regulators are not expected to demand additional concessions of the deal partners.

-

EC documents do not give details of individuals, but said the ringfenced team ranges in seniority.

-

The ACCC had initially said it would wrap up its investigation into the competitive implications of the merger by May 27.

-

The larger broker says it lost more than $6.5mn in revenue after leaders “solicited” colleagues and clients.

-

With around 50 members of staff across the business, the divestiture is not expected to significantly alter the competitive landscape.

-

The US regulator has proposed Willis sells its San Francisco and Houston CRB businesses, and its Bermudian insurance broking arm.

-

The broker aims to cut emissions by at least half by 2030.

-

The hires come amid an exodus of talent from Willis to corporate broking rivals.

-

The number four broker is seeking to acquire both Willis Re and the European insurance broking businesses.

-

The move follows the brokers’ submission of a remedies package last week to allay competition concerns.

-

A New York court has ruled that the names of two clients who are friends with a broker who has left Willis Re to join rivals TigerRisk can be published.

-

Further details of the proposed remedies to the European Commission are revealed.

-

The executive has been named head of its healthcare division.

-

The move follows Willis’ explorations of sales of Willis Re and European units.

-

The Competition and Consumer Commission of Singapore launches a public consultation over the proposed merger deal.

-

The broker says clients in the sector are using local investment as a key tool to mitigate supply chain risk.

-

This week, we revealed that Aon/Willis Towers Watson are looking to separately divest a block of Willis' European businesses and Willis Re, as they work to get their mega merger approved by regulators in the face of competition concerns.

-

It is understood that the ~$300mn fac business will be packaged along with the treaty unit.

-

The largest of the businesses, Gras Savoye, has been seen as one of the jewels in the crown at Willis.

-

Both Bart and Matte join as directors, with the former arriving from Milliman and the latter joining from Promutuel Insurance.

-

The potential disposal may help to alleviate competition concerns within the French market.

-

The Aon president said insureds will begin to “test” carriers and brokers on price.

-

He launched the broker’s transactional risk unit in Chicago and previously led two MGAs in the space.

-

As yet, the European Commission (EC) has not produced a formal State of Objections to Aon's proposed takeover of Willis Towers Watson following the Phase II competition probe it began in December.

-

According to the Capitol Form, antitrust regulators will consider the deal's impact on the world’s fourth largest insurance broker AJ Gallagher

-

Surprisingly, beyond the InsurTech names, changes in short interest were somewhat muted for the broader P&C sector.

-

The survey finds rate rises were most pronounced for excess liability and D&O business.

-

Willis Re executives said Aon takeover was "was not good for clients".

-

EU antitrust regulators will warn Aon that its $30bn bid to acquire Willis Towers Watson may hurt competition in the broking marketplace, according to a Reuters report.

-

The spread is currently the second-largest among pending M&A, with a target firm value of at least $5bn.

-

United Airlines’ all-risks policy could face liability claims, while the Pratt & Whitney policy could see a partial grounding claim.

-

The payment last month brings to end 15 lawsuits against the broker over the collapse of the financial group in 2009.

-

The merger may cause price increases or reduced service levels for major insurance buyers.

-

Event definitions were also tightened at renewals, the broker said.

-

Sources have emphasised that such pauses are a routine part of the Phase II review process.

-

Margins expanded in three of four business units, including by 200 bps in corporate risk and broking, but contracted by 37 bps overall.

-

Michael Burwell, Gene Wickes, Carl Hess and Joseph Gunn will each receive a payment for staying with the business until the deal closes.

-

Executives reiterate the mid-single expansion guidance announced in March, despite growing organically by 1% in 2020.

-

Of the largest insured losses from single events last year, the top eight occurred in the US.

-

In a joint submission, the intermediaries argue that the deal will not reduce market competition in New Zealand.

-

Business COO James Platt will take on the role until the expected closing of the broker’s merger with Willis Towers Watson.

-

Companies with strong brands still fall down on “traditional success criteria”, the InsurTech head says.

-

Before Willis, the executive had been with Lockton and Aon in his nearly 30-year career.

-

The broker warns that some carriers are seeking to limit cover in response to the attack.

-

Bloomberg Law reports that a settlement would bring litigation in Virginia and Delaware to a close.

-

Inside P&C’s research team examines some of the areas that will be closely watched during the results season.

-

Principals Patti Hull and Ross Schofield now report to NFP Canada managing director Brian Timmis.

-

The new recruits are the latest in a raft of appointments to the new business division.

-

Sources warn further unrest is possible and anticipate rising demand for SRCC and even full political violence cover.

-

The move breaks new ground for Alliant in Eastern Tennessee and comes amid a period of intense competition for talent in the retail broking sector.

-

The appointment comes after mass resignations in the Latin American team earlier in the year.

-

The milestone was set out in a combined all-staff townhall as the firms look forward to an H1 close.

-

The pace of rate rises slows for first time since Q3 2018.

-

The European Commission sets a provisional deadline of 21 December for the review.

-

Purchasing the analytics firm will help Willis meet growing demand for climate change services.

-

The departures include LatAm chairman Tony Phillips and upcoming CEO Cameron Roe.

-

Deal volume also spiked by 41% and included several high-profile transactions.

-

The project is looking at the impact that tools like controlled burns can have on insurance premiums.

-

The two CEOs say the combined entity will focus on emerging risks, new forms of capital access and “under-served” pockets of the market.

-

The broker’s Clips survey also recorded a significant acceleration in property prices.

-

Inside P&C takes a detailed look at the next steps including the potential for anti-trust issues and the brewing war for talent.

-

The companies claim “overwhelming” investor support at meetings today.

-

Reserves in scope have not been finalised, but sources estimated the figure to be in the low hundreds of millions of dollars.

-

Alexander Van Gorden has joined the broker from Guidewire Software.

-

The partnership aims improve infectious disease risk transfer and mitigation.

-

Staff on the scheme will be paid 25% on closing, with the rest paid 12 or 18 months later.

-

The combination secures support from major proxy advisers two weeks ahead of shareholder votes.

-

Response also rebuffs complaints over Goldman Sachs conflict disclosures.

-

The investment bank will sell P&C insurance policies alongside existing life and protection products.